I presented at a great conference last week on how ot start a bank. The conference featured some fine discussions of the challenges and opportunities of opening a new bank in Britain, and included a presentation from Victoria Raffé. Victoria was, until recently, the go to person fornprocessing bank licence applications with the Financial Conduct Authority, and is now independent.

Victoria talked about the applications in process, and highlighted that most new banks in the past three years have been overseas subsidiaries of foreign banks rather than new banks. However, there are 26 being processed today.

20 are in pre-application, which means they might never exist as anyone can apply. That leaves six near fruition. I’m aware of some of these, such as Starling and Atom, but why does it take so long to get from pre-application to license. Atom Bank first announced their plans over 15 months ago, and yet only just got a license. That’s a bank run by Anthony Thomson who founded Metro Bank, so he’s been through this process before.

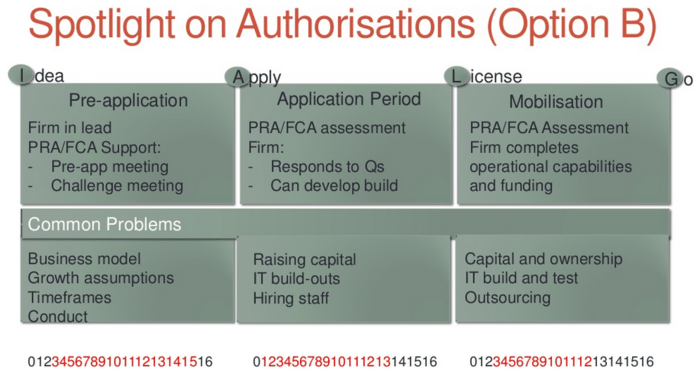

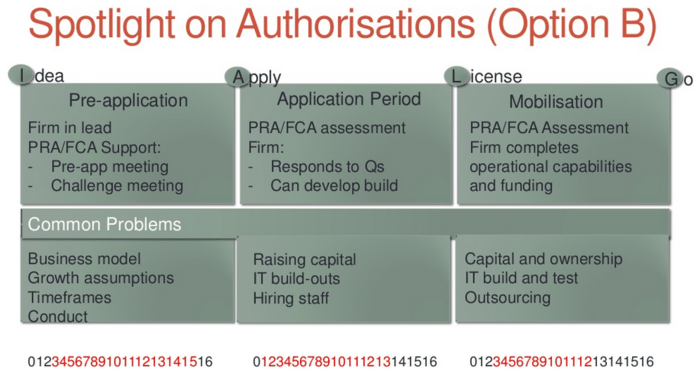

Well the issue is all about understanding. Victoria presented this chart:

What this shows is the three phases of getting a banking licence. First, the pre-application which is open to all. Second, the application itself, which is only allowed after the regulator has approved the idea of the bank. Finally, the mobilisation period once you receive the licence.

At the bottom of the chart is the time each phase can take from fastest to slowest. So the fastest pre-application process is 3 months and slowest 15 months; fastest licence approval 4 months (3+1) and slowest 28 months (15+13).

All in all, the chart demonstrates that the fastest licence approvals take around 4 months and will often be for an existing overseas bank launching a subsidiary operation in the UK. The longest time is 40 months, mainly because the applicant is not up-to-speed at the start. As mentioned, a lot of applicants will drop out during the first phase too.

Typically, according to Victoria, if they get through the first pre-application process they may even then not make it through to the end. So what makes things go wrong?

Apparently, much of it is assumptions in the plan are wrong. The application has no clear understanding of the banking market, how things work, what’s involved in holding deposits, etc. That’s a clear stumbling block. Their growth assumptions show that they will achieve 1% of the deposit account market by 2020, but doesn’t show how or justify itself. Their idea of how many switchers they’ll achieve based upon their seductive terms just don’t pan out.

Equally, many have not created a robust business model as they have not been tested rigorously on the nuances of finance until they meet the regulator. That’s another big challenge.

If the applicant can get through the rigorous challenge phase with the regulator, then they get to start a pucker application. I’m aware from one applicant that their original pre-application was about four pages. By the time they got their license, their full application had grown to 1,000 pages. This takes detail.

In that detail, there still may be fall-out. For example, common issues to all applicants is the technology required and the cost of the technology needed. Add on to this the cost of hiring, capital requirements, authorisations, launch marketing, etc. and this is a massive investment.

The typical cost of an applicant to just get their licence is around £10 million ($15 million). Budget a further £10 million a year thereafter to cover the costs of technology and operations, and you soon see this is a business that is not for the faint-hearted.

That is why the full bank model with a full bank licence is not going to work for all. Mind you, Holvi, Klarna, iZettle, Zopa and a number of others didn’t let this stop them, so there is room for manoeuvre. It’s just very hard to manoeuvre into the centre of banking if you don’t have a licence. It’s a bit like being a Eunuch at a brothel, which is maybe what the regulator wants.

Anyways, if you’re interested in more info, here’s Victoria’s complete slide deck:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...