Following on from yesterday’s blog about traditional bank thinking versus digital bank views, there are three slides I use in my presentations that illustrate this big change. This is the change in banks moving from being trade focused to community focused.

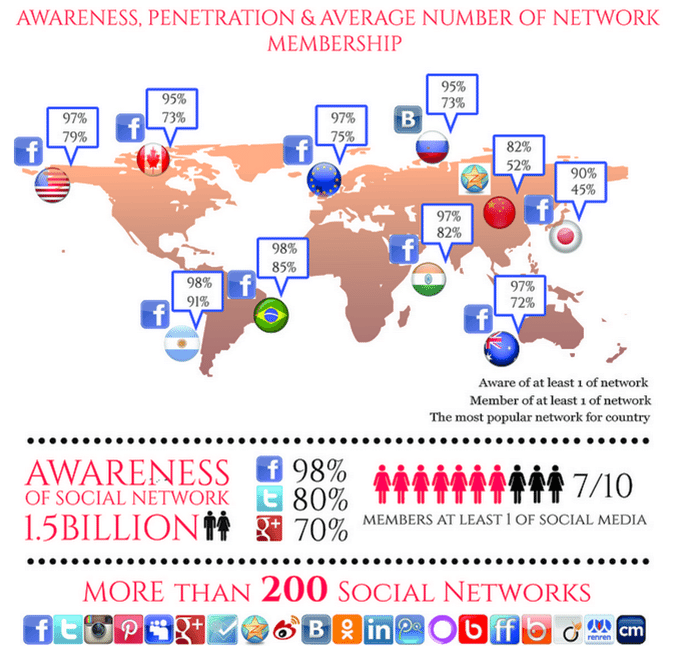

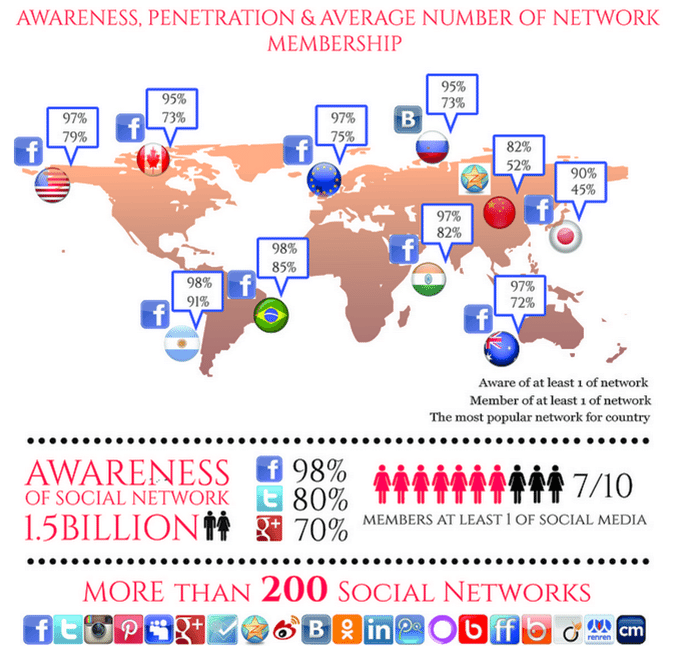

The first points out that banks must be in the social network, as that’s where their customers are.

Chart from Fashionbi

If the customer is building their relationships through digital social networks, then banks have to be in those networks and relevant, as discussed yesterday (specifically the Fidor example).

The second thing I talk about is the sharing economy, and the fact that within these online social communities there is a lot of value shared. This value is not necessarily in monetary form, but in a social form. Gifting, shares, likes, favourites are all forms of caring and supporting in these communities and can lead to real value exchanges that do translate into monetary forms. For example, in the largest social network you’ve probably never heard of called YY in China: “top karaoke singers regularly make $20,000 per month off of virtual gifts, with one college student reportedly earning an astonishing $188,000 per month by using the site to give Photoshop lessons”.

These earnings are created through virtual gifting and likes of your karaoke songs and Photoshop videos. The way it works is that “you create an artist account, put up some of your songs, and hopefully develop a following. After building up a respectable fan base, you could even schedule a live concert on the site, and for the price of one virtual rose, your followers would be able to watch the performance and interact with others attending the concert via video and chat. After the concert, you would be able to exchange your hard-earned virtual roses for real money.”

In other words, in the social network, there are many alternative ways of building value than trading pure products or traditional services. In the social network, any individual can be a media station. A great example is PewDiePie who makes about $4 million a year through YouTube videos of his reactions to popular game releases thanks to his more than 32 million subscribers.

That subscriber base is bigger than most TV channels.

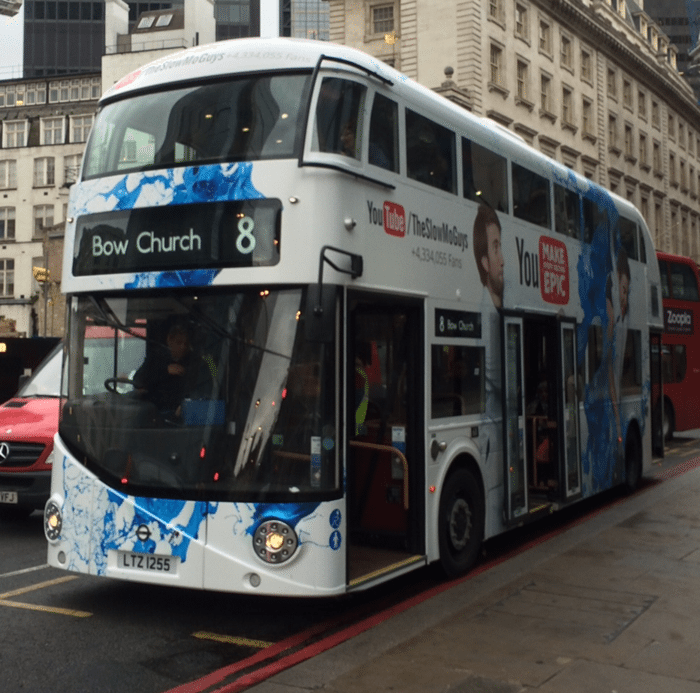

Equally, over here, we have the Slow Mo Guys with more than 4 million subscribers. These guys are growing fast and even have their own advertising campaign going on the London buses.

So here, I get into the real point with banks that they have to make the cross-over between the traditional financial world of trade and the new inclusive world of sharing and caring.

This is the key: digital banks are making a transition from pure cold profit machines to warm and fuzzy relationship providers. It’s difficult as, when we get to the point of being able to cuddle our bank, we will know the world has really changed.

Finally, when we reach that level of understanding, we can see why cryptocurrencies are so important as we have moved from a card and cash physical value exchange to a chip based digital value exchange. In this new world, tokens are just as important as gifts and likes and shares as money. Hence, in the new community based model, banks focus upon the digital exchange of value through tokenisation rather than the physical exchange of currencies to provide products and services.

It’s a fundamental shift that is being driven through the combination of digital innovation and millennial creativity and it will be interesting to see where it takes us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...