I talk about M-PESA and mobile financial inclusion a lot. It’s high on the agenda of many governments and charities, most notably the Bill & Melinda Gates Foundation who claim that the world’s poorest nations will see an uplift in their wealth faster than any other nations over the next fifteen years thanks to mobile money.

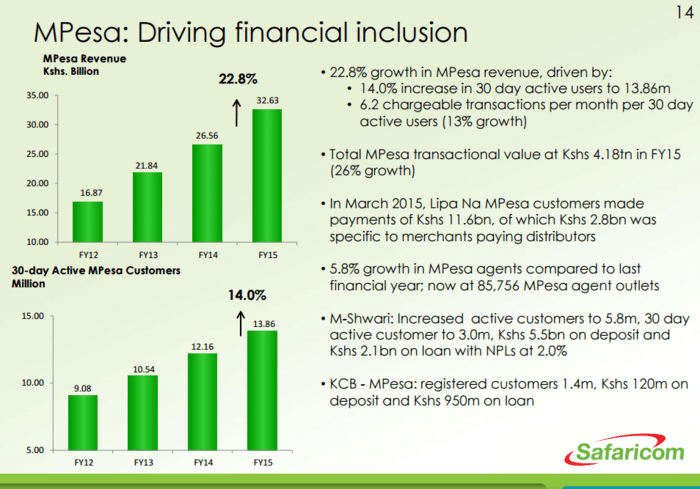

A lot of this is based upon the success of M-PESA in Kenya. Launched in 2007, M-PESA boasts significant statistics of success such as:

- 14 million Kenyans actively use MPESA today moving almost Sh4.2 trillion (USD$42 billion) per annum through the network;

- Nearly 60% of Kenya’s GDP moves via mobile money transfers;

- Over six million transactions are carried out over the service daily, more than Western Union does globally, through M-PESA’s 80,000 strong agent network; and

- In 2009, only 41% of Kenyan adults had access to financial services rising to over 70% today, thanks to mobile financial inclusion and mobile credit histories (take M-PESA out of the equation and this drops to 26%).

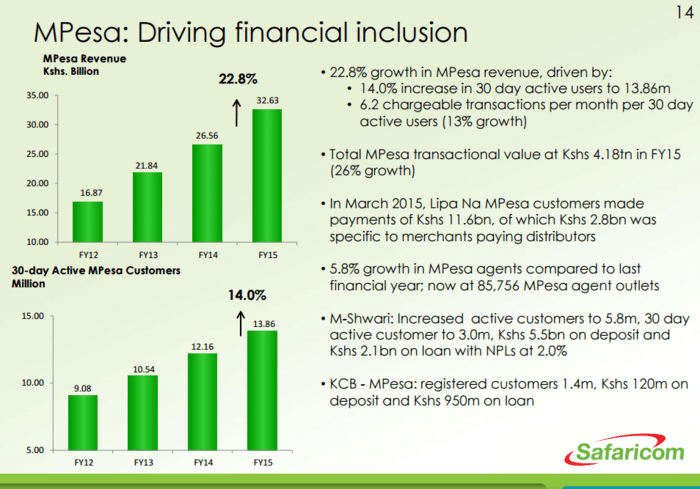

The overall story of mobile in Kenya has been phenomenal:

M-PESA’s success in Kenya has led to increased competition from a variety of providers, including the banks. For example, Equity Bank launched a competitive service to M-PESA late last year. In doing so, Equity said that it will more than halve interest rate charges (“… instant loans will be available at a maximum of 2% per month compared with the 7.5% per month offered in the market”) and extremely low transaction costs for money transfers – between Kshs1 ($0.01) and Kshs100 ($0.28). In response, M-PESA slashed transaction charges by 65%, and the market has heated up considerable.

According to statistics provided by the Central Bank of Kenya, there were 825 million mobile transactions up to November 2014, compared to 732 million transactions in 2013. Kenyans made an average of 75 million mobile money transactions in 2014, with October having the highest number of transactions at 82 million.

So here’s the often asked question: why has M-PESA been so successful and why isn’t there an example of another M-PESA elsewhere?

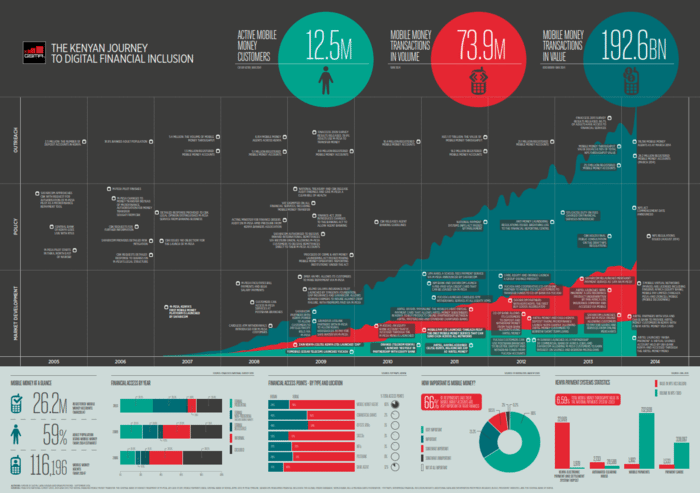

Well, there are examples of similar success elsewhere. Tanzania, for example, saw a massive rise in mobile money usage between 2011 and 2013:

In fact, there are now 16 countries where mobile money accounts outnumber bank accounts.

In 2013, there were just nine countries where this was the case: Cameroon, the Democratic Republic of the Congo, Gabon, Kenya, Madagascar, Tanzania, Uganda, Zambia and Zimbabwe. Seven new countries joined these nine in 2014: Burundi, Guinea, Lesotho, Paraguay, Rwanda, the Republic of the Congo and Swaziland, bringing it to a total of 16 countries. So the M-PESA success is being repeated across Africa slowly, but there are key factors necessary for success, one of which is having a strong agent network.

This is why there are some people betting that the next M-PESA will break out of Africa and appear in Latin America or, to be more specific, Brazil. Of the 200 million people who live in Brazil forty percent, mainly in the North-East of the country, are unbanked and this is a source of concern and opportunity. According to a recent blog by Mondato:

Brazil has long been the leader in bank-based branchless banking, with the result that Brazilian banks’ agent networks have a presence in each and every one of Brazil’s almost 6,000 municipalities. This means that one of the most crucial elements of the MFS ecosystem, the agent network, is already in place in Brazil even in the absence of mobile money itself. Recently, the Banco Central do Brasil (BCB) has introduced new regulations that could give the boost that is needed to take a full mobile money deployment to scale in a Latin American country for the first time. The regulations are an innovative mixture of “light-touch” and caution, and the BCB has clearly keenly observed the experiences of Kenya and the other ‘Pesas’.

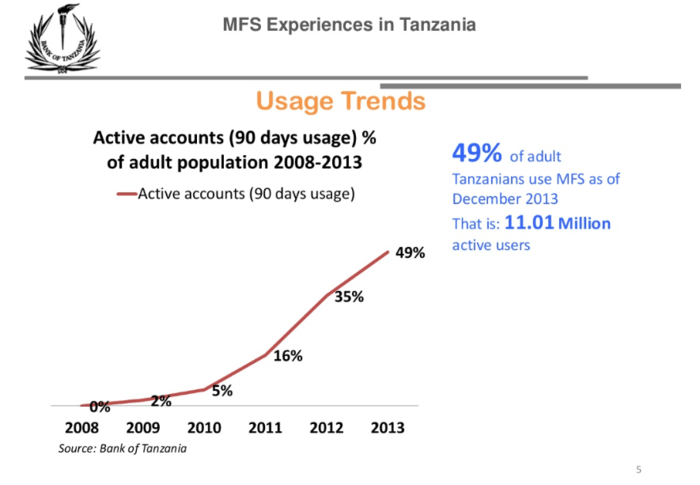

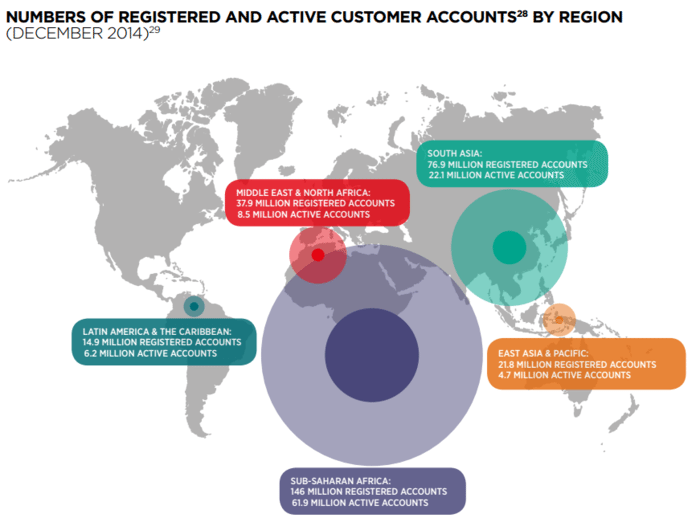

When we see mobile inclusion break out of Africa to Latin America and Asiana, then we will really know that mobile financial inclusion is changing the world. For now, it’s still early days. For example, the GSMA’s annual mobile money adoption survey finds that there are 255 mobile money services live across 89 countries with 300 million users. That leaves a huge potential for future growth, as 300 million accounts represents just 8% of mobile connections in the markets where mobile money services are available.

Chart taken from the GSMA's Mobile Money Adoption Survey 2014

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...