It’s interesting reflecting on my blog earlier this week from Blythe Masters speech on blockchain. She mentioned the friction between the old system that works and the new system that’s being built, and how the two have to work together. You have to migrate the old with minimum risk to the new, and the new needs to be built in such a way as to allow the old to catch up as a result.

This frustrates the new, as they don’t see why any of the old needs to be there; and it frustrates the old, as they want to renew but it’s too darned difficult.

The more I think about that friction, the more I can see it in every aspect of banking. Incumbent banks need to migrate to digital, but it’s really hard when you have 42 deposit systems, 57 transaction systems and several dozen others that have all been built at various times, and are now sitting there due to mergers and acquisitions and over-inflated CIOs of the past. Attempts to consolidate systems have been made, but the cost of replacement versus the cost of maintenance is always a major factor. As a result, many just sit there because it’s cheaper to leave them than replace them.

Now new customer demands, digital transformation, cloud and blockchain technologies and more are demanding migration, and yet the risk and cost is too great. This is a known factor and known risk within the bank, but all banks deal with it.

Meanwhile, the innovators and developers are frustrated by the fact that the old bank is sitting there and not incorporating, enhancing, renewing and leading with the latest technologies. They wonder why there’s no clean data structures, easy data analytics capabilities and leverage of bank knowledge of the customer. They wonder why the new world cannot be embraced and just dump the old world.

But you cannot have a new world without the old world and vice versa. The old world runs the world right now. Visa, MasterCard, SWIFT, EBA, ECB, CHIPS, Fedwire, RTGS and ACH systems globally make banking work. Card networks, money transmissions and counterparty connectivity enable banks, merchants, corporates and institutions to interoperate with trust and security. You cannot dismantle and remove that overnight and, if you did, you would probably end up with 1000 Ashley Madison’s in the banking industry. That just would not be acceptable to the customer or the economy. After all, look at the RBS glitch if you wonder what that all means.

So the new systems have to work out a way to attract the old ones to migrate. Meanwhile, the old systems have to keep running alongside the new until they do. This is why banks spend so much on maintaining legacy and why, regardless of the shouts of change, the only new things that make a difference are those that wrap around the old bank networks (like ApplePay, PayPal, Moven, Simple, etc).

This is why there were two items I recently spotted that show this frustration between old and new. The first was research that found European banks spent £40 billion on IT in 2014, but only £7 billion of that investment went into new systems (17.5%); the remaining £33 billion (82.5%) was spent patching and maintaining legacy systems. It is that legacy that frustrates but must be migrated, and it’s not just legacy systems but legacy everything.

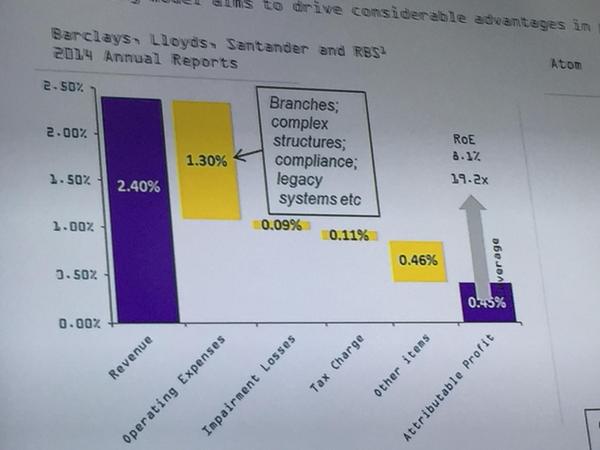

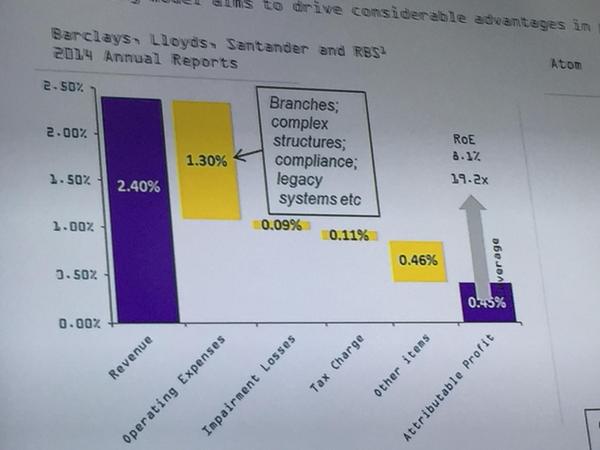

For example, the second item was a slide presented by Anthony Thomson (co-founder of Metro Bank and Atom Bank) shown at a recent conference. The slide showed that HALF of bank’s operational costs are wrapped up in legacy.

Legacy buildings, legacy processes, legacy systems and some legacy people too.

It’s that legacy that bank CEOs and Boards are all aware of, but it cannot be exterminated overnight. It has to be migrated. The real question is can it be migrated fast enough to keep up with new business models and new innovators?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...