I’ve been wondering how this year would start and so far the answer seems badly. What with David Bowie’s death on the same day as I catch man-flu, could it get any worse? Well yes. I wake up to the headline: Sell everything ahead of stock market crash, say RBS economists. NNNNOOOOOOO!!!!!

Royal Bank of Scotland warns of ‘cataclysmic’ year with slumps in shares and oil and advises clients to shift to bonds

NNNNOOOOOOO!!!!!!!

Stock markets could fall by up to 20% and oil could slump to $16 a barrel, economists at the Royal Bank of Scotland have warned.

ARRRGHHHHH!!!!!!!

OK, the oil price is tanking, there are rumours of a Fintech boom-bust and George Osborne came out last week, with the news that the UK economy faces a ‘cocktail of threats’.

WHAT?????

Yes, a poisonous cocktail of threats face us from:

- a slackening in UK growth;

- declines in North America following news that US oil stocks had risen by 10% in the past week , the biggest increase since 1993;

- steep drops in share and commodity prices amid concerns about weak growth in China;

- North Korea’s claim to have exploded a hydrogen bom; recessions in Brazil and Russia;

- growing tension between Saudi Arabia and Iran, two of the world’s biggest oil producers;

and more.

NNNNOOOOOOO!!!!!!!

In fact, if you look at the investment outlook for 2016, it’s pretty scary. Just read Michael Hartnett, the outstanding Chief Investment Strategist at Merrill Lynch, who outlines six top investment trends to watch for 2016.

- Bye-Bye QE: The era of worldwide quantitative easing soon may be coming to an end. While it has been over in the United States for some time, it may start to wind down in Europe as well. Many strategists, Harnett included, seem to feel that the United States and the S&P 500 may be a better vehicle for growth investors this year.

- Oil Age: Is this the end of the oil age? While oil, natural gas and gasoline will of course still be required around the globe, the question is will technology prevent meaningful recovery in the sector. The trades here for investors are what Merrill Lynch calls “best of breed” U.S. energy stocks. ConocoPhillips Inc. (NYSE: COP) and Exxon Mobil Corporation (NYSE: XOM) both fit that profile, and are both rated Buy at Merrill Lynch.

- Black Dragon: With China de-pegging its currency from the U.S. dollar, we could be in for a new era of volatility across multiple asset classes. While some on Wall Street make the case that removing the peg is good, the ensuing volatility, at least on a short-term basis, can ratchet up. Hartnett refers to this scenario as the “Black Dragon.”

- Recession Reset: While the risk of a recession looks doubtful, at least at this juncture, the case is made, and correctly so perhaps, that asset prices are not pricing in the possibility. Until Purchasing Managers Index (PMI) numbers start to trend above 50 again (which indicates growth and expansion) in China and the United States, the risk of a recessionary scenario does indeed remain in place. One investment idea put forth is to buy one-year puts on the very crowded FANG stocks.

- The Late Show: The case is made that we are near the end of the investment cycle, which also has merit. The market bottomed in March of 2009 with an ominous intra-day print of 666 on the S&P 500. Despite the current turmoil, we are still at 1,939 on the index, a massive run over the past almost seven years. The combined U.S. macro, Federal Reserve tightening, junk bond bear market, narrow market breadth and overall market damage hint that we are near the end. Any weakness in growth could draw fiscal policy changes. That said, there are few arrows in the policy-makers’ quiver to use.

- Cybergeddon: The Merrill Lynch investment suggestions are skewed to what the firm terms the “transforming world investment theme” for 2016. Cybersecurity is cited as one of the top investment ideas. Internet of Things, virtual reality, artificial intelligence and other areas of changing technology also seemingly would fit the bill.

Jeez. Happy New Year you grumpy muppets. Is there no good news?

Well, there’s some. Motley Fool proposes some key bank stocks to watch in 2016 including Silicon Valley Bank, TD and Wells Fargo, which should all do well. Oh yes, and there is Jim Marous’s Digital Banking Report for 2016. 82-pages of fact-packed information on the latest 2016 Banking Trends and Predictions report, which I summarised the Top 10 on the blog last week.

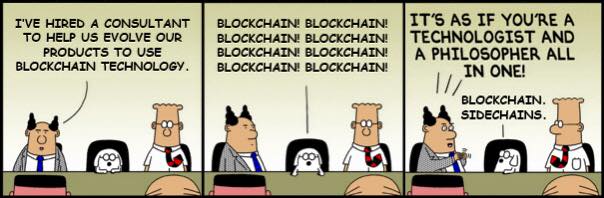

Interestingly, lots of talk about blockchain, as Dilbert can confirm.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...