Reflecting on another conversation at last week’s conference, there were lots of discussions about why the mobile wallet wars were lost. No one’s won the mobile wallet war yet, not even Apple, but it is there to be won. In fact I wondered why it took a firm like Apple to take up the mantra and aim for this crown – not forgetting WeChat, Alipay and others – and realised it’s because no one has yet worked out what a mobile wallet is for.

For example, PYMNTS.com came up with some interesting stats the other day. The website did two surveys of iPhone 6 users – 400 people in November 2014 and 1,000 in March 2015 – in partnership with InfoScout. The findings are intriguing.

The March 2015 numbers showed improvement over the November 2014 in all categories – 6 percent use the service (up from 5 percent), 9 percent had tried it but weren’t using it (up from 4 percent) leaving 85 percent who had never tried it (as opposed to 91 percent).

In the almost six months since Apple Pay launched, users have certainly become more willing to try Apple Pay – that category nearly doubled since InfoScout first measured it in November. So why weren’t those users using it more often and converted from “triers” to “users?”

The main reason those who had tried Apple Pay in the past, but didn’t on some transactions where it was available, seems to be forgetfulness – almost a third (32 percent) said they just forgot it was an option.

“Muscle memory is a challenge,” InfoScout Co-Founder and CEO Jared Schrieber told an audience at Innovation Project yesterday. “If I’m Apple, I’m dead-focused on point of sale and making sure there is a trigger to make sure I pull out my phone and not my card.” Schrieber further noted that Apple could perhaps leverage beacon technology as a triggering mechanism.

OK, so the mobile wallet has to be relevant and seen in the same way as card or cash, and it’s not right now. For example, I mentioned other attempts to crack this markets include Japan with LIN£ Pay, a Facebook Messenger service that started late last year. LINE has 170 million active users in 230 countries and the service is available globally except in Korea and China. The service has been enhanced recently by Cybersource, but there’s little results yet.

In Korea, Daum Kakao launched BankWalletKakao and Kakao Pay. In this case the internet giant Daum Kakao has partnered with 16 banks to enable bank transfers and online payments, as well as peer-to-peer payments that garnered 1.2 million users in the two months after launch, only to encounter teething troubles such as not being able to make payments on the first day of launch. Still a way to go.

Probably the best success so far that we’ve seen is Tencent’s WeChat and Alibaba’s Alipay in China. This is because they are both taking this seriously, investing heavily and aiming to capture this market for mobile money before anyone else does. In order to do this, you have to create a reason – an incentive – to open up a wallet and use it. Both companies achieved this by targeting the tradition of sending red envelopes of gifts of money to friends and family for Chinese New Year.

WeChat launched the first salvo in this market area last year. According to Forbes, over 40 million virtual red envelopes, totalling 400 million yuan ($64 million), exchanged in just a few day. As a result, millions of new users signed up to WeChat’s Tenpay payment system and linked their bank accounts to it.

Jack Ma of Alibaba called the move a “Pearl Harbor moment” for his company and so, not to be outdone, launched its own virtual red envelope campaign this year. According to Alibaba spokeswoman Teresa Li, 240 million virtual red envelopes were sent through Alipay on February 18 alone, accounting for almost 4 billion yuan ($640 million).

All in all, China is showing a different approach by focusing upon the use case for a mobile wallet, and reinforcing it with rewards. In fact, this update from the Financial Times puts China’s approach to the market in perspective:

Third-party mobile payment providers [in China] processed Rmb6tn ($960bn) in payments in 2014, five times the previous year’s total, according to iResearch. That compares with $52bn in the US last year, according to Forrester Research, though that figure is set to grow following the launch of Apple Pay. Five months since its launch, Apple already accounts for two-thirds of all US mobile payments.

In China, most mobile payments are still used for online purchases, but thousands of brick-and-mortar retailers have begun to accept QR payments — made by scanning codes — over the past year.

Alibaba and Tencent have shrugged off a directive by China’s central bank halting mobile payments based on swiping barcode-like QR symbols and are moving aggressively to expand their reach to offline stores.

Retailers that accept QR-code payments through Alipay’s mobile app include 7-11 and Family Mart, two convenience store chains with a combined 3,100 outlets across China.

International fast-food chains Pizza Hut and Dairy Queen are also on board, along with local chains such as Old Auntie’s Boiled Dumplings. Meanwhile, at least six major department store and shopping mall chains accept QR code payments through WeChat.

“The central bank just suspended QR payments but didn’t ban them. After that they never put out any official policy, so Alipay and WeChat just kept on going,” said Qian Haili, internet finance analyst at China E-Commerce Research Center.

The use case, rewards and working around the regulations are all key ingredients to the China story which, in many ways, is leading the world. After all, I’ve been blogging about this stuff for long enough to see that not many markets have yet worked out what a mobile wallet is for.

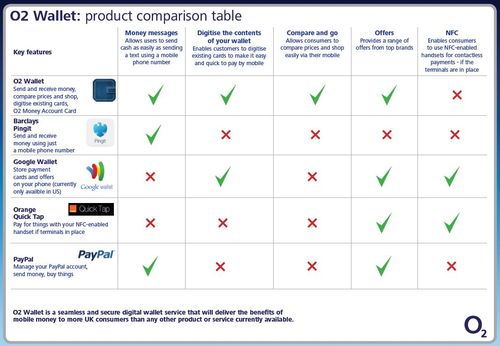

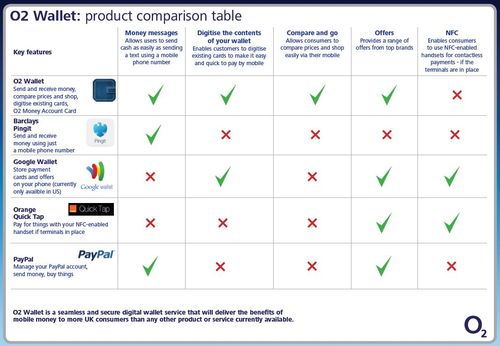

Take this example from three years ago: Let the Mobile Wallet wars begin, which had this chart of the key players in 2012 (doubleclick chart to enlarge):

Not much movement there, with Orange and O2 out of sight and Pingit moving along nicely … but not really as a wallet (yet).

Or take this research from December 2013: The Future of Money (in Denmark), which looked at what it would take to get consumers onto mobile wallets. The main conclusion: consumers are ready for mobile payments, but that does not mean they will use mobiles for payments. There has to be a reason.

Simple, but darned hard as no-one’s really cracked this yet. If anyone will, it’s probably Tencent, Alibaba and Apple.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...