Researching crowdfunding and P2P lending, I found three research reports and a newspaper article that give you a tip for the future of banking.

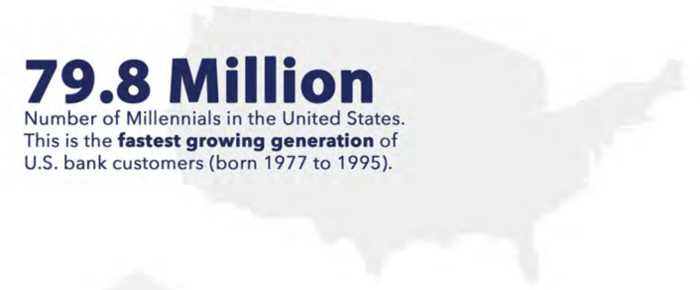

The three reports go together and are all about millennials. Yes, that group of under 35s who grew up as net natives or, if you prefer, the folks born after 1980.

The three reports are:

- The Millennial Disruption Index;

- The Independent Community Bankers of America Survey; and

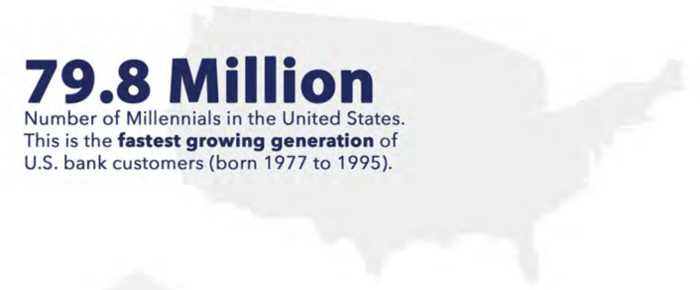

- Accenture survey of 4,000 American consumers

There are many other millennials research reports out there, but these three stand out as they tell you something.

First, millennials are a BIG CONSUMER SEGMENT.

Second, they think differently.

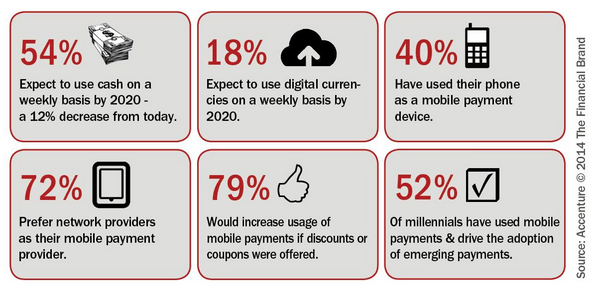

Third, they don’t like traditional banking.

Fourth, they have been royally screwed by their mums and dads. As the Daily Telegraph points out this week:

If you’re under 30, old people have stolen your future … in a nutshell, they’ve shafted you financially. It’s a depressingly familiar list: property, pensions, the NHS, further education, student debt, the national debt and so on. They built a giant, towering pyramid scheme to ensure they had lovely lives and they’re now spending their gold-plated pensions on exotic holidays … meanwhile, you live in a tiny shared rented flat, working in a job whose wages are so meagre it may as well be in internship.

It’s worth reading this article and its near 2,000 comments (!!!), as well as similar articles such as this: 10 Reasons Millennials Are the Screwed Generation.

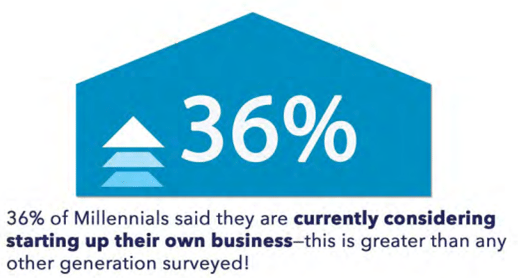

Because this generation is screwed they want to reshape the world, and specifically banking, for the future.

They are disillusioned and that is why many are creating the future by founding their own start-up businesses using crowdfunding and bitcoin for their entrepreneurial operations.

I could add much, much more but the bottom line is that if you are under 35 and want to change the world, you probably will because:

- you can do it thanks to being a net native; and

- what have you got to lose?

Just a thought.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...