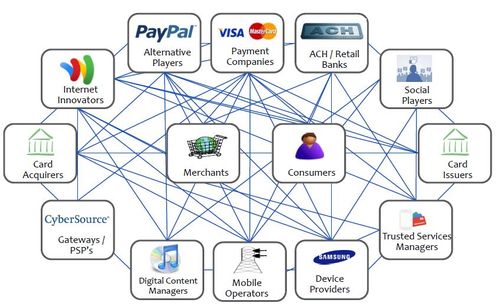

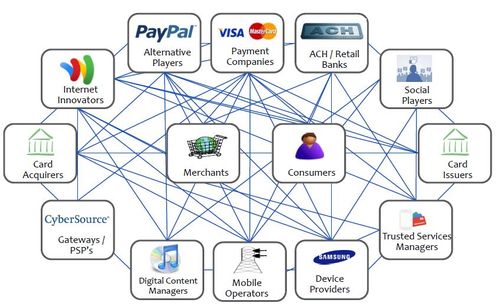

I had a good chat about the mobile financial ecosystem today. Maybe a good example of that ecosystem is represented below:

What this portrays is that it’s complicated. There’s a lot of players doing a lot of things and the bank has to herd cats to make it work.

What’s interesting though is that this slide is from 2013 and things have changed. Take Apple Pay launching with Stripe to create a front end payments system that simplifies stuff. Take the roll out of APIs, such that anyone can incorporate any payment into their systems anytime, all the time. Take the simplification of technologies and usage through cloud, apps and the increasing open source software movement in banking and payments.

Add all this together and what I get a sense of is that there was an old way of thinking last decade that created a tough ask for banks. Banks, in order to be rollout a mobile payment service, would have to work with multiple players like the telco providers, handset makers and more to create a mobile payments service. This would involve greedy telco’s asking for a high stake of fee and payment to allow the banks in the game, and led to many failed attempts to get these things off the ground. Just think of the Mobey Forum, Simpay and more, to see how difficult it was. The partnerships just didn’t make sense a decade ago.

But then the telco’s got pushed out of the picture because we have moved from mobile proprietary services controlled by mobile network operators to mobile open services through the mobile internet of apps.

That really has changed things as anyone can now offer a service anywhere. This is why Venmo and TransferWise have kicked off so fast, and why Apple Pay and Facebook Pay can leverage rapid scale uptake if they get it right.

Within all of this, you then have players who are creating higher value and higher valued services, such as Square. Square takes a good fee – up to 3.5% + 15 cents per transaction - from their service but, customers don’t mind as before, they couldn’t even take a payment.

And there’s the big news. We have a very different world of value exchange with anyone with a bright idea able to jump on the bandwagon of making and taking payments using apps, API’s and cloud.

That’s why, just to put in context, TransferWise has achieved this.

According to Payments Source since its founding in 2011, TransferWise has processed roughly $4.5 billion and saved users around $200 million in bank transfer fees.

No wonder because a mystery shopper exercise commissioned by the company found that the cost of sending $1,000 from the US to Germany was on average $68 cheaper when using TransferWise versus 11 different US retail banks — but this process is only possible because of the existing banking system.

Mind you, the comment from banks is that they’ll only have this advantage whilst they avoid the cost of regulation and compliance overheads. That’s a big deal as, per their American market opening, the regulatory cost of setting up in the U.S. market could be as high as $3 million.

So the new entrants really only have advantage for as long as they can avoid the burden of the regulatory structures of banks … or so some say.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...