One of my good connections via social media is Huy Nguyen Trieu. Huy writes a regular blog at Disruptive Finance, as well as being a Managing Director for Macro Structuring at Citi. He posted something in the last week that I felt was worth re-posting here as a guest blog.

The One Chart you Need to Understand Fintech

Traditional finance providers such as banks or insurance companies are being challenged by new players such as Lending Club or Transferwise. These startups want to disintermediate the incumbents and revolutionize the financial world.

But what is the biggest difference betwen a bank or insurer and a Fintech startup?

- Legacy systems vs. lean IT? Yes.

- Innovation culture? Of course.

- Faster development cycle? Certainly.

All these elements are valid, but I think that finance in 2025 will be fundamentally different because of a single reason:

DATA.

Of course, big data is a buzzword that is being used everywhere, but that's not what I mean. What I have in mind is: BUSINESS MODELS BASED ON DATA MONETIZATION.

What is the business model of a bank?

To understand this important concept, let's go back to the fundamentals of traditional finance.The revenue model of a bank or insurer is primarily made of :

1) Interest Income: if a bank manages to lend money at 2% and borrows at 1%, then it makes 1% of income. In practice, it's much more complex than that and a good Asset Liability Management ensures that this equation stays true.

2) Fees: a bank would charge for certain transactions (e.g. a currency transfer) or to sell certain products (e.g. distribute insurance contracts). This generates revenues from fees.

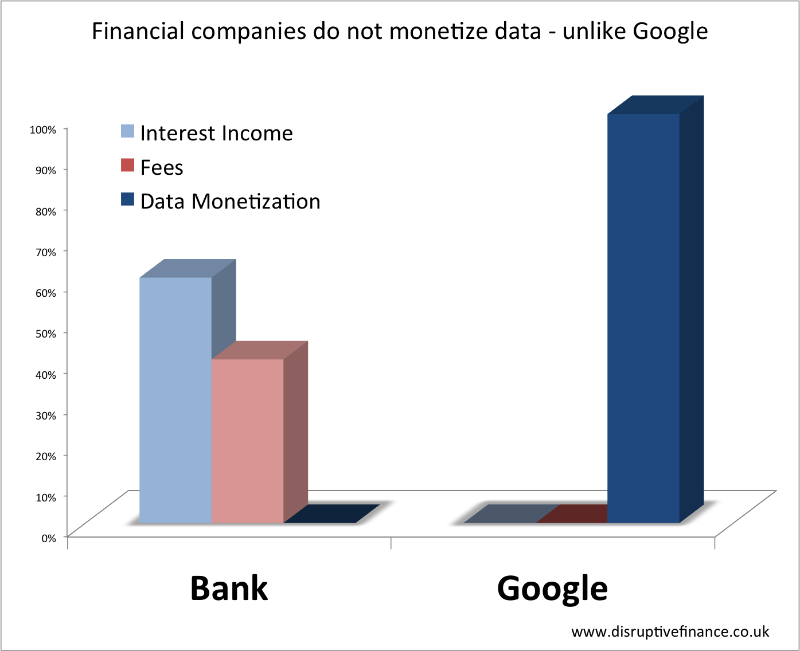

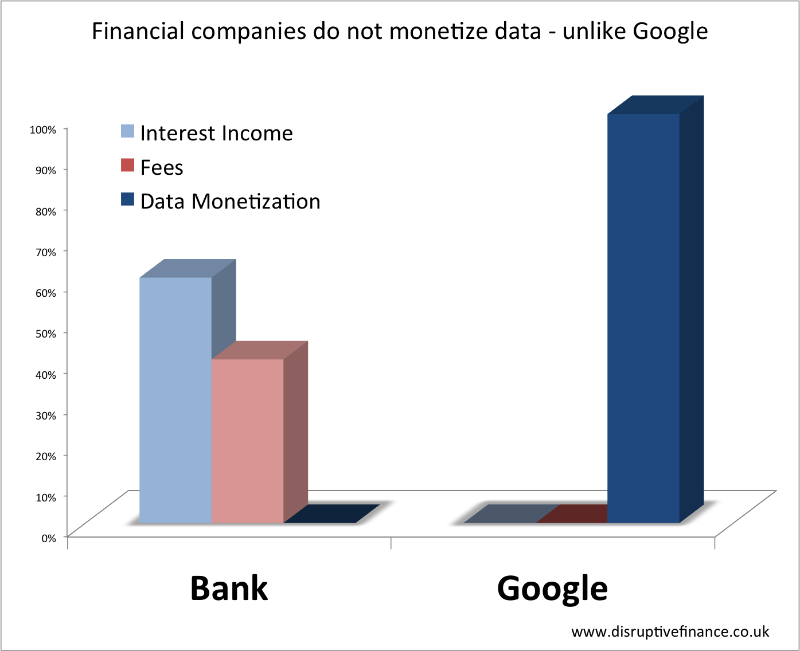

A document from Deutsche Bank shows that Interest Income represents 65% of revenues and Fees represent 35% for a typical bank.

We can see that data is not important in that business model. Data can be used to improve the business - for example in insurance underwriting - but it is not a source of revenues for traditional finance.

What is the business model of Google?

Now, let's take Google. How does Google make money? 95% of its revenues are from advertising. But of course, advertising is just the medium, the business of Google is Data Monetization. Google exploits the data it collects, processes and sells that information in the form of targeted ads. The exploitation of data generates the revenues, without any needs for fees or interest income.

Comparing the revenue models of a bank and of Google, we can see that the sources of revenue are totally different. This can be summarised in a single chart as below.

Finance does not monetize its wealth of data

Traditional finance is based on the century-old model of making money from interest and fees. But technology has allowed data-led business to make money from the information itself - without the need to charge for fees. Today, these two worlds are separate : finance is still based on interest income and fees and does not monetize information about clients' behaviours.

But if a company like Google can generate $66bn of revenues from browsing information alone, imagine the kind of business that will be built based one real-time financial information about clients. Instead of Google trying to guess your spending power, a financial company actually knows exactly how much you have spent, where you spent it, what you like spending on, and how much you can spend.

Will data monetization be the game changer in finance?

If you think that the business model of Google cannot apply to finance, then have a look at Credit Karma that just raised $175m which tries to do just that...

This is in my opinion the major revolution that will happen in finance over the next 10 years, where financial providers will realise that monetization of financial data is a business in itself. And that is the biggest threat of Fintech for traditional finance.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...