I know I write about Apple Pay quite often, but was surprised to hear that one of my colleagues recently purchased an iMac in the Apple Store using his Apple Watch and Apple Pay. Yes, he’s an Apple guy, but really? A £1,000 purchase with a fingerprint? I thought, as do most, that you could only make small transactions using contactless payments. In the UK under £20 (£30 from September 1) and in the USA under $25.

Cartoon by Pugh

But it is not the case at all.

Good friend of the Financial Services Club David Birch has written a whole blog update on the subject, and notes that it’s the Point-of-Sale (POS) software that is key, not the device or payment instrument you are using. The POS makes the difference between whether you are limited to low value or high value payments.

The low value limit is when there’s no verification involved or, rather, no Cardholder Verification Mechanism (CVM). That is not the case with Apple Pay however, as Apple Pay is based upon a biometric Touch ID. In this case there is an additional layer of consumer identification based upon the device and an additional recognition layer, in this case your fingerprint. This method is therefore based upon a Consumer Device Cardholder Verification Method (CDCVM) rather than no verification. This is the reason you can have high value payments with CDCVM but are limited to low value when you lack this device authentication.

All of this comes into the open just as Samsung ramps up its entry into the wallet war market, and Samsung have one big advantage over Apple, according to Time Magazine:

“In addition to near-field communication (NFC) connectivity, Samsung’s new devices employ a technology called ‘Magnetic Secure Transmission’, which allows its mobile payment system to be used on standard credit card machines. Apple Pay only uses NFC connectivity, which is far from ubiquitous in the checkout lane ... All you have to do is swipe up on the screen, select a card, and input your PIN or fingerprint to authenticate. Then wave the phone over the credit-card reader and be on your way.”

That’s not only incredibly friendly, but also capable of being used as a CDCVM checkout.

Then there’s Android Pay, the Google upgrade to Google Wallet to compete with Apple and Samsung. Some claim Android Pay has advantages over Apple and Samsung by being integrated with loyalty programs, such as MyCokeRewards; it’s contactless payment system doesn’t require a fingerprint or other authentication (although that defeats the high value payment option); and Android phones are far more plentiful in choice from the Samsung Galaxy S4 to the HTC One M7 to the LG G2 to the original Moto X and Nexus 5.

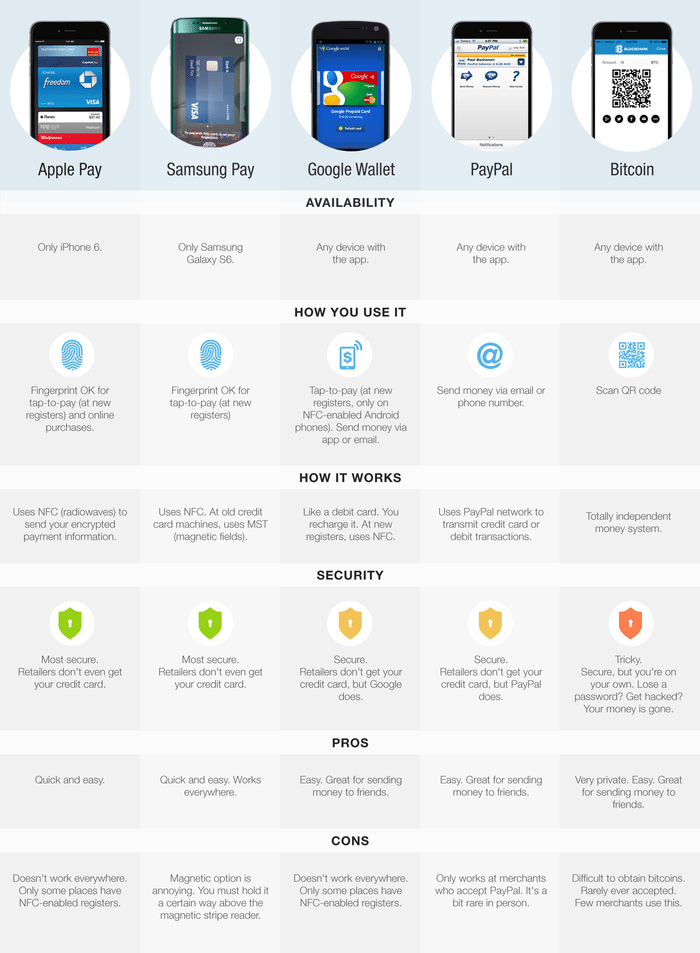

All in all, it’s getting really interesting so thanks to CNN for this infographic, which also includes PayPal and Bitcoin to see the range of options now available (doubleclick image to enlarge).

It really is a mobile wallet world (at last).

This post adds to previous updates including:

- Let the mobile wallet wars begin (April 2012)

- Wallet wars haven't really started yet ... (August 2014)

- Does anyone really need a mobile wallet? (March 2015)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...