Few of us can forget the terrible attack on Paris in November. When the Paris attacks took place at the end of last year, I was lucky enough to visit Paris a couple of days later for the annual CARTES conference event.

Some firms had pulled out last minute for fear of further attacks, but I just call them cowards. A strong word, but one that I will use for people who think that when a one-off event occurs we should boycott a country completely. To be honest, when such events occur, standing in solidarity with those who have been impacted is far braver than dumping a friendship.

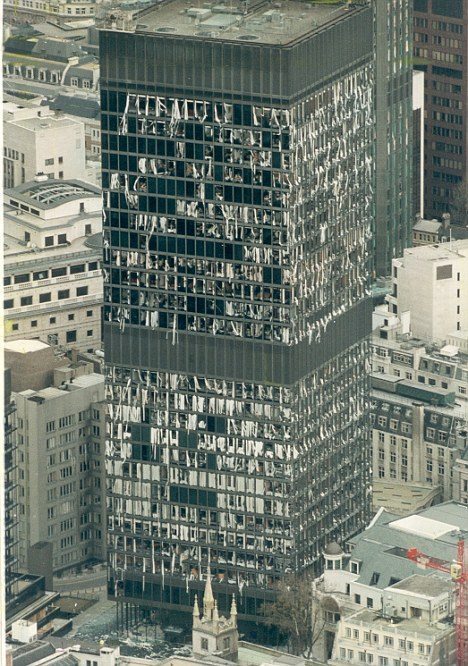

I guess I’m slightly tainted as I still remember the 1993 bombing of the City of London ...

… and the devastation it caused to the NatWest Tower (now Tower42) and Commercial Union offices wrecked.

It’s hard to even imagine such events occurring today, unless you watch Black Mass with Johnny Depp which refreshes the mind, but I can still remember my American colleagues all steadfastly refusing to come to London for about a year afterwards.

Why is this top of mind again today? I guess because of the tensions created by the USA and now ricocheting back from Middle East through Europe to their shores. When the Paris attacks took place, there was one news report that showed a devastated Frenchman saying it was the Americans who caused this. He blamed it on the war on terror started by George W. Bush and the fact that that action has resulted in all of the issues in the Middle East, with the outcome of a massive migration from the region into Europe. It may be true that mass migration is cultural clashes and, for some, a concern that the long-term future for Europe is one where we all become Muslim.

Perhaps the real surprise is the American reaction, or not. If you look at Donald Trump with his ideas of banning anyone who is Muslim entering America and building a massive wall along the Mexican border, like a Berlin Wall but bigger, it seems extreme but it resonates with the mainstream guy on main street. So then we have the action that has been taken by the USA to tighten the Visa waiver program in Europe, in case you accidentally send over a member of ISIS/Daesh.

I hadn’t actually noticed this action until it was raised during our debate about Europe at the Financial Services Club last week, but the US began implementing restrictions to its Visa Waiver Program (VWP) under a law passed after last year’s attacks in Paris, making it harder for citizens of the European Union countries to visit in some cases. The reason is that several of the Paris attack terrorists had European passports that would have slipped through the Electronic System for Travel Authorization (ESTA) program. Citizens of 38 countries* can travel using ESTA, and it makes a much simplified method of travelling. Now you need a visa if you’ve travelled to Iran, Iraq, Sudan or Syria since March 1, 2011.

That makes sense, but it’s getting worse. Just a week after the new rules came in, US Secretary of State John Kerry issued warnings to Germany, Belgium, France, Italy and Greece after two bombers from the Paris terrorist attacks were found to have stolen passports. He is said to have given these countries just three days to fix a 'crucial loophole' in the passport process, or lose access to the visa waiver program.

Such a move is creating a divisiveness between Europe and the USA that could easily ripple into trade wars, particularly as we are already in a trade war between Europe and Russia. For example, on the same day that John Kerry warns German and brethren to tighten their borders, Eurocrats begin the first lockdown on tax loopholes exploited by Google, Amazon, Facebook and Apple. According to the International Business Times: “The Anti Tax Avoidance Package was introduced on Thursday by Pierre Moscovici, Europe’s tax commissioner, who said they will aim to ‘hamper aggressive tax planning, boost transparency between Member States and ensure fairer competition for all businesses in the Single Market.’

“Among the key proposals being introduced are legally binding measures to block the most common methods used by companies to avoid paying tax and a recommendation to member states on how to prevent tax treaty abuse. To improve transparency, the commission is also proposing that the 28 EU member states share tax-related information on multinationals as well as creating a new process for listing countries that refuse to play fair.

“Ahead of the announcement, American Innovation Matters — a lobbying group that includes U.S. companies like Cisco, Boeing, Apple, Intel and Facebook — called the EU proposals ‘the latest example of the aggressive moves being made abroad in an effort to tax even more American earnings, and use them to pad the coffers of foreign governments.’”

So, we enter 2016 with many dark clouds on the horizon. A Chinese economy that is slowing, and a European-American harmony that has existed as a special relationship since the Second World War coming under tremendous strain. Those strains exist between regions and within, as we also see the Union of Europe being tested to the brink. All this just as Iran is welcomed back into the political debate. A strange world we live in indeed.

* Andorra, Australia, Austria, Belgium, Brunei, Chile, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, New Zealand, Norway, Portugal, San Marino, Singapore, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Taiwan and United Kingdom.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...