So I’m just going to close off the branch debate (this time around, it comes up often) by talking a moment about demographics. In my gut, I hate the use of demographics as, when it comes to digital, I prefer psychographics. As a baby boomer, I feel more like a digital native, having grown up in the technology industry as my career, than a digital immigrant but, according to demographics, I’m an immigrant.

Whatever.

Truth be told, it doesn’t matter so much because there are some clear demographic differences when it comes to use of branch and paper. Old people prefer branches and cheques, whilst the young prefer mobile and apps.

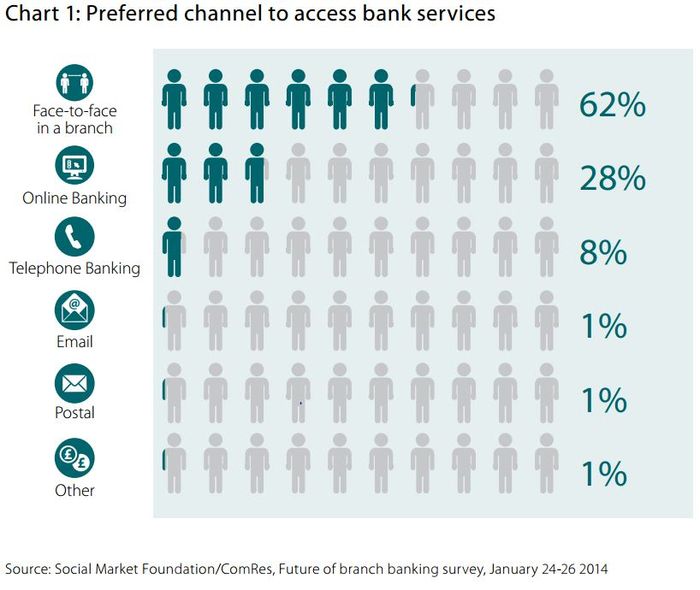

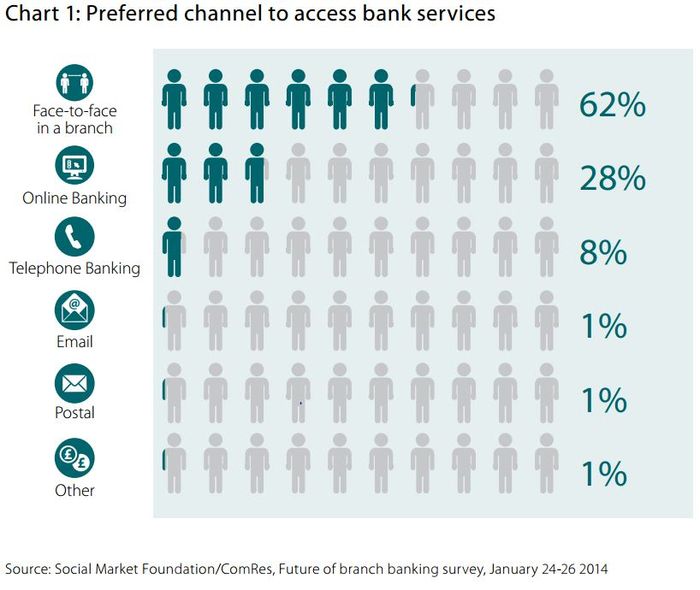

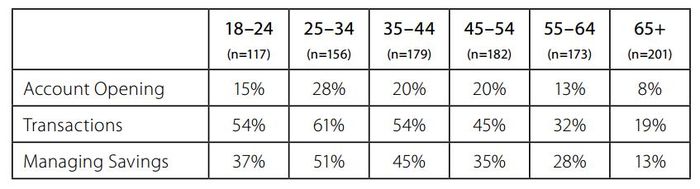

Now that seems ageist but, bear with me, as research bears it out. For example, the Social Market Foundation performed research into preferences for access amongst UK consumers last year and found:

Face to face service in a branch is still the preferred mode of accessing bank services for 62% of people. While we might be comparing prices and ordering goods online, and certainly that is where we are checking real estate listings, eight out of ten people would prefer to go to a branch to seek financial advice; almost seven out of ten to open or upgrade a current account; and it’s only when we ask about simpler payments transactions, that other channels – primarily online banking – become a common preference … the affluent (AB social class) and the young (25–34 year olds) have a weaker preference for the branch than others, with more than half of these groups preferring other channels. This trend in their attitudes is significant because the affluent, by way of their higher deposits, contribute the most to banks’ net interest income; and the young acquire the highest number of financial products and services in these years, contributing the most to banks’ fee-based income.

In other words, the financially competent and confident and the digital natives are the non-branch lovers, which means the financially less well-off and digital immigrants are the branch users. The charts below shows the preference for using online banking, which declines the older or less well-off you are.

Part of the reason the elderly are not going to want to lose their branch access is that they’re not online at all. In another recent survey by UK Gov of internet usage in the UK:

Over eight in ten (83%) of adults now go online using any type of device in any location. Nearly all 16-24s and 25-34s are now online (98%), and there has been a nine percentage point increase in those aged 65+ ever going online (42% vs. 33% in 2012).

So 17% of the UK are not online, rising to 58% of people over 65, the majority.

Now the point I’m making here is actually not about age and demographic. It’s a thoroughly different but important point. The point is that, as an industry, we are too accommodating of too many choices for too many people.

Each time we introduce a new access service to the bank – mobile and apps – we don’t close down an old one – the branch – because some of the people use some of the services some of the time. As long as some of the people use some of the service, we keep it available.

It is similar to the idea the Payments Council had a few years ago to get rid of cheques. There was a huge outcry because the elderly use cheques, so the action was revoked. How many old people use cheques?

There’s not a great deal of up-to-date info on this, to be honest. For example, in a paper prepared for Parliament a year ago, only two paragraphs talk about the demographics of cheque usage:

Women are more likely to carry a cheque book than men (47% of women said they always carry a cheque book when they go shopping compared to only 19% of men). Cheques are most popular with people aged 50 and over ... A survey on payments to retailers undertaken by the Payments Council (formerly known as APACS) in 2005 found that 46 per cent of cheque use was by users aged 55 and over, despite this age group accounting for only 34 per cent of the adult population.

Similarly, the Payments Council’s report on The Way We Pay only mentions demographics in passing:

Cheques tend to be favoured by older people who are used to paying that way, the self-employed and families with children who have to pay for childcare and children’s activities.

However, this point reinforces the branch access point: we are purely continuing these outmoded services from the last century because a small group of citizens want to use it.

Meanwhile, we introduce new services that are absorbed rapidly by digital natives and immigrants, and find ourselves stretched. If you look at those new services, some class of citizen has taken to them like ducks to water, so to speak.

The British Banker’s Association (BBA) reports about The Way We Bank Now shows how rapidly things are changing. Key statistics from June 2014 include:

- Apps offered by banks have been downloaded more than 14 million times. Some of these services have already racked up well over 1 billion uses in just a few years.

- Mobile phone banking is popular, but many customers still prefer internet banking for larger transactions. Nearly £1 billion a day is being transferred using the internet.

- Internet and mobile banking is now used for transactions worth £6.4 billion a week – up from £5.8 billion last year.

- Banking apps for mobiles and tablets have now been downloaded more than 14.7 million times – a 2.3 million rise since January at a rate of around 15,000 per day in 2014.

- Internet banking services typically receive 7 million log-ins a day

But the demographics here are similar to the opposite of those mentioned above with branches and cheques. For example, Barclays Pingit launched in 2012 and, after three months, had some interesting demographics:

- 29% of users are 18-25 years old;

- 37% are 26-35;

- 26% are 35-50; and

- 7% are over 50.

In a nod to our across the pond friends, The Financial Brand summarising Pew Research findings shows similar numbers:

|

% Who Use Desktop-Based | |

|

All internet users |

61% |

|

Men |

63% |

|

Women |

58% |

|

Race/Ethnicity | |

|

White |

63% |

|

Black |

48% |

|

Hispanic |

62% |

|

Age | |

|

18-29 |

67% |

|

30-49 |

65% |

|

50-64 |

55% |

|

65+ |

47% |

|

Education | |

|

No high school diploma |

30% |

|

High school grad |

47% |

|

Some college |

66% |

|

College+ |

75% |

|

Household Income | |

|

Less than $30,000 per year |

48% |

|

$30,000 to $49,999 |

57% |

|

$50,000 to $74,999 |

71% |

|

$75,000+ |

75% |

|

Urbanity | |

|

Urban |

62% |

|

Suburban |

66% |

|

Rural |

42% |

So what we really have going on is banks offering services and trying to be all things to all people. Banks try to please all of the people all of the time, and it just doesn’t wash. There’s a cost overhead that the digital natives and immigrants are paying to cross-subsidise the costs of the branch and paper users. Will we see a digital divide opening in banking? Will the digital crowd migrate to cost-efficient pure digital plays, leaving the oldies and poor using the physical networks?

It’s a good question and a very pertinent one to ask. After all, it builds on my discussions the other day about insurance.

What is more likely to happen is that the old will have to get their kids and grandchildren to do their banking for them, whilst the poor will use mobile financial services for inclusion in the network somewhere. However, during this transition, there will be some blood on the floor with the most likely change being the pure-play digital companies gaining the most affluent and savvy customers, leaving the incumbent banks with an even bigger dilemma on their hands.

Close down too many branches too quickly and they get called foul; don’t close branches fast enough and they can’t compete.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...