I was reflecting on the demonstrations of Deep Mind against Go Champion Lee Se-Dol along with Watson at CeBIT and other artificial intelligence (AI) developments.

It soon becomes apparent that we are evolving rapidly to a state where data learning through data analytics will be the battleground. In fact, it is clear that the battle over data is already won by those who have data architectures fit for AI. Going back to my favourite chart:

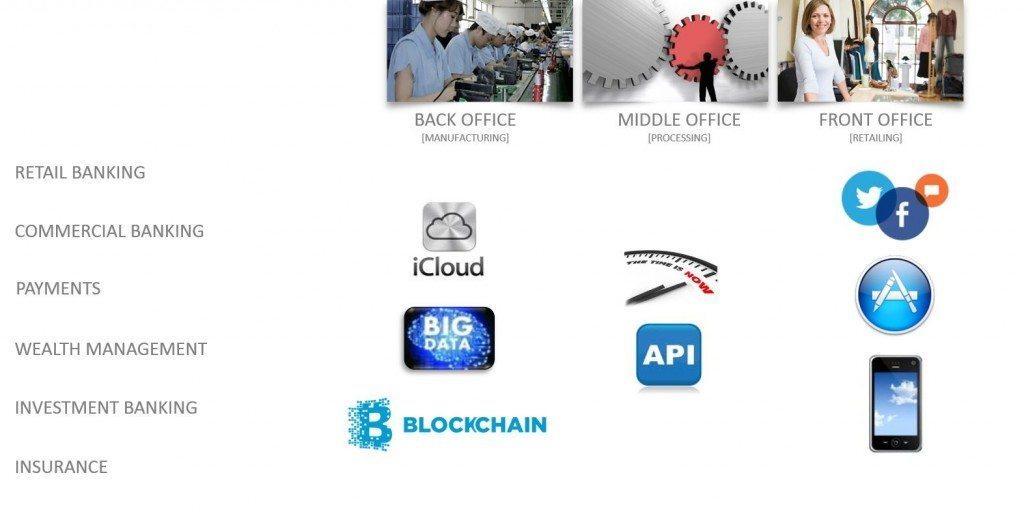

If you don’t recognise this chart, then please read the series of blogs I wrote in 2014 about such things.

In this chart, I outlined the structure of a bank is front, middle, back office – or retailer, processor, manufacturer – and that this structure is being attacked by technologies. Front office is being reinvented by mobile and intelligent devices in the Internet of Things (IoT); middle office is being reinvented by real-time APIs; and back office is being reinvented by cloud, data analytics and the blockchain.

This is the chart for the open sourced bank and, when you have an open sourced bank, you can move really fast. You can incorporate any other Fintech into the open sourced bank and, just as powerfully, you can connect the open sourced bank into any other Fintech. I have a strong feeling that this chart defines the architecture of a new bank called Solaris Bank which, last week, announced they have gained a banking licence in Germany which can now be passported across the whole of the EU.

I will probably blog more about Solaris Bank, whom I am meeting next week, but the key to their vision is that they are a Bank to Business to Consumer structure. In other words, they can plug and play into any other Fintech, Payments or other players.

In doing this, and combining this with the themes of rearchitecting the bank for open sourcing, I can see one particularly powerful play: the AI bank.

This has been alluded to for a while, and has some crude illustrations such as the BankAmericard Rewards. Using Cardlytics, Bank of America can push you a reward coupon via their app at the point of relevance, e.g. as you’re walking past one of your regular stores of purchasing. That’s powerful today but will be seen as dumb tomorrow.

Equally, we see powerful capabilities today such as UBS (Switzerland) and DBS (Singapore) using Watson to analyse terabytes of data non-stop in real-time to push knowledge to their high net worth customers. Personalised investment portfolios are issued every morning, with analytics on every $ held with the bank. That’s powerful today but tomorrow …

Tomorrow.

I guess my vision of the near-term tomorrow is where a bank has cleansed their data into an enterprise architecture that is separated from processing. The enterprise data store is held in a private cloud, and has non-stop real-time analytics. These analytics enable the bank to delve deep into the psyche of their clients, and use neural networks to proactively predict their needs, advisory services and support mechanisms.

These support mechanisms are provided in non-stop real-time to my devices who tell me what is important and transact and manage what is not. ~The delivery of knowledge to my devices is sometimes via the bank direct, but often through third party APIs that have plugged into my open sourced bank. As a result, my financial ecosystem is massively personalised at a micro level, and I stop thinking about questions. Who would ever ask What’s my balance or Must remember to pay that bill, when my system takes over all those tasks for me. All I really need to know is you are low on your deposit balance or You should save more for that holiday this month, and I just say yes or no, dependent upon my mood and feeling.

This means that banking has moved from a pull industry – where I have to go and find my information and manage it – to a push industry – where my bank tells my things what to do.

I love the idea of the open sourced bank and a financial ecosystem personalised to my lifestyle and managed for me. The problem we have today and right now, is that banks have only just got to the point where they can take a debit and credit statement and plug it into a mobile app. An open sourced structure proactively pushing service to my IoT ecosystem is going to be a big stretch. Luckily banks like Solaris Bank (Germany) and PrivatBank (Ukraine) are developing these services anyway, so we can all benefit from this new structure of Banking-as-a-Service in the open sourced world.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...