I’ve been stunned by the rise of P2P lending and crowdfunding, with Goldman Sachs (download their PDF white paper) predicting that it’s going to eat 7% of bank profits from the credit markets over the next five years and 14% over the next ten.

Goldman Sachs states ‘We see the largest risk of disintermediation by non-traditional players in: 1) consumer lending, 2) small business lending, 3) leveraged lending (i.e., loans to non-investment grade businesses), 4) mortgage banking (both origination and servicing), 5) commercial real estate and 6) student lending. In all, [US] banks earned ~$150bn in 2014, and we estimate $11bn+ (7%) of annual profit could be at risk from non-bank disintermediation over the next 5+ years.‘

That’s a good prediction, and one founded on fact.

For example, talking with the original peer-to-peer lender Zopa, they’re growing year-on-year by doubling their enabled lending. Zopa is expected to lend over £1 billion this year, which is quite a result after ten years of growth. In fact, UK P2P markets are the most active in the world with over £450 million lent in the first quarter of this year alone.

Figures published this week by the Peer-to-Peer Finance Association (P2PFA) show that more than £459 million was lent by platforms such as Zopa in the first three months of the year. Compared with the final quarter of 2014, this represents an increase of almost a third.

In 2014, the UK P2P industry lent £1.2 billion over the whole of last year, and 2015 looks guaranteed to be a record-breaker with over £2 billion loaned or, in context, around five percent of all UK consumer credit is being generated by the new industry model of P2P lending. According to industry analyst AltFi, there has already been more money advanced via P2P and other sources of alternative finance this year than in the whole of 2013. In fact, if you look at P2P money, their predictions for 2015 are that:

- Peer-to-peer lending will arrange £2.5billion in new loans

- RateSetter to overtake Funding Circle in terms of arranged loans

- Funding Circle to overtake Zopa in terms of active loans

- Several existing providers will exit the market

- There will be a change in ownership of at least one provider

I agree with most of this, but am more intrigued by what’s happening worldwide. This week, I’m in Korea and Taiwan for example, and they have a couple of great P2P lenders in the form of Moneyauction and Shacom. In fact, I’m here with the Asian Banker Magazine who have published their list of active peer-to-peer sites worldwide:

|

Australia |

SocietyOne | |

|

|

|

|

|

China |

China Rapid Finance | |

|

|

Creditease | |

|

|

Dianrong (formerly SinoLending) | |

|

|

HongLing Capital | |

|

|

Lufax | |

|

|

pPdai | |

|

|

Qifang | |

|

|

RenRenDai | |

|

|

SHAcom | |

|

|

Wangdaizhijia | |

|

|

Yooli | |

|

|

|

|

|

France |

Pret d’Union | |

|

|

|

|

|

Germany |

Lendico | |

|

|

Auxmoney | |

|

|

Smava | |

|

|

Zencap | |

|

|

|

|

|

Hong Kong |

Queen Capital | |

|

|

WeLend | |

|

|

WeLab | |

|

|

|

|

|

India |

Rang De | |

|

|

Faircent | |

|

|

i-Lend | |

|

|

|

|

|

Japan |

Aqush Tomo | |

|

|

Maneo | |

|

|

|

|

|

South Korea |

Money Auction | |

|

|

|

|

|

UK |

Assetz Capital | |

|

|

Funding Circle | |

|

|

Marketinvoice | |

|

|

RateSetter | |

|

|

Rebuildingsociety | |

|

|

ThinCats | |

|

|

UYDO | |

|

|

Virgin Money | |

|

|

Wellesley & Co. | |

|

|

Zopa | |

|

|

|

|

|

US |

BTCjam | |

|

|

CommonBond | |

|

|

Energy in Common | |

|

|

Grameen America | |

|

|

Lenddo | |

|

|

Lending Club | |

|

|

Prosper Marketplace | |

|

|

Sofi | |

|

|

Vittana | |

|

|

Zidisha |

That’s not an exhaustive list – for example, we could add Smava in Germany and the list completely misses Latin American lenders like Afluenta – but that’s not the point. The point is this: every market in the world has a P2P lender growing and eating into bank credit markets.

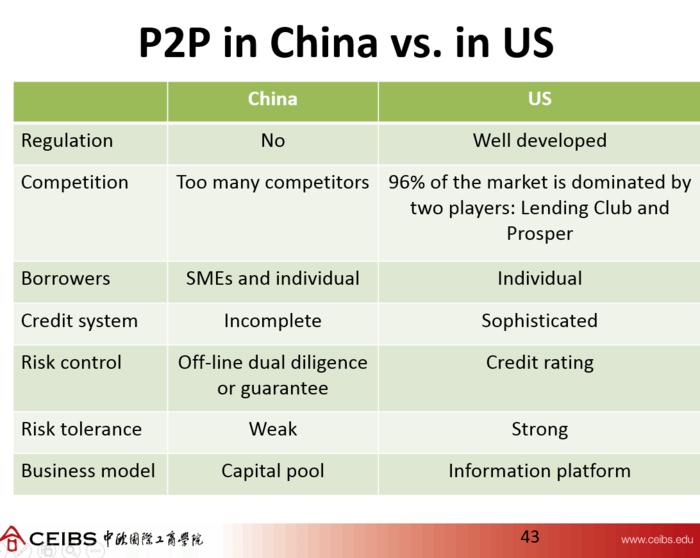

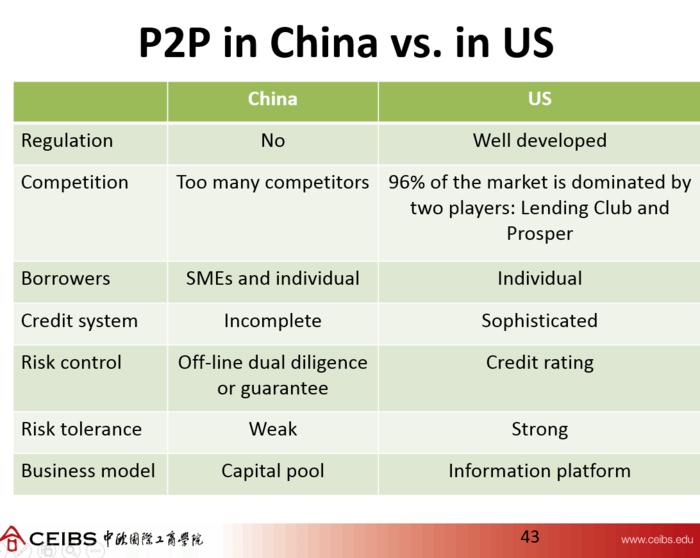

Take the China example. There are lots of P2P lenders but their models are not robust. They are unregulated and have exposures. I recently attended a presentation by Dr. Oliver Meng Rui, Professor of Finance and Accounting at CEIBS (the China Europe International Business School). Dr Rui made clear that China’s model is not reliable when compared to the American structure:

What this demonstrates is that every market is different. The UK now has a P2P regulator and incorporates P2P into government offers like ISAs (our savings products) whilst the US has forced Lending Club and Prosper to use the wholesale funding markets to operate.

Regardless, we are seeing a massive reshaping of credit finance through peer-to-peer connectivity. It’s just a shame that some of our protagonists aren’t more erudite.

http://auxmoney-presse.de/en/

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...