I mentioned a few weeks ago that we had a great twitter debate between Brett King and Michal Panowicz, with others joining like Jim Marous and myself. The debate is now being staged live at Next Bank New York tomorrow.

It’s not so much a rumble in the jungle but a wrinkle-in in Brooklyn.

Anyways, I’ve decided to dive into the debate again, as there were too many reports coming out at the weekend signalling the death knell of the branch operation.

It started with the BBA’s annual update on the Way We Bank Now, which found amazing stats, such as:

- The use of UK bank branches fell by 6% in 2014, as customers channelled more transactions over phone and the internet;

- The number of branches in the UK fell from 13,349 20 years ago to just under 9,702 in 2013;

- In 2009, UK customers called banks nearly 50 million times to transfer money between their accounts. By the end of 2013, the figure had fallen to just over 16 million;

- Between 2008 and 2013, telephone transactions fell 43%;

- Banking apps were used 10.5 million times a day across the country in March 2015, eclipsing the 9.6 million daily log-ins to internet banking services, and both services are still growing rapidly;

- More than 8 million people downloaded banking apps in the past year;

- In a typical week, Brits are transferring £2.9 billion through apps;

- Bank branches carried out 427 million transactions last year, the equivalent of 1.17 million per day (assuming they are open seven days a week); and

- The shift to online leaves the 6.4 million people in the UK who have never used the internet increasingly out of step with their banks.

There were a few other zingers in there, such as the fact that over a million people switched banks in the year to March, up 7% on a year ago; and that contactless bank cards were used 40 million times in January, a three-fold increase on a year ago; but these are the main things.

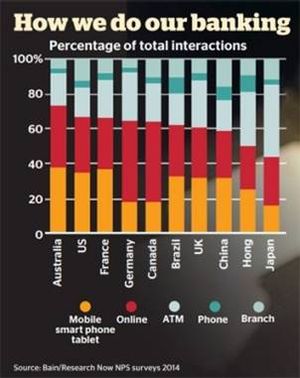

This report was followed by another from Bain & Co, which shows clearly that mobile and internet are proving to be a killer combo in most countries globally:Excellent.

So some people would use this information to claim that the bank branch is dead; the bank is no longer relevant; mobile digital is all; and the customers will move even if the bank moves.

Now I disagree with this view for a whole variety of reasons, but the core comes down to this.

First, even digital firms find the need for physical presence if, for no other reason, they need to reassure customers they are real, can be trusted and are backed by humans.

Second, a digital only play narrows the focus to only those customers who want digital only service. Those customers are often mature, confident and competent with money, in the case of banking. It’s different to the youth millennial or iGeneration, who are confident and competent with technology but not with money. The latter demographics want human contact when it comes to big scary things like buying their first house and, just to refresh old memories, a pension is the last thing on the mind of a raver.

Third, and probably the most important factor, is that the digital only bank has two forms. A digital form based upon apps for the best user experience where the client is sophisticated in approach; and a mobile form based upon text messaging for the simplest user experience where the client is basic. These two mobile form factors are critical to future bank services. In fact, the mobile only play for financial inclusion II do believe is transformational, as it enables five billion people previously excluded from the financial network to be included. However, where I fundamentally disagree, is that banks can exist in a digital form only. The reason I disagree with this is that there are very few digital only behemoths – Google. Facebook, Amazon, Uber – but all of these have a physical form.

Google is nothing without someone touching their search engine with their fingers; Facebook is nothing without someone providing a status update; Amazon is nothing, without people who need goods to be delivered and having the physical capability to deliver those goods; Uber is nothing without guys in cars driving folks who need cars to their destinations.

In other words, the provocative view that money is just data and can all be digitalised with no bank involved is a good theory, possible in our dreams, but unworkable in reality as society wants to deal with real people in real places when it comes to real money.

Or that’s my view anyway.

“While most banks have been reducing the size of their high street presence since the 1980s, the death of the bank branch has been much overstated. More than a quarter of the UK’s bank branches have been refurbished in the past three years, clearly demonstrating the commitment to bricks and mortar.”

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...