I was upset to be unable to join the recent debate in New York on digital banking. The debate was framed around the theme: "This House Believes Fintech Will Eat The Bankers Lunch", and I was going to oppose the motion. It ended up that I was conflicted and had to defer to a far mightier second man, Ron Shevlin.

Ron obviously was a stand-out star of the discussion in that not only did he win the debate with Michal Panowicz as his tag team partner, but he also got a lot of coverage of his rap:

Don't be a fool,

Fintech don't rule.

No doubt they're cool.

But they're just a bank's tool.

Two stand out articles have appeared subsequent to the debate from Sarah Todd in American Banker and Sam Maule in Bank Innovation.

Sam’s article in particular resonated as it focused upon Paul Revere’s Midnight Ride alerting the rebellious colonials to the fact that the Brits are Coming. Ron Shevlin likened this to Jamie Dimon’s comments that Fintech is Coming and we know how this ended – the Brits lost, as will Fintech in Ron’s view.

Sam calls Ron on this one though, and says that although the American rebels beat the British in 1776, it all ended up in a “special relationship” and that’s what will happen with banks and Fintech.

I somewhat agree, and would rather liken the Brits to the Banks and the Rebels to the Start-ups. The Start-ups may win the battle but there won’t be a war. Just a symbiotic special relationship. As Sam says: “Over time the U.S. and Britain became strong allies and developed what is known as the special relationship. I believe that the banking ecosystem will thrive with growing the special relationship between banks and Fintech.”

This is where it gets interesting as I mentioned this to a bank friend last night and he responded by saying that there already is a special relationship out there. Many banks are investing in and mentoring start-ups, helping them to flourish and grow. Many banks are engaged in the blockchain and cryptocurrencies. Many banks are offering joint ventures with crowd funders or investing in P2P lenders.

Santander recently announced over 20 use cases for the blockchain in banking, Barclays are nurturing blockchain start-ups whilst UBS has opened a London-based blockchain research lab.

On the P2P lending side, according to the Financial Times, the US P2P lending “platforms have been dominated by institutional money since both Prosper and Lending Club shut their doors in 2008 — under pressure from regulators that did not want them to offer securities to all and sundry — and relaunched in a different guise. About 80 per cent of their loans are taken by institutions, and they have dropped the ‘peer-to-peer’ label.”

In the UK, Santander and RBS have partnered with Funding Circle to say that if your credit history, as a small business, is not good enough to get a loan with them then talk to Funding Circle. Equally, Goldman Sachs and Société Générale are rumoured to be backing Aztec Money, an emerging peer-to-peer financing platform where people can bid for company invoices

In fact, I see more and more of these partnerships developing every day.

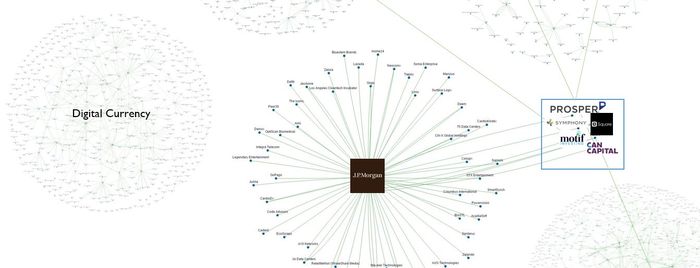

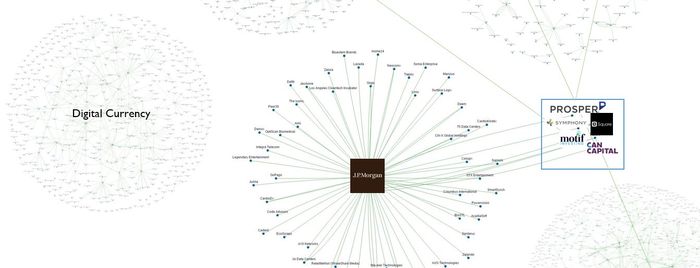

JPMorgan Investment Activity into FinTech Startups Intensifies

For more checkout this page from CBInsights.

This means that these new markets are growing with bank support, not against the banks themselves. Some believe that these markets will eventually bite the hand that feeds them and take over. According to Goldman Sachs: “$11bn+ (7%) of annual profit could be at risk from non-bank disintermediation over the next 5+ years”, which is why the 146 year old bank is the first to launch its own P2P lender next year.

Do they need to?

I’m not so sure. Right now, a lot of Fintech is serving the underserved markets, such as small business loans, lending to higher risk consumers and enabling payments in easier form over the old bank rail network. This is why many banks refer to the Fintech community as alternative finance although, interestingly, many Fintech companies refer to themselves as narrow finance. Narrow finance focuses upon a piece of the financial system and democratises it or, if you prefer, connects that system by replacing the trusted third party institution with a trusted third party processor. Fintech focuses upon replacing buildings with servers and, in so doing, wipes out a ton of cost overhead. There’s nothing alternative about this therefore. It’s core.

However, even if Fintech does grow into a larger monster, there’s plenty of time for banks to respond by either acquiring or launching competitive services, such as Goldman Sachs’ P2P lender. Just to put it in perspective, these two Economist articles make the point.

Through crowdfunding “websites, individuals and funds provided over €1.5 billion ($2 billion) in equity and debt to European small and medium-sized enterprises (SMEs) in 2014 … that is a pittance compared with the €926 billion of total new external funding made available to European SMEs the year before, mostly by banks.”

From the people, for the people

The P2P lending “sector has grown rapidly: the five biggest platforms for consumer lending—Lending Club, Prosper and SoFi, all based in San Francisco, and Zopa and RateSetter in London—have so far issued nearly 1m loans between them and are generating more at the rate of well over $10 billion a year … those loans are still dwarfed by the $3 trillion of consumer debt outstanding in America alone.”

In other words, there’s a long way to go before Fintech becomes mainstream, and it’s going to take a long time before the world really takes notice. By the time it does, most banks will own this sector or a large part of it, so don’t write off the banking system too soon.

As I would say to the Fintech community, the Banks are Coming, and we all know how that turned out don’t we?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...