The Fourth Age of Man: the Network Age

Part of the reason for talking about the history of money in depth this week is as a backdrop to what is happening today. Money originated as a control mechanism for governments of Ancient Sumer to control farmers, based upon shared beliefs. It was then structured during the Industrial Revolution into government backed institutions, banks, who could issue paper notes and checks that would be as acceptable as gold or coinage, based upon these shared beliefs. We share a belief in banks, because governments say they can be trusted and governments use the banks as a control mechanism which manages the economy.

So now we come to bitcoin and the internet age, and some of these fundamentals are being challenged although the basics remain the same …

Before we get into that though, let’s just take a step back and talk about how the internet age came around.

Some might claim it dates back Alan Turing, the Enigma machine and the Turing Test, or even further back to the 1930s when the Polish Cipher Bureau were the first to decode German military texts on the Enigma machine. Enigma certainly was the machine that led to the invention of modern computing, as British cryptographers created a programmable, electronic, digital computer called Colossus to crack the codes held in the German messages.

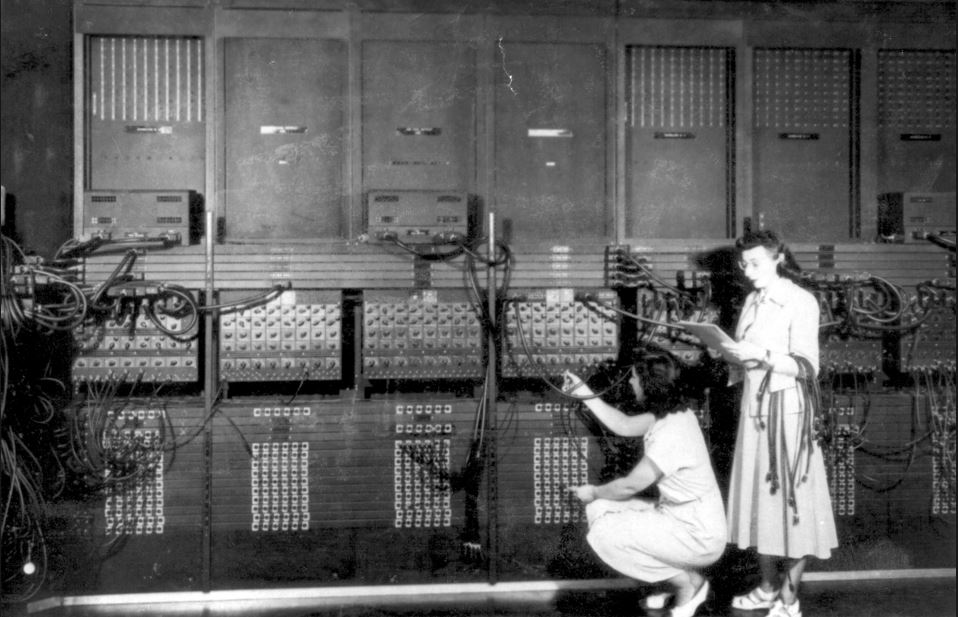

Colossus was designed by the engineer Tommy Flowers, not Alan Turing – he designed a different machine – and was operational at Bletchley Park from February 1944, two years before the American computer ENIAC appeared. ENIAC, short for Electronic Numerical Integrator and Computer, was the first electronic general purpose computer. It had been designed by the US Military for meteorological purposes – weather forecasting – and delivered in 1946.

When ENIAC launched, the media called it The Giant Brain, with a speed a thousand times faster than any electro mechanical machines of its time. ENIAC weighted over 30 tons and took up 1800 square feet of space. It could process about 385 instructions per second.

Compare that with an iPhone6 that can process around 3.5 billion instructions per second, and this was rudimentary technology, but we are talking about 70 years ago, and Moore’s Law hadn’t even kicked in yet.

The key is that Colossus and the ENIAC laid the groundwork for all modern computing, and became a boom industry in the 1950s. You may think that surprising when, back in 1943, the then President of IBM, Thomas Watson, predicted that there would be a worldwide market for maybe five computers. Bearing in mind the size and weight of these darned machines, you could see why he thought that way but my, how things have changed today.

However, we are still in the early days of the network revolution and I’m not going to linger over the history of computers here. The reason for talking about ENIAC and Colossus was more to put our current state of change in perspective. We are 70 years into the transformations that computing is giving to our world.

Considering it was 330 years from the emergence of steam power to the last steam power patent, that implies there’s a long way to go in our transformation. Maybe. Or maybe we are already entering the fifth age of moneykind, which I will talk about tomorrow.

Let’s first consider the fourth age in more depth as the key difference between this age and those that have gone before, is the collapse of time and space. Einstein would have a giggle, but it is the case today that we no longer are separated by time and space as we were before. Distance is collapsing every day, and it is through our global connectivity that this is the case.

We can talk, socialise, communicate and trade globally, in real-time for almost free. I can make a Skype call for almost no cost to anyone on the planet and, thanks to the rapidly diminishing costs of technology – there are $1 phones out there today, and the cheapest smartphone in the world is probably the Freedom 251. That’s an Android phone with a 4-inch screen that costs just 251 rupees in India, around $3.75. In other words, what is happening in our revolution is that we can provide a computer far more powerful than anything before, and put it in the hands of everyone on the planet so that everyone on the planet is on the network.

Once on the network, you have the network effect which creates exponential possibilities as everyone can now trade, transact, talk and target one-to-one, peer-to-peer.

This is why I think of the network as the fourth age of man and money, as we went from disparate, nomadic communities in the first age; to one that could settle and farm in the second; to one that could travel across countries and continents in the third; to one that is connected globally, one-to-one. This is a transformation and shows that man is moving from single tribes to communities to connected communities to a single platform: the internet.

The importance of this is that each of these changes has seen a rethinking of how we do commerce, trade and therefore finance. Our shared belief system allowed barter to work until abundance under-mined bartering, and so we created money; our monetary system was based upon coinage, which was unworkable in a rapidly expanding industrial age, and so we created banking to issue paper money. Now, we are in the fourth age, and banking is no longer working as it should. Banks are domestic but the network is global; banks are structured around paper but the network is structure around data; banks distributed through buildings and humans, but the network distributes through software and servers.

This is why so much excitement is hitting mainstream as we are now at the cusp of the change from money and banking to something else. However, in each pervious age, the something else hasn’t replaced what was there before. It’s added to it.

Money didn’t replace bartering; it diminished it. Banking didn’t replace money; it diminished it. Something in the network age isn’t going to replace banking, but it will diminish it. By diminish, we also need to put that in context.

Diminish. Barter is still at the highest levels it has ever been – about 15% of world trade is in a bartering form – but it is small compared to the monetary flows. Money in its physical form is also trading at the highest levels it has ever seen – cash usage is still rising in most economies – but it is not high compared to the alternative forms of monetary flow digitally and in FX markets and exchanges. In other words, the historical systems of value exchange are still massive, but they are becoming a smaller percentage of trade compared with the newest structure we have implemented to allow value to flow.

This is why I’m particular excited about what the network age will do, as we connect one-to-one in real-time, as it will create massive new flows of trade for markets that were underserved or overlooked. Just look at Africa. African mobile subscribers take to mobile wallets like ducks to water. A quarter of all Africans who have a mobile phone have a mobile wallet, rising to pretty much every citizen in more economically vibrant communities like Kenya, Uganda and Nigeria. This is because these citizens never had access to a network before; they had no value exchange mechanism, except a physical one that was open to fraud and crime. Africa is leap-frogging other markets by delivering mobile financial inclusion almost overnight.

The same is true in China, India, Indonesian, the Philippines, Brazil and many other under-served markets. So the first massive change in the network effect of financial inclusion is that the 5 billion people who previously had zero access to digital services are now on the network.

A second big change is then the nature of digital currencies, cryptocurrencies, bitcoin and shared ledgers. This is the part that is building the new rails and pipes for the fourth generation of finance, and we are yet to see how this rebuilding works out. Will all the banks be based on an R3 blockchain? Will all clearing and settlement be via Hyperledger? What role with bitcoin play in the new financial ecosystem?

We don’t know the answers to those questions yet, but what we will see is a new ecosystem that diminishes the role of historical banks, and the challenge for historical banks is whether they can rise to the challenge of the new system.

The Fourth Age of Moneykind is a digital networked value structure that is real-time, global, connected, digital and near free. It is based upon everything being connected from the seven billion humans communicating and trading in real-time globally to their billions of machines and devices, which all have intelligence inside. This new structure obviously cannot work on a system built for paper with buildings and humans, and is most likely to be a new layer on top of that old structure.

A new layer of digital inclusion, that overcomes the deficiencies of the old structure. A new layer that will see billions of transactions and value transferred at light speed in tiny amounts. In other words, the fourth age is an age where everything can transfer value, immediately and for an amount that starts at a billionth of a dollar if necessary.

This new layer for the Fourth Age is therefore nothing like what we have seen before and, for what was there before, it will supplement the old system and diminish it. Give it half a century and we will probably look back at banking today as we currency look back at cash and barter. They are old methods of transacting for the previous ages of man and moneykind.

This fourth age is digitising value, and banks, cash and barter will still be around but will be a much lesser part of the new value ecosystem. They may still be processing volumes greater than ever before, but in context of the total system of value exchange and trade, their role is lesser.

In conclusion, I don’t expect banks to disappear, but I do expect a new system to evolve that may include some banks, but will also include new operators who are truly digital. Maybe it is the Google’s, Baidu’s, Alibaba’s and Facebook’s; or maybe it is the Prosper’s, Lending Club’s, Zopa’s and SoFi’s. We don’t know the answer yet and if I were a betting man, I would say it’s a hybrid mix of all, as all evolve to the Fourth Age of Moneykind.

The hybrid is one where banks are part of a new value system that incorporates digital currencies, financial inclusion, micropayments and peer-to-peer exchange, because that is what the networked age needs. It needs the ability for everything with a chip inside to transact in real-time for near-free. We’re not there yet but, as I said, this revolution is in early days. It’s just 70 years old. The last revolution took 330 years to play out. Give this one another few decades and then we will know exactly what we built.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...