I’m often talking about Victorian visions of the future to illustrate the issue we have today. The Victorian vision of the future was dealing with a number of problems, one of which was horse shit. Manure. Manure was a massive issue. Victorian Britain had too many horses and carriages on the streets, and the horses produced lots of manure.

Hundreds of people were involved in clearing the streets of this manure and putting on a tray to be carried out of town … by a horse.

The horse form of transport was a major problem. Then we created steam power and the train took over some of the horse drawn functions. Steam could power lots of things. Steam enabled us to travel across countries and continents far faster than we ever could before.

So guess what the Victorians invented as their vision of the future?

You got it, a steam-powered horse.

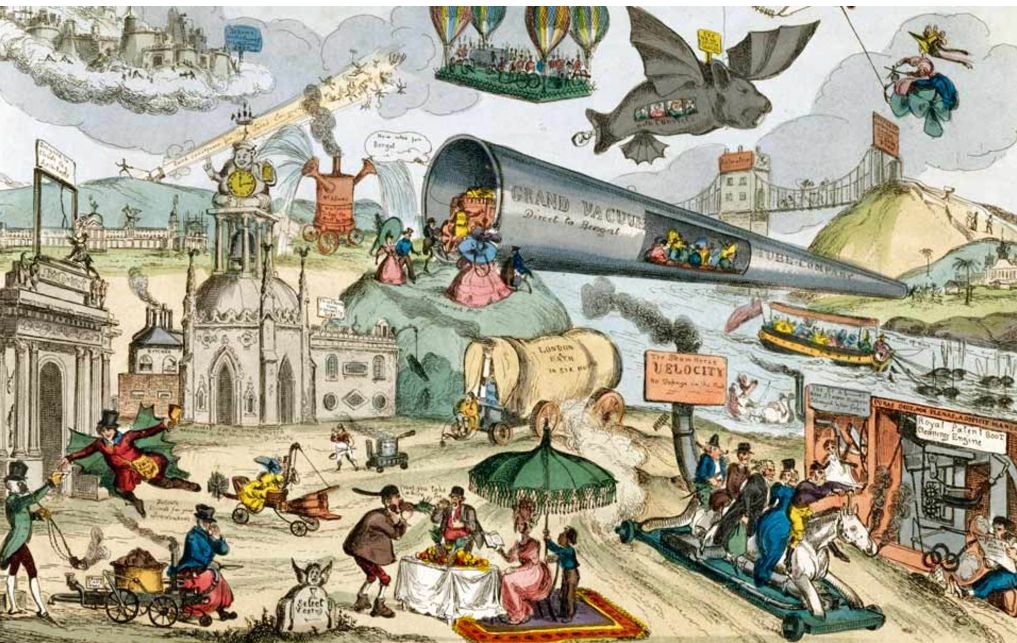

In the lower right of this 1800s vision of tomorrow, you can see a steam powered horse with the sign above: “Velocity – no sloppage on the road”.

In other words, steam-powered horses had two benefits: faster and cleaner. We could get rid of the manure issue whilst travelling with more people. Fantastic.

So Henry Ford was spot on: if he had listened to the customer, they would have asked for faster horses.

Now fast forward to today, and the open sourcing of banking and the lack of technology leadership and knowledge in the boardroom. So we ask the CxO what does the bank need? Faster banking, with less risk and lower cost. In this simplistic view of the world, I wonder whether banks are investing in faster banking in the same way as the Victorians want faster horses.

Faster banking is all about taking what we do today and moving it to the internet. Digitalise what we do today. Put what we do today on a blockchain.

Are we really rethinking banking? Are we really reinventing our value exchange structures? Are we challenging our creativity and thinking? Or are we just transitioning the easy way we do things today and automating them?

Just a thought.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...