So we had our annual update on all things EU yesterday from David Doyle, loyal friend of the Financial Services Club and our opening keynote in most years as we are all keen to know what the Eurocrats are thinking. In prepping for the meeting, I got to thinking about the state of Europe today. It’s a mess. After all the optimism of the last decade, we now have:

- a Greek failure shortly to be followed by an Italian one;

- a heap of debt and unemployment that looks unsolvable;

- a migrant crisis where millions from the Middle East are landing in Europe;

- a cultural crisis, where the migrants are causing friction with the locals;

- a structural crisis as Britain heads for a Brexit, and other nations are questioning the future;

- a domestic crisis as the cement of Europe – Germany – loses faith in its leader;

- an ongoing tension between Europe and Russia;

and more and worse.

Things really do not look good. For example, since the last European elections, a large part of the European Parliament is comprised of MEPs who are anti-Europe. A third or more of voters voted for Eurosceptic parties in Hungary (71%), UK (60%), Greece (57%), Denmark (38%), Ireland (36%), Sweden (35%), France (34%), Netherlands (31%) and Italy (30%). That’s quite a large number of key nations who are showing major leanings against a European Union.

Meanwhile in the midst of all this mess, the Eurocrats continue to try to shift the banking system towards harmony. For example, we now have the Single Supervisory Mechanism coming into play, where all member states’ banks are overseen by the European Central Bank.

Based upon the Single Supervisory Mechanism, no member state can bail out a bank as of 1st January 2016. That means no country can sort out their bank failures from now on, so maybe it was no surprise that we saw Italy bailout four banks in December 2015.

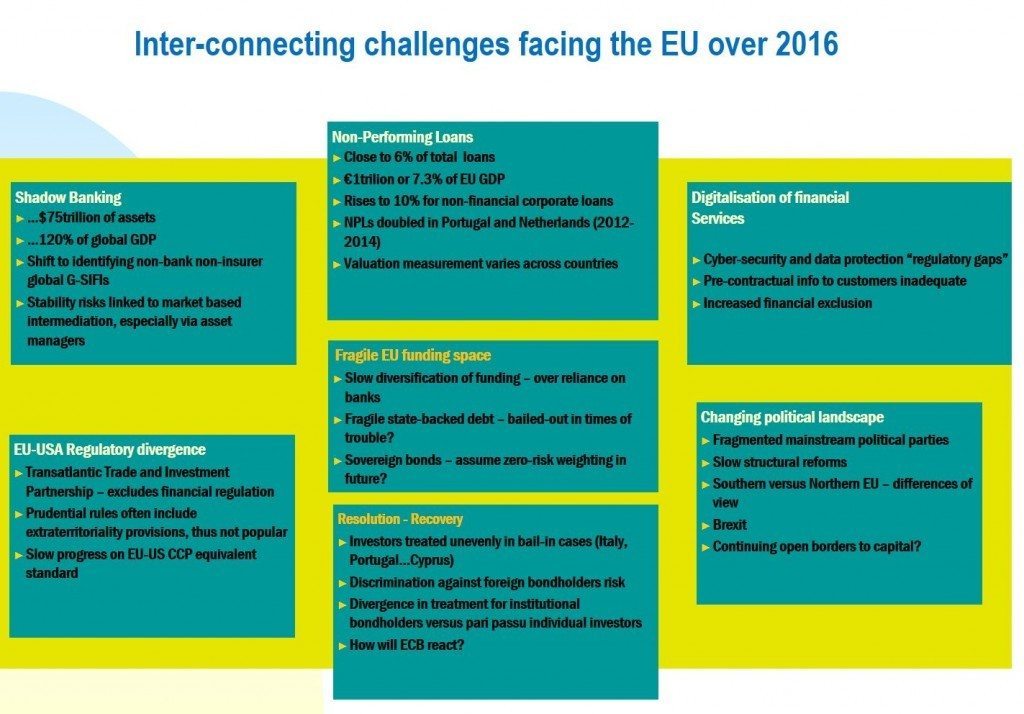

I won’t repeat David’s presentation here, except for the one slide that says it all.

This one slide shows the interconnected issues at the macro level that Europe has to deal with today, and really brings home the message that this is the most challenging times we have ever lived through.

Changing political landscape

- Fragmented mainstream political parties

- Slow structural reforms

- Southern versus Northern EU – differences of view

- Brexit

- Continuing open borders to capital?

Fragile EU funding space

- Slow diversification of funding – over reliance on banks

- Fragile state-backed debt – bailed-out in times of trouble?

- Sovereign bonds – assume zero-risk weighting in future?

EU-USA Regulatory divergence

- Transatlantic Trade and Investment Partnership – excludes financial regulation

- Prudential rules often include extraterritoriality provisions, thus not popular

- Slow progress on EU-US CCP equivalent standard

Shadow Banking

- …$75trillion of assets

- …120% of global GDP

- Shift to identifying non-bank non-insurer global G-SIFIs

- Stability risks linked to market based intermediation, especially via asset managers

Non-Performing Loans

- Close to 6% of total loans

- €1trilion or 7.3% of EU GDP

- Rises to 10% for non-financial corporate loans

- NPLs doubled in Portugal and Netherlands (2012-2014)

- Valuation measurement varies across countries

Digitalisation of financial services

- Cyber-security and data protection “regulatory gaps”

- Pre-contractual info to customers inadequate

- Increased financial exclusion

Resolution - Recovery

- Investors treated unevenly in bail-in cases (Italy, Portugal…Cyprus)

- Discrimination against foreign bondholders risk

- Divergence in treatment for institutional bondholders versus pari passu individual investors

- How will ECB react?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...