One of my good connections via social media is Huy Nguyen Trieu. Huy writes a regular blog at Disruptive Finance, as well as being a Managing Director for Macro Structuring at Citi. He posted something in the last week that I felt was worth re-posting here as a guest blog. Read and weep.

If you can’t beat them, join them: Goldman Sachs enters Fintech

Goldman Sachs has been a very active investor in Fintech (and Tech in general), with the latest investment in Circle (Bitcoin), but also CompareAsiaGroup (Comparison website for financial services), Oscar (Challenger Insurance) or Kensho(Data analytics for finance) for example.

But what caught my eye was the very detailed research they published a couple of months ago about how non-bank lenders will take away business from banks.

Their conclusion was that :

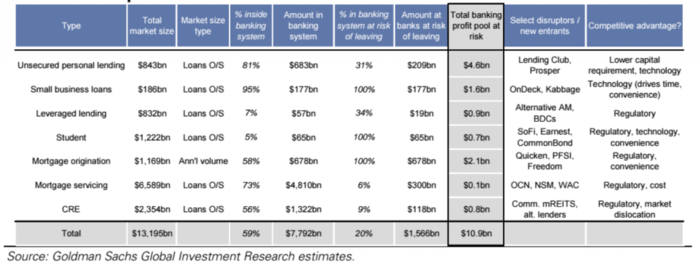

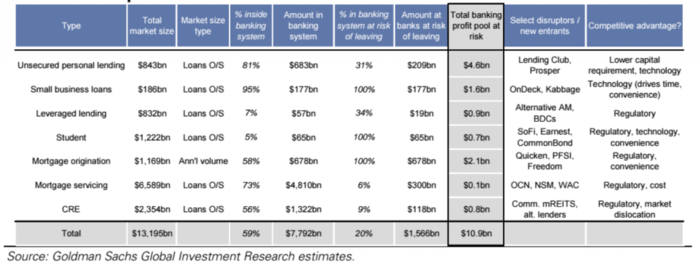

- US banks earned $150bn profit from lending in 2014

- In 5 years, $11bn of these could be captured by non-bank lenders – and in particular online lenders such as Lending Club, Prosper, SoFi, Kabbage etc.

- The table below (click image to enlarge) shows very clearly what are the areas they have in mind, and the competitive advantages of the online lenders.

Non-Bank Lenders will take away profit from Banks says Goldman Sachs

Source: Lend Academy

The research document is very interesting, and shows that GS had clearly identified a very important trend in lending – and a potential threat to banking profits.

But then investing in Fintech and writing good research is not really a game changer, so what did they do?

They announced that they will build an online lending activity, within the bank itself: ” Goldman Sachs Group Inc. hired Harit Talwar, the head of Discover Financial Services’ U.S. cards division, to help develop an online lending effort for individuals and small businesses…is seeking to join startups such as LendingClub Corp. in using technology to disrupt traditional banks.” (Bloomberg, May 2015)

And that is very interesting indeed, because we’ve had from Goldman Sachs:

- Investing in and working with the Disruptors

- Analysing the Disruptors

- And now, Disrupting the Disruptors!

Which seems very simple said like this, but to my knowledge this is the first such initiative at this scale.

Until now, there has been a love-hate relationship between online lenders and banks, where banks observed online lenders with interest, but saw them as smallish competitors that were not really taking business away. And banks were even happy to partner with online lenders like Santander with Funding Circle.

Now, with Goldman Sachs’ announcement, both Lending Club and Ondeck had to justify why GS would not be a threat. This is a game changer in my opinion, with banks having to ask themselves the question: how should online lending be part of their strategy? Should they partner with startups or develop their own solutions?

And what kind of online lending? Is it data-driven lending a la Kabbage or Ondeck? Is it p2p (b2p, b2b, p2b?) platforms a la Lending Club or Funding Circle? Is it invoice-financing a la Finexkap or MarketInvoice? It seems from the first reports that GS will focus on a Kabbage model – i.e. data-driven lending – but it would definitely make sense to have some disintermediation component for their institutional investors (i.e. p2p).

Going forward, this will obviously impact more than just online lending. It will be fascinating to see what happens over the next few months, and if other banks follow suit.

For updates on Disruptive Finance and Fintech, follow Huy on Twitter here

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...