I’ve been talking about the hot new start-ups targeting the banking markets for a while. There are literally 1000’s of them – the Fintech Awards had over 750 firms to review this year alone – and sifting the wheat from the chaff is hard. There are a few standouts however, and these are the ones I talk about in my presentations.

They generally fall into three categories: wrappers, replacers and reformers.

The wrappers are ones we don’t need to worry about too much, as all they are doing is wrapping themselves around the old banking marketplace. These are the Moven’s, Simple’s and Apple Pay’s of this world. These are Square, iZettle and Wonga. These are PayPal, Google and Facebook.

Right now, they are not trying to replace or reform the banking system. They just want to remove the friction from the old system by wrapping themselves around it and making money easy to save, spend and use.

Then there are those who wish to replace core bank services with servers. These firms are more worrying as they’ve realised one basic idea: you don’t need a third party organisation to transfer finance; you just need a server.

It’s what Zopa realised very early on: take money from those who have it and transfer to those who need it, using the processor as the trusted intermediary. The server processes the transaction and assesses the risk. No human hand needs to be involved (although Zopa does have humans assessing risk too).

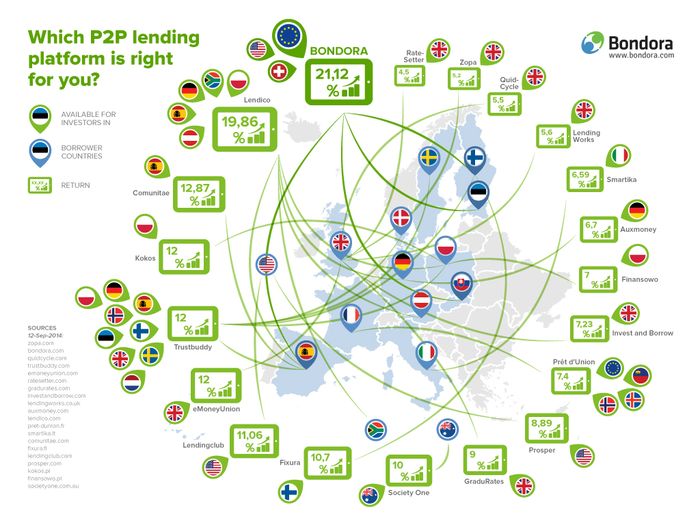

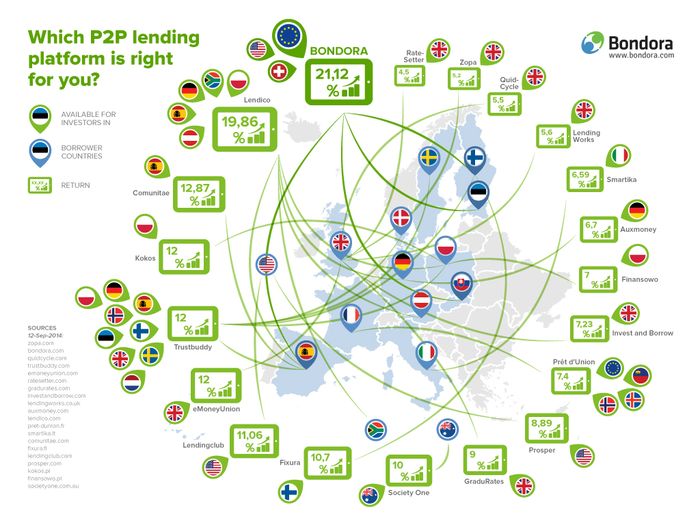

This is why the replacers need to be more keenly watched, as they are trying to displace the bank rather than remove the friction. And there are many replacers. Zopa’s P2P lending model has rapidly caught fire such that it has been copied globally.

I now find a Zopa in almost every country: Prosper and Lending Club in the USA; Smava, Germany; Harmony, Australia and New Zealand; ppdai, China …

Slide courtesy of Bondora

Slide courtesy of Bondora

You know something is hot when it’s copied around the world. Add on to this a sprinkle of crowdfunding and you have a $1 trillion by 2025 according to Foundation Capital . That market is across all credit products from personal loans to small business lending to mortgages and realty.

Slide courtesy of Foundation Capital

Slide courtesy of Foundation Capital

That’s a serious displacement of a core banking product: credit.

And it’s not just happening in credit as remittances, foregin exchange, trading and more are being attacked by neat and nimble new players from currency cloud to etoro.

Then there is the final category: reformers.

These guys see a reformation of financial services. Right now, there are only two reformations I see happening, but I’m sure there are more.

The first is financial inclusion through mobile technologies (see Bill Gates speech and the video clip at the end of this blog); and the second is the reformation of money through bitcoin (see last week’s blog).

The first is reformational because access to financial services for everyone on this planet will mean that no-one needs to be poor because the systems excludes them. The second is reformatinal because the creation of a value exchange without banks involved is a totally new concept and marketplace.

So there we have it: wrappers, replacers and reformers.

If I were a bank, I’d be watching all of them and be just a little bit worried. But there again, I’m not a bank. Just a blogger.

Kosta Peric, Deputy Director for the Financial Services for the Poor initiative at the Bill & Melinda Gates Foundation, talking at last week’s payments conference in New Zealand.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...