The Third Age: The Industrial Revolution

The use of money as a means of value exchange, alongside barter, lasted for hundreds of years or, to be more exact, about 4,700 years. During this time, beads, tokens, silver, gold and other commodities were used as money, as well as melted iron and other materials. Perhaps the weirdest money is that of the Yap Islands in the Pacific that use stone as money.

This last example is the favourite illustration of how value exchange works for bitcoin libertarians, who use the stone ledger exchange systems of the Yap Islands to illustrate how you can then translate this to digital exchange on the blockchain, as it’s just a ledger of debits and credits.

The trouble is that stone, gold and silver is pretty heavy as a medium of exchange. Hence, as the Industrial Revolution powered full steam ahead, a new form of value exchange was needed.

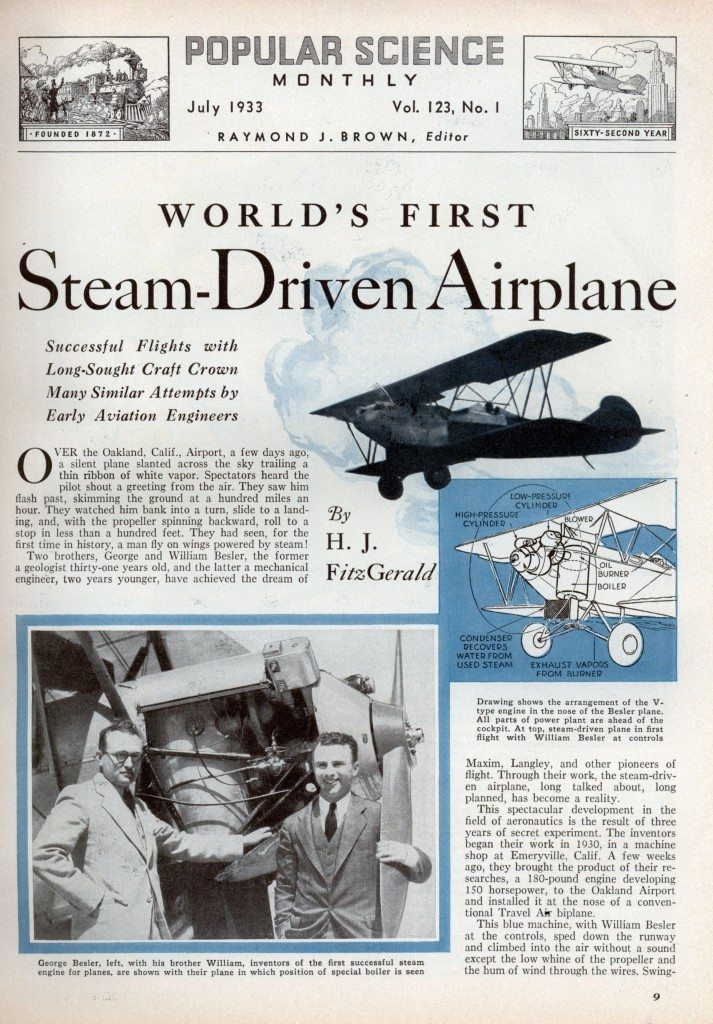

In this context, I used the term full steam ahead as a key metaphor, as the timing of the Industrial Revolution is pretty much aligned with steam power. Steam power was first patented in 1606, when Jerónimo de Ayanz y Beaumont received a patent for a device that could pump water out of mines. The last steam patent was in 1933, when George and William Besler patented a steam powered airplane.

The steam age created lots of new innovations, but the one that transformed the world was the invention of the steam engine. This led to railways and transport from coast to coast and continent to continent. Moving from horse power to steam power allowed ships to steam across oceans and trains across countries. It led to factories that could be heated and powered, and led to a whole range of transformational moments culminating in the end of the 19th century innovations of electricity and telecommunications. The move from steam to electricity moved us away from heavy duty machinery to far lighter and easier communication and power structures. Hence, the Industrial Revolution ended when we moved from factories to offices but, between 1606 and 1933 there were massive changes afoot in the world of commerce and trade.

Within this movement of trade, it was realised that a better form of value exchange was needed, as carrying large vaults of gold bullion around was not only heavy but easily open to attack and theft. Something new was needed. There had already been several innovations in the world – the Medici bankers created trade finance and the Chinese had already been using paper money since the 9th century – but these innovations didn’t go mainstream until the Industrial Revolution demanded it. And this Revolution did demand a new form of value exchange.

Hence, the governments of the world started to mandate and license banks to enable economic exchange. These banks appeared from the 1600s, and were organised as government-backed entities that could be trusted to store value on behalf of depositors. It is for this reason that banks are the oldest registered companies in most economies. The oldest surviving British financial institution is Hoares Bank, created by Richard Hoare in 1672. The oldest British bank of size is Barclays Bank, first listed in 1690. Most UK banks are over 200 years old which is unusual as, according to a survey by the Bank of Korea, there are only 5,586 companies older than 200 years with most of them in Japan.

Banks and insurance companies have survived so long as large entities – it is notable that they are large and still around after 200 to 300 years – because they are government instruments of trade. They are backed and license by governments to act as financial oil in the economy, and the major innovation that took place was the creation of paper money, backed by government, as the means of exchange.

Paper bank notes and paper cheques were created as part of this new ecosystem, to make it easier to allow industry to operate. At the time, there must have been massive surprise at the idea of this. A piece of paper instead of gold as a payment? But it wasn’t so outrageous.

Perhaps this excerpt from the Committee of Scottish Bankers provides a useful insight on why this took off:

The first Scottish bank to issue banknotes was Bank of Scotland. When the bank was founded on 17th July 1695, through an Act of the Scottish Parliament, Scots coinage was in short supply and of uncertain value compared with the English, Dutch, Flemish or French coin, which were preferred by the majority of Scots. The growth of trade was severely hampered by this lack of an adequate currency and the merchants of the day, seeking a more convenient way of settling accounts, were amongst the strongest supporters of an alternative.

Bank of Scotland was granted a monopoly over banking within Scotland for 21 years. Immediately after opening in 1695 the Bank expanded on the coinage system by introducing paper currency.

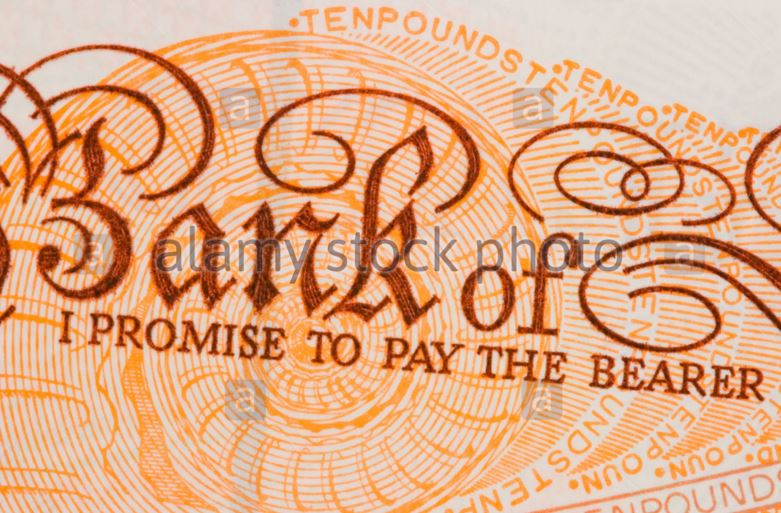

This idea was first viewed with some suspicion. However, once it became apparent that the Bank could honour its "promise to pay" ...

... and that the paper was more convenient than coin, acceptance spread rapidly and the circulation of notes increased. As this spread from the merchants to the rest of the population, Scotland became one of the first countries to use a paper currency from choice.

And the cheque book? The UK’s Cheque & Clearing Company provides a useful history:

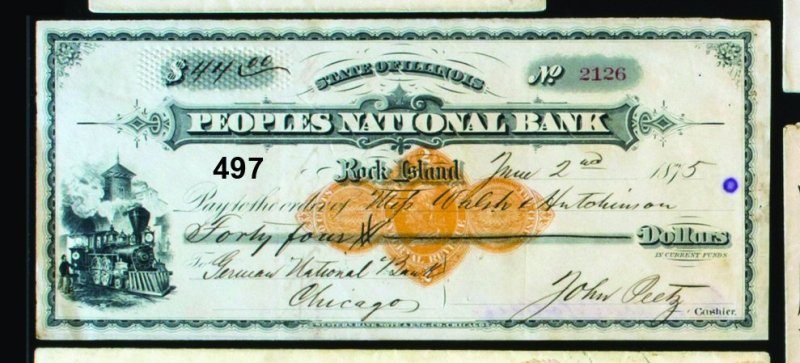

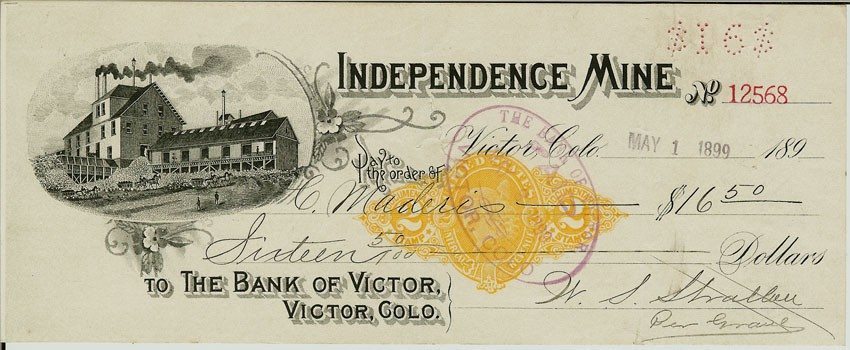

By the 17th century, bills of exchange were being used for domestic payments as well as international trades. Cheques, a type of bill of exchange, then began to evolve. They were initially known as ‘drawn notes’ as they enabled a customer to draw on the funds they held on account with their banker and required immediate payment … the Bank of England pioneered the use of printed forms, the first of which were produced in 1717 at Grocers’ Hall, London. The customer had to attend the Bank of England in person and obtain a numbered form from the cashier. Once completed, the form had to be authorised by the cashier before being taken to a teller for payment. These forms were printed on ‘cheque’ paper to prevent fraud. Only customers with a credit balance could get the special paper and the printed forms served as a check that the drawer was a bona fide customer of the Bank of England.

In other words, the late 17th century saw three major innovations appear at the same time: governments giving banks licences to issue bank notes and drawn notes, cheques, to allow paper to replace coins and valued commodities.

The banking system then fuelled the Industrial Revolution, not only enabling easy trading of value exchange through these paper-based systems, but also to allow trade and structure finance through systems that are similar to those we still have today.

The oldest Stock Exchange in Amsterdam was launched in 1602 and an explosion of banks appeared in the centuries that followed to enable trade, supporting businesses and governments in creating healthy, growing economies. A role they still are meant to fulfil today.

During this time, paper money and structured investment products appeared, and large-scale international corporations began to develop, thanks to the rise of large-scale manufacturing and global connections.

So the Industrial Revolution saw an evolution of development, from the origins of money that was enforced by our shared belief systems, to the creation of trust in a new system: paper.

The key to the paper notes and paper cheque systems is that they hold a promise to pay which we believe will be honoured. A bank note promises to pay the bearer on behalf of the nation’s bank and often signed by that country’s bank treasurer.

A cheque is often reflective of society of the time, and shows how inter-linked these value exchange systems were with the industrial age.

In summary, we have three massive changes in society over the past millennia of mankind: the creation of civilisation based upon shared beliefs; the creation of money based upon those shared beliefs; and the evolution of money from belief to economy, when governments backed banks with paper.

That concludes part three of this series. Part four looks at the next big change in thinking: beyond banking in the networked age.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...