So last week I was honoured to present at a conference in Washington just before Senator Elizabeth Warren, the leading voice in America for changing the bank system.

Senator Warren made a strong-worded speech condemning big bank mentality.

A few choice comments included a condemnation of Jamie Dimon, who apparently was personally calling congressmen to get amendments to Dodd-Frank to suit JP Morgan, and threatening to bring government and the economy to a standstill if they didn’t. Another comment about too big to fail (TBTF) being alive and well, and that the only way to overcome it is by breaking up the big banks by bringing back Glass-Steagall.

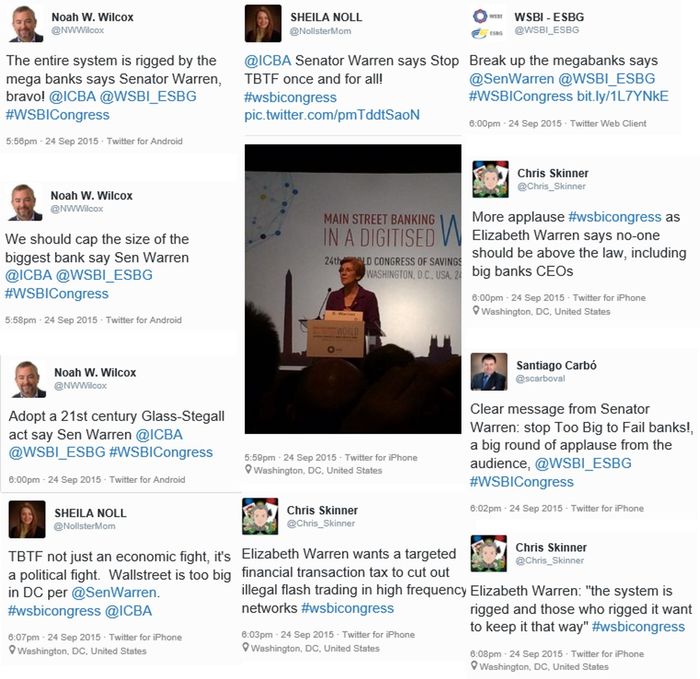

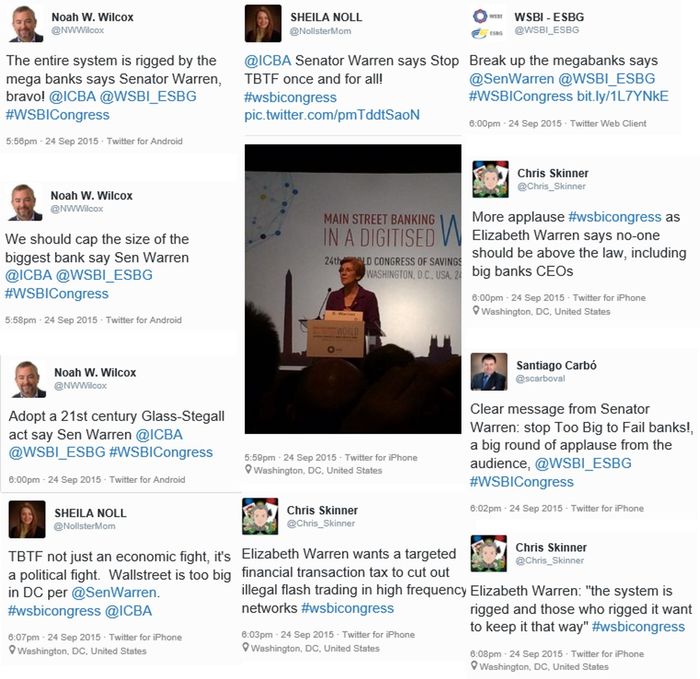

It was all well received by the savings bank audience, who want community banking to be the focus rather than big banking. This tweet cloud kind of says it all:

Picking up one key point in her speech, is that Senator Warren believes that a transaction tax is needed. Several times there were comments about high frequency traders bucking the system, and that a FTT (Financial Transaction Tax) would stop this.

Interesting that she should raise this as, just as she does, the Labour Party Conference kicks off this week with the new Labour team calling for a FTT:

[The shadow chancellor] John McDonnell looks set to use his first Labour conference speech as shadow chancellor to push for a "Robin Hood tax" on stock market trading. Chancellor George Osborne has fought moves to introduce such a tax, warning it would harm the financial sector. But Mr McDonnell believes it could rein in the excesses of the City and help pay for improvements to the NHS and other public services. He will also set out arguments for "new economics" in his address on Monday.

At the European Commission level, there’s a call for a FTT to fund the migrant crisis we are facing. Writing on the Huffington Post Philippe Douste-Blazy, Under-Secretary General of the United Nations and Chair of UNITAID, says:

The European Union Should Levy a Financial Transaction Tax to Fund a "Marshall Plan" for Refugees

Considering that we are faced with a situation which is totally unprecedented since the Second World War,

Considering that more than two million Syrian refugees are now based in Turkey, many of them in dire conditions pushing them to flee to Europe, including 600,000 children most of whom have no schooling,

Considering that 50% of the migrants are not fleeing from war but from extreme poverty,

Considering that certain countries of the European Union are coming under overwhelming pressure, notably Italy, Greece, Hungary and Austria,

We call on the states of the European Union to come to an agreement and take action. An adequate response is urgent if we want to prevent a dangerous rise in racism and xenophobia.

Considering that in 2014 eleven European countries (France, Austria, Germany, Italy, Spain, Belgium, Portugal, Greece, Slovakia, Estonia and Slovenia) accepted the principle of a microscopic solidarity contribution on the financial transactions.

We appeal to the states of the European Union to set up a tiny tax between financial institutions charging 0.1% against the exchange of shares and bonds and 0.01% across derivative contracts, if just one of the financial institutions resides in a member state of the EU FTT. According to the European Commission, if the 28 countries of the European Union agree to implement this tax, it would raise 59 billion euros.

We call on the European Union to allocate:

- 25% of the proceeds of this tax to countries receiving migrants, in the form of financial and technical assistance, as proposed by the OECD

- 50% of the proceeds of the tax to developing countries in the form of Global Public Goods (food, drinking water, health care, sanitation and education).

This mechanism of innovative financing is the only solution making it possible to

1) receive political refugees with dignity and integrate them into our societies, in conformity with European values and in conformity with international law to which all European countries have subscribed

2) to avoid the enormous wave of migration which is looming because of the widening gap between the rich and the poor at a time when communication is more and more globalized.

Philippe Douste-Blazy, Under-Secretary-General of the United Nations, and Giuseppina Maria Nicolini, Mayor of Lampedusa

Do you ever get the feeling that the political will of the left is starting to create a real cry to make a FTT a reality?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...