I've talked about open sourcing banking and finance by converting everything to components (APIs) that can be plug and played into any front-end user experience (UX) through apps and devices, supported by data analytics, cloud and blockchain to reduce and automate the back office.

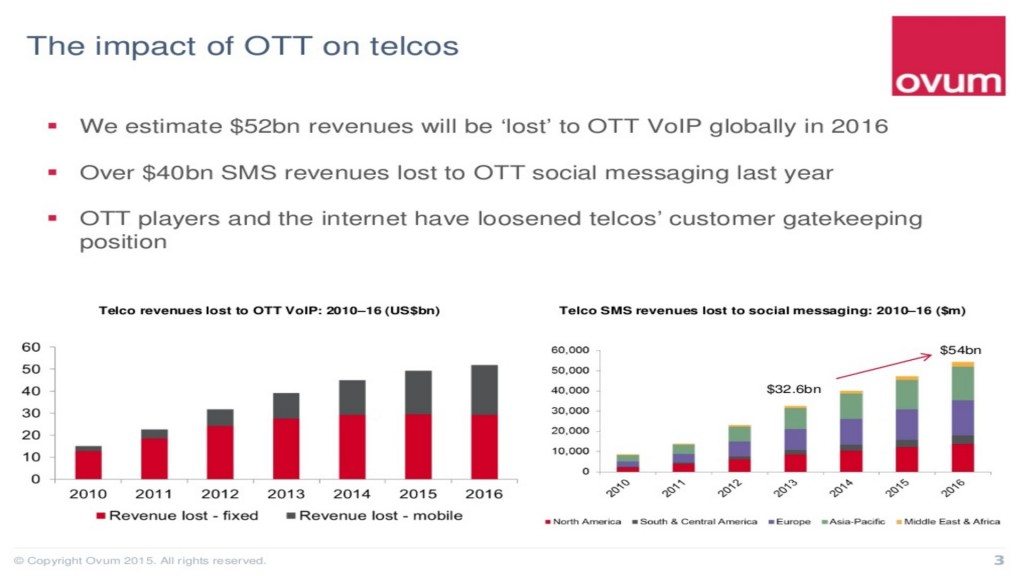

All of this can be summed up as MoIP: the conversion of the financial system to Money over Internet Protocol. MoIP is as fundamental to finance as VoIP has been to the telco industry. Between 2012 and 2018, telecommunications firms are estimated to have lost nearly $400 billion in revenues on international calls and roaming fees, and that’s a trend that is just going to get worse as apps like WhatsApp, LINE, Messenger and more take over. These apps based upon VoIP are called Over-The-Top services, or OTT for short, and these services are really hitting the heart of the telco industry because telco revenue loss is being hit by more than just lost phone calls. These apps provide social networking and video streaming services that equate to both more lost revenues, as well as more attraction to move than the just a phone plan offer from the incumbents. The new players are sticky, fun and interesting. The incumbents are dull, slow and constrained by their traditional operations and views.

This is why Ovum predicts that consumer use of OTT services will grow at a compounded annual rate of 20% between 2012 and 2018 to reach 1.7 trillion minutes of usage in 2018, translating to $63 billion in lost revenue in that year alone.

Pitching for ‘same service, same rules’, telecom companies have warned of a data tariff hike if over-the-top (OTT) players [Ed: VoIP streaming apps] are not brought under regulations, like the telecom service providers (TSPs).

What’s this got to do with banking?

Well, the move to open sourcing MoIP is just the same debate and battle that telco’s are going through with OTT. The telco vs OTT fight is similar to the bank vs Fintech discussion and, if we take a step back, we can see how this might play out.

Ten years ago, many magazines made predictions about telco revenue losses due to VoIP. The telco industry watched and waited. Their response was that services like Skype would not impact as the availability of internet services was limited. At that time, most internet access was via dial-up and low-speed broadband lines, so they might have been right. Ten years later, WiFi is an essential part of our lives …

… and no one believes that the old networks are needed. I no longer have a fixed line, laugh when forms ask for my home telephone number and use my mobile incessantly to communicate, mainly via Whatsapp, Twitter and Facebook. When I travel, I avoid using my mobile subscriber services, but use WiFi to Skype as it’s near free versus $2 a minute. I wonder why my telco even bothers as I dislike them intensely, and cannot wait for the day that they disappear from the face of this planet.

Now I don’t feel quite as intense about my bank, but the traits are similar. I remember when Sainsbury Bank launched back in 1997, and they had conducted a survey of consumer views of banks. The main words associated with banks were greedy, complacent, arrogant and lazy. The survey may have been skewed but the words resonate. Twenty years later, the banks are still as strong, maybe stronger – in the UK, the big 4 banks market share of deposit accounts has grown to 77% from 69% twenty years ago – but the attack is still strong, and getting stronger.

The UK has near 30 challenger bank start-ups, and the reason is that they see the opening to create new services. New services that have little to do with transactions and accounts, but are more to do with digital-first engagement. Being sticky and social and fun. Certainly that’s what I see with Atom Bank, who have acquired a design firm for User Experience, and are focusing heavily upon gamification for customer engagement.

In other words, the bank versus digital start-up is going along the same lines as the telco versus OTT player, and the results will be the same. The banks will lose billions in revenue streams to these new players if they do not respond effectively.

An effective response?

As per my mantra: build a digital foundation and then place buildings and humans on top of that foundation. The means ripping out the core systems and silo structures and replacing them with IP-enabled bedding. If that’s too big an ask, launch a new digital-first bank. Either way, in ten years, MoIP will have moved the financial fight into a whole new playing field, and it will be fascinating to see which players are left playing on it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...