We started the new season of the Financial Services Club last night with meetings in both London and Edinburgh. The Financial Services Club runs from autumn to summer, and this is our 12th year of operation after starting our first meetings in London in 2004. Now in 8 countries and possibly more to come, the years have seen us grow into a fairly substantial force.

Anyways, this week we were honoured to host Anthony Browne, CEO of the British Bankers’ Association at the London Club ...

... who outlined some of the challenges on the banking landscape today. And there are many. He bucketed them into a number of key areas and, bearing in mind that this is under the Chatham House Rule, I thought that I would give my own interpretation of these major areas of challenge.

1. Politics

We have a whole host of issues with regulations and politics from the localised discussions of a British exit from the European Union (EU) – known colloquially as a Brexit – to the challenges of dealing with European regulatory structures. Most of the UK’s banks are against the idea of leaving the EU, but do find that the Continental Europeans are a little narrow in their thinking. By way of example, I blogged the other day about the potential inevitability of a Financial Transaction Tax (FTT). EU MEPs believe that around €35 billion could be raised each year through a FTT. What they don’t realise is that half of that would be generated by trading placed through the City of London but, assuming other regions do not apply a FTT, it would then mean that most of that trading would move away from the City of London. We may have a better relationship with the Eurocrats today than we did five years ago when the crisis hit, but the Eurocrats need to be more conscious of the global nature of finance if we are to stay supportive of further integration. This leads to our second bucket …

2. Competitiveness

After the crisis hit, and the subsequent scandals, we know that the banking industry needed reform, but is the reform right? With FTT, bonus caps, ring fencing and more, we are seeing issues arise that are seriously impacting the markets. For example, George Osbourne has introduced five new bank taxes in the last five years, many of which punish the smaller banks more than the bigger ones. Equally, and many do not realise this, banks cannot charge VAT but they do pay VAT. This sector is the one sector that pays more VAT than most others combined. All of these developments are creating questions about the global competitiveness now and in the long term for the UK Financial Sector and, specifically, for the City of London. We often talk about banks like HSBC and StanChart moving headquarters overseas, but even moving to Dublin where taxes are lower and wages cheaper is becoming a viable option, particularly for the American banks who see their first European touchdown in Cork. So London maybe the #1 Global Financial Centre today, but it isn’t a given that it will stay that way.

3. Competition

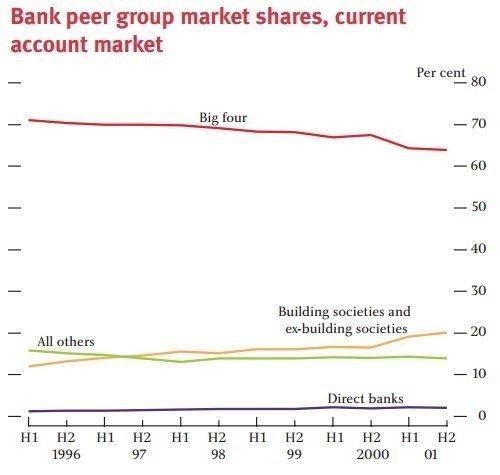

Competitiveness is a global issue but competition between banks is a more local issue. We know that the banking industry is too concentrated in the hands of the Big Four banks – HSBC, Barclays, RBS/NatWest and Lloyds. There may be a number of challenger banks emerging like Santander, Sabadell (TSB), Metro, Tesco, Virgin, Shawbrook, Aldermore, Triodos, Atom, Tandem, Mondo and such like, but will they take market share from the Big Four? The facts speak for themselves. In 2001, a trend had emerged during the previous decade of a gradual decline in market share of deposit accounts amongst the UK’s Big Four banks.

Source: Bank of England, Spring 2004 Quarterly Bulletin

By 2014, the UK’s 65 million deposit accounts were dominated once more by the Big Four, with 77% of UK accounts in their hands, up 13% over the past decade as a result of mergers, acquisitions, consolidation and overall presence. Regardless of the previously debated threats of the Virgin, Tesco and Sainsbury banks, the big banks just get bigger.

This is the subject of an active review by the Competition Markets Authority (CMA) and will likely result in a call for far more transparency and openness. I just doubt it will result in much as every review I’ve seen in the past thirty years calling for openness and transparency and more competition hasn’t changed a single thing. The big banks just keep getting bigger.

4. Conduct

We have seen crisis after crisis: LIBOR, FX and commodity market rigging; PPI and swaps mis-selling; AML fines for breaching sanctions and ignoring regulations; and worse. Although European banks have paid $250 billion in fines since 2008 for such misdemeanours not a single bank has gone broke or executive jailed. Even with all the regulatory reactions to such joie de vivre such as living wills, ring fencing, stress tests, has much changed? Possibly, but more as a result of the EU safety nets than the industry’s moral structure and ethics. For example, the ECB is now confident that, if the 2008 crisis happened again, only 1 EU bank would fail.

5. Digital

Anyone who reads this blog will clearly be aware of the rise of fintech and all of the senior executives are awake to the challenge. Most of the chairs of the big banks are talking about this, as they don't want to suffer a Kodak moment, but the question is what to do about it. After all, McKinsey just produced a report this week that shows 60% of bank profits from lending will disappear in the next decade. So it’s all good knowing that the Kodak moment is coming – Kodak knew that – the question is what to do about it.

As you can see, there are huge challenges for banks today, across the board. Dealing with all of these challenges at the same time would be too much for most banks, so the answer is to create multiple project teams reporting to the Executive Board to deal with each and then, as a Board, make sure they are joined up. That is not easy, but hey, you wouldn’t be on the Board of the Bank if it was.

Meantime, here’s the other meetings planned for the Club in London this year. Feel free to join if you’re interested. They’re free for banks to attend and membership is cheap for non-banks. Just go to www.fsclub.net to find out more.

29 September

The State of British Banking

Anthony Browne, CEO of the British Bankers’ Association

5 October

Gamification in banking

Gabe Macintyre

28 October

Disintermediating banks and brokers

Philippe Gelis, Co-Founder and Chief Executive Officer, Kantox

12 November

Developing the blockchain in banking

Jeremy Wilson, Vice Chairman, Barclays Corporate Banking & John Edge, Managing Partner, RRVIG

18 November (Dinner)

Apple, Facebook and Google in Finance

Sigridur Sigurdardottir, Head of Customer and Innovation at Banco Santander

Daryl Wilkinson, Group Head of Innovation, Nationwide Building Society

Lee Jay Burningham, Head of Financial Services UK & EMEA, Facebook

TBC, Google

25 November

Developments in P2P lending

Giles Andrews, Zopa

7 December

Fintech 2015 – a review and forecast for Fintech 2016

Chris Gledhill, David Brear, Duena Blomstrom and Simon Taylor

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...