Some technology trends are highly predictable. One such trend is the modularization of banking, a theme picked up in a new Oliver Wyman report that’s free to coincide with Davos.

You can download the report here, but it’s basically saying something we’ve known since the 1990s: banking is a set of component pieces that customers can now manage themselves.

I say we’ve known this for years because I grew up in an age of Object Orientation. This was followed by Modular Computing and Service Oriented Architectures.

These things aimed to create the components of banking for the bank.

The difference today is that those modules and objects are now apps and APIs, and those apps and APIs are the components of banking for the customer.

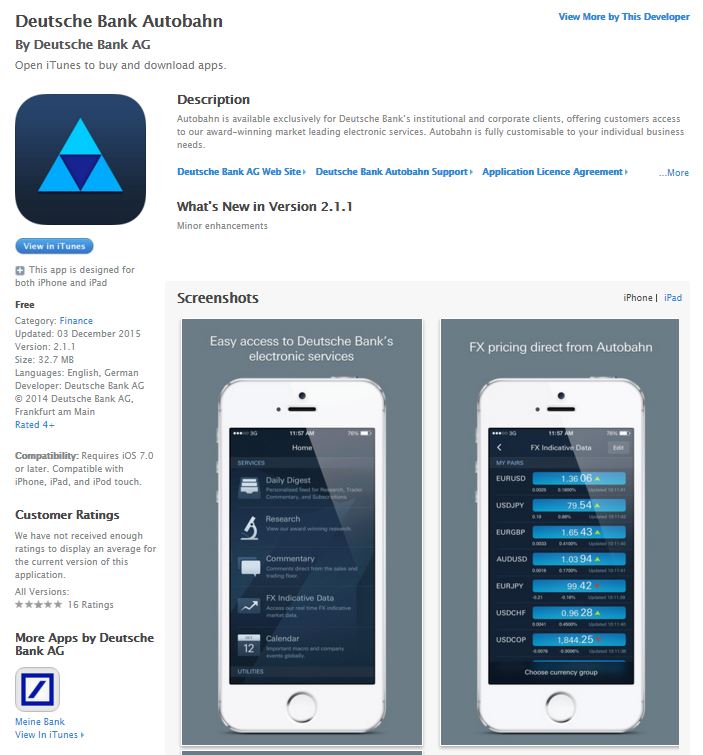

This is something I've blogged about often, and can be well illustrated by the Deutsche Bank Autobahn App Store for Corporates.

When I saw the Autobahn App Store, I could see that this illustrated well the idea of offering 100s of component pieces for corporate clients to put together into their own structure of operations. Easily provided through apps, the corporate is in control.

All well and good but, in this case, all the components are built by Deutsche Bank. What about a bank app store that supports any apps and APIs the customer might want to use? What about a bank offering their data and services through APIs so that any developers could develop apps using the banks’ data and APIs to create new ways of customer to use finance?

Sound ridiculous? Not really, as OpenAPI programs are already rife in some banks led by BBVA.

So the modularization of banking to place the components of finance in the customer’s mobile wallet is at hand, and Oliver Wyman’s report makes a worthwhile read to reinforce this view. Here's a brief summary if you want to know more before downloading the report:

Financial services are becoming “modular”, with digital distribution platforms, new product providers, alternative sources of capital and a growth in outsourcing fundamentally reshaping the industry. This is according to Modular Financial Services: The New Shape of the Industry, a new report by Oliver Wyman. The Oliver Wyman study estimates that this change could see $1 trillion of revenues and costs shift in banking and insurance, an industry with $5.7 trillion of revenues today. New customer platforms could capture $50-$150 billion of revenues from today’s banking and insurance markets, equivalent to several eBays or 1-2%+ of banking and insurance revenue today.

Consumers will benefit most from modular financial services. They will be able to access a wider range of product providers, and the increase in competition will drive margin compression. The report estimates that $150-$300 billion of value may migrate to consumers by way of lower prices. Innovative business models based on new technology will capture share, with the potential to capture a further $150-$250 billion of existing revenues.

The report highlights that large, integrated financial services firms still enjoy significant competitive advantages -- including existing customer relationships, secure at-scale operations and meeting the requirements of regulatory compliance -- and are still well-positioned to succeed. However any costly, inflexible legacy infrastructure will be unsustainable and competition will force a significant overhaul of incumbents’ operating platforms. The report estimates target cost savings for the world’s largest banks may need to as much as $340 billion. The cost of “replatforming” the world’s largest banks is substantial, potentially more than $4 billion each, larger than the average annual dividend paid by the 100 largest universal banks of $1.7 billion.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...