There’s lots of discussions about financial markets and their different structures. Retail and commercial banking are likened to farms, whilst investment banking is a jungle. Retail and commercial banking have dull products likened to chickens. Look after them and they produce regular and predictable results. Investment banking is just full of testosterone fueled animals that would kill each other for a bonus.

OK, a little extreme but maybe some truth in there somewhere.

Bring that round to technology, and it is certainly true that investment markets are far more aggressive with technology deployment than retail and commercial banking. Many retail banks are running systems that pre-date the birth of Taylor Swift; most investment firms have systems that are younger than Grumpy Cat. This is because investment markets are built upon the tactical deployment of technology as a strategic weapon, whilst retail banks are built upon the strategic deployment of technology as a long-term investment.

This is changing as the cost and power of technology changes, but when you look at data analytics, cloud, APIs and other innovations, the investment firms far outstrip their retail brethren in deployment and usage of such services. Just look at colocation, low latency, high frequency trading structures and you’ll see what I mean. So it’s interesting to see the largest density of blockchain start-ups appearing in the clearing and settlement space.

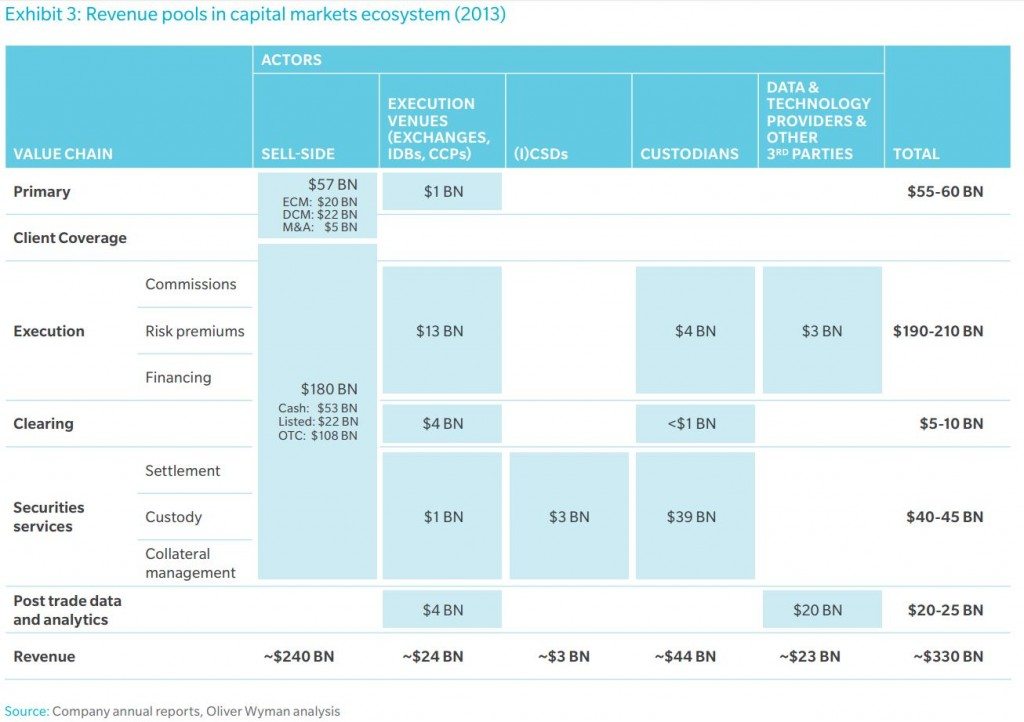

Maybe that’s not surprising as the three-day settlement cycles in most investment markets are slow, inefficient and costly. According to a recent Oliver Wyman report, clearing and settlement costs the industry $50 billion or more a year. If that can be reduced rapidly by providing real-time clearing and settlement, then settlement risk, collateral management and more is completely reimagined, with upwards of $20 billion of costs saved.

Another Oliver Wyman paper, sponsored by Santander, concluded:

“Our analysis suggests that distributed ledger technology could reduce banks’ infrastructure costs attributable to cross-border payments, securities trading and regulatory compliance by between $15-20 billion per annum by 2022.”

No wonder this is the hotbed of innovation investment for blockchain in banking. Here’s a quick low-down on the key players so far in this space:

Overstock are pushing to replace the DTCC with T0, a method of clearing in real-time rather than three days (T3). Their case is strong as they’ve received approval by the SEC for the issuance of public securities on the blockchain. You can read more in this Wired overview.

Overstock began by offering a private trading platform for stocks and equities, and Symbiont have started in this space as well. In fact, they both started their developments in the same space, the Counterparty Project, although Symbiont is at an earlier stage, having just completed a $7 million funding round valuing the firm at $70 million. One interesting development here is that they have just partnered with Gemalto to offer a hardware security key to protect transactions.

Digital Asset Holdings are getting all the headlines because they are not only run by a former star banker, Blythe Masters, but just gained investment from 13 banks including JP Morgan, Citigroup, BNP Paribas, PNC and ABN AMR0 with Bloomberg putting the round at $52 million valuing the company at $100 million. This news was combined with a proof of concept trial at the Australian Stock Exchange, so Digital Asset Holdings should be taken seriously.

SETL launched in July 2015 with my friend Peter Randall at the helm. Peter made Chi-X the success it is today, and is a powerhouse for technology in investment markets. Not much has been in public domain about where the company is going, apart from a significant press release in October that the company can process over a billion transactions a day followed by the announcement this month of former Barclays Bank Chairman Sir David Walker joining the firm as Chairman of SETL.

R3CEV has developed a consortium of 42 banks dedicated to developing blockchain technology for settlements and payments, among other things, and has started an active Blockchain-as-a-Service trial between 11 banks (Barclays, BMO Financial Group, Credit Suisse, Commonwealth Bank of Australia, HSBC, Natixis, Royal Bank of Scotland, TD Bank, UBS, UniCredit and Wells Fargo) using Microsoft Azure and Erethreum. Ethereum. Launched in mid-2015, it offers its own decentralized blockchain platform that allows each blockchain to be customized to fit the specific security that is subject to clearance and settlement.

itBit started out as a bitcoin exchange but has evolved that exchange into a settlement system called Bankchain. Bankchain is a private consensus-based enterprise ledger system for financial institutions that uses a proprietary itBit protocol derived from the blockchain protocol, but not blockchain based. itBit is interesting because they were the first company to receive a trust company charter from the New York State Department of Financial Services (NYDFS) allowing the firm to create the itBit Trust Company (ITC). For 2016, itBit’s “tech team is hard at work implementing ACH deposits, real-time streaming market data and other features”.

Last year Oliver Bussmann, CIO of UBS, starting talking about developing a Settlement Coin, and has partnered with Clearmatics to develop one.

Using the open-source protocol Colored Coins, Colu lets its users 'colour' a tiny fraction of a bitcoin with a specific attribute. This, in essence, ties it to a real-world asset while keeping bitcoin's best attributes – including its cryptographic security and fraud-proof ledger – and has actively been focusing upon securities settlement as one of its early use cases, in partnership with Deloitte.

Epiphyte is working with a number of global banks on instant settlement for foreign exchange and securities transactions. In November 2015, Visa announced it has teamed up with Epiphyte to test how blockchain technology can improve remittance service in terms of fees, speed and ease of use.

Tradeblock is a portal for blockchain data and digital currency analysis, watching everything involved with trades, regulations, protocol updates and mining.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...