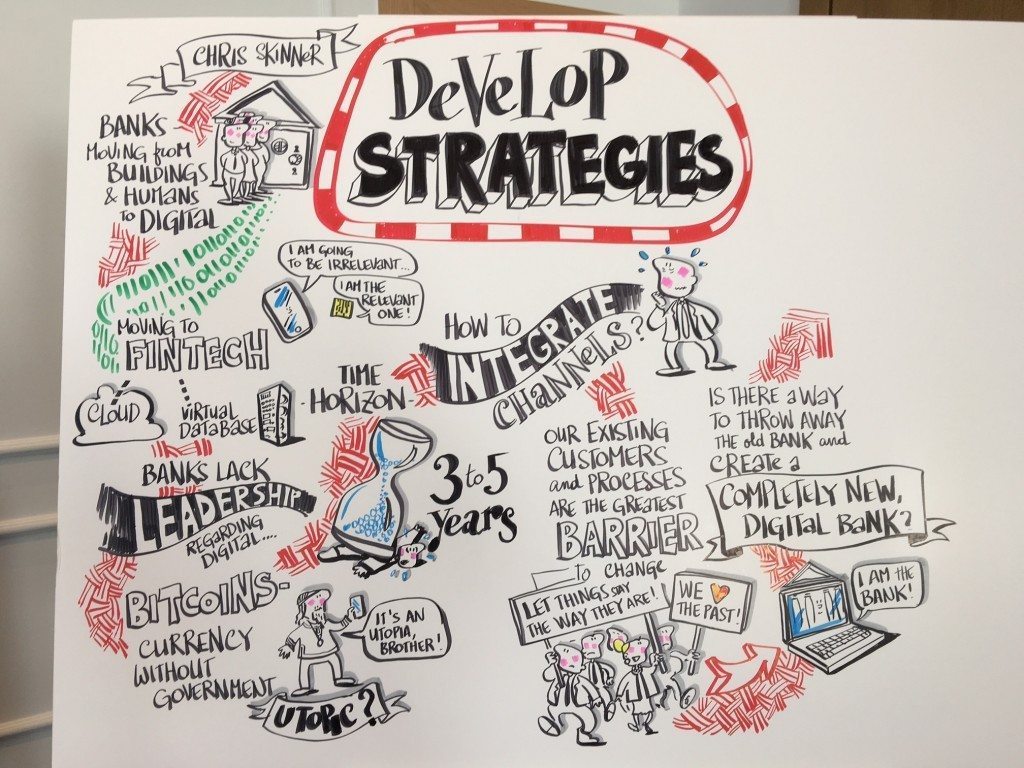

I spent a day working on a bank’s digital strategies the other day. It was a fascinating day and, as is the norm with some of these offsites, a scribe artiste was scribbling my ramblings on a chart. The summary I like so much that I thought it was worth sharing here.

So what this shows is the challenge on the top left: how do we convert an institution built for the physical distribution of paper in a localised network focused upon building and humans into a digital disruption structure for data in globalised network focused upon software and servers.

That’s pretty much the tenet of the book Digital Bank and is elaborated into stories of banks who have tried to do this. This is shown on the bottom right: how do convert the bank? Do we throw away the old bank? Do we run new bank alongside old bank? Do we just try to stick digital on top of old bank?

Most banks take the latter approach which is why they have a Chief Digital Officer and talk about channels and integration. It’s tosh, as those banks won’t be around in ten years. When you are competing with new start-up firms that enable P2P transfer of value in real-time for 100 basis points -0 the costs of their software and servers – how can an incumbent compete long-term, when their consumer to bank to bank to consumer operation invokes credit risk managers and underwriters who sit in offices and cost 300 basis points to employ? This is the point: if you have a competitor using software and servers to transmit value at 100 basis points, you cannot keep up if you are competing using buildings and humans that cost 400 basis points.

But most banks operate this way: let’s do digital and stick on top of our old systems. It maintains the status quo, is easy and enables the bank to look good by sticking lipstick on the pig. Fact is it’s still a pig though and, in a few years, the pig will snort.

Nothing against pigs, but I’d rather deal with Jennifer Lawrence or Orlando Bloom.

So the fact is that the bank must juxtapose its physical thinking with digital thinking. It has to build a digital foundation with access via form factors – human, mobile, chip-based and more – rather than integrating channels to a physical foundation. That takes leadership, as it entrails strong courage to change the banks’ core systems. It also takes strong technology vision and understanding, which most bank leaders lack as they came through a risk and finance function and think that, by having a digital team, they‘ve done the job and covered the bases. Wrong.

There’s lot of other thoughts in there, but the final one is that to get this change across to the board team, you just need to be really simplistic.

Moving banks data to the cloud is just moving our mainframe to the internet,

Moving our systems of record to the blockchain is just moving our databases to the internet.

Focusing upon mobile is good, but think of mobile as just a transitionary period to moving everything onto the internet. That’s the internet of things.

I likened it to growing up. When I grew up, I had a car that I had to fuel with gas and fill myself; when I grew up, I had a television that could play four channels and was controlled by a central authority (the BBC and ITV); when I grew up, my mum would go to the store two or three times a week and fill up the fridge with groceries from the local store.

These were all physical movements and exchange, involving cards, cash and cheque payments.

Now, my children are growing up in a world where the car runs on electricity, drives itself and runs on the internet; the television plays to demand and orders the shows I like through the internet; my fridge gets filled with groceries it orders direct from the store over the internet.

Everything is on the internet: the internet of things; and my bank has to be on the internet too. It may not need to be there in 2016 but, by 2020, if it’s not on the internet, it’s in the bin.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...