I’m such a sad banking geek that in my two hours off here in Seoul I ran around to the Bank of Korea’s Money Museum.

Yes, I really am that sad but hey, it was near the hotel and the only thing I could do within walking distance apart from shopping. Yes, I really am that sad.

Anyway, it turns out it’s a great Museum.

It’s free for a start, although it did make me laugh as I wanted to get the audio guide and was told they only took cash. I guess, as a Money Museum, that would make sense (or cents?). Luckily, the audio guide wasn’t really needed as everything was clearly explained in Korean and English.

Starting downstairs you get the whole kit and caboodle about barter systems leading to shells and stones being exchanges leading to coins and then, centuries later, paper. The bank explains how monetary policy works, the role of the Central Bank and how interest rates and inflation affect the economy. All of this designed in a way that even a child could understand although, obviously, it was all way beyond me. This dumbing down never did me any good.

Upstairs was a room full of gold, which explained how it worked as a value store right from the days of King Midas. Then there is the money printing room, and it shows how money is both made – paper money – and destroyed.

Finally, you get to a room full of money from around the world, including everything from the Malaysian Ringgit to the Greek Drachma ...

... now, that one may make a comeback, no?

Anyways, my favourite nuggets from this particular brief tour is how language and mentality of money crosses borders so easily. Here are a couple of examples.

Koreans have a saying “ttangjeon han pun obda”, which is the equivalent of the American “I don’t have even a red cent” and British “I haven’t got a brass farthing”. The saying dates back to the 1860s when the Royal Palace issued a currency to cover the King’s expenses. Because they were issued in such great quantities – the King was building a lot of Royal Palaces – the coins quickly lost value and so the cost of goods and services increased accordingly.

The result was that any money of little value was called ‘dangjeon’, a shorter version of the full name of the currency (Dangbaegjeon). To show their contempt for how worthless such coins were, Koreans then accentuated the first consonant, hence making it ‘ttangjeon’. Adding the ‘pun’ at the end, made this a brass coin and so “ttangjeon han pun” is the same as a red cent or brass farthing. In other words, I’m so broke, I don’t even have the most worthless coin of the land.

Another phrase commonly used by Koreans is “gaepyeong”. Gaepyeong comes from gambling and relates to when someone loses a lot of money to plead not to take the short off his back. When gambling, there would often be a lot of small change left on the table at the end and this had the word “gae”, a small amount. Adding “yeong” conveys the idea that although the other person may have won, leave enough on the table for the other guy to at least be able to make it back home.

I love these stories. Another particular focus at the museum also appears to be the amount of wasted banknotes there are in Korea. Every year, according to their explanations, 500 million banknotes have to be destroyed. If you put them all together in a stack, the combined notes would reach a height of 52 kilometres, or six times the size of Mount Everest (where do they get this stuff from?). Destroying the banknotes involves 89 five-ton truckloads a year being shredded and, once shredded, the old money is recycled and used as vibration damping pads for cars and other materials. So the next time you brake on the interstate, just think of those banknotes squealing your way to a stop.

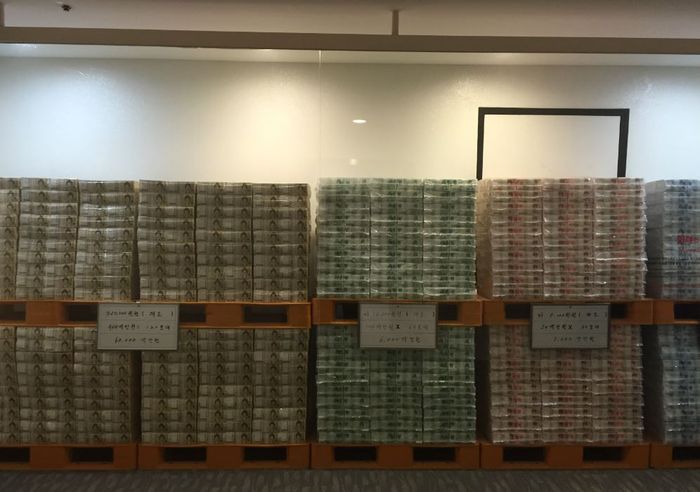

Anyways, at the very end of my walk around the bank, I found this room …

… and this was inside …

… if I don’t blog ever again, you now know the reason why. Yes officer, I’ll come with you now …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...