I’m often asked, as we move more and more to digital communications: what will happen to the people? What will happen to the people? As we move to robotics, automated agents, augmented and artificial intelligence, what will happen to the people. If we have no branches, no structures and no buildings that need humans, what will happen to the people.

It’s a good question. It’s a question that always crops up as we move from one form of work to another. If we have no farms, where will people work? If we have no factories, where will people work? If we have no offices, where will people work?

Jobs change, as does life, and we have already moved from hard labour to blue collar to white collar. Where we go next is the big question. My feeling is that we move to a world of servicing technology. Technology will allow us to live our lives more easily, smarter and with greater confidence. In return, we will nurture and generate technologies that allow us to live our lives easier, smarter and more confidently.

Unskilled workers will service robots and machines; skilled workers will create amazing services with robots and machines; and machines will gradually nurture and operate themselves. Just because a machine can manage itself however, doesn’t mean it will never breakdown. Equally, just because a machine has artificial intelligence, doesn’t mean it will never need real intelligence to make the next breakthrough.

So our concerns about machines and automaton are often misplaced as machines and automation often create new industries, new jobs and new opportunities. A good example is the end of the branch. It is clear that the transactional teller jobs and branch structure is past its sell-by date. It is a last century structure of physical distribution that is no longer needed in the age of automation. So what do we do with the branches and the humans? Branches can be sold. Many are now coffee bars and wine bars. But the humans? What will happen to the people?

Well, if the humans are any darned good, they will move to support digital interactions. If the branch staff are that good at relationship, then get them on to Facebook and Skype to create digital relationships. Surely a really empathetic, engaged and enthusiastic member of the branch workforce could share that empathy, engagement and enthusiasm just as easily through a Skype call or Facebook message?

I guess the question is more whether they have that empathy, engagement and enthusiasm in the first place, bearing in mind that most branch staff are pure administrators who are paid peanuts. So, what are the jobs of the future in banking? Where will the people make a difference?

Andy Haldane of the Bank of England gave a great speech about the implications of robots on labour last year, and warned that automation posed a risk to almost half those employed in the UK and that a “third machine age” would hollow out the labour market, widening the gap between rich and poor.

Be very afraid: Andy Haldane @bankofengland reveals how likely you are to be replaced by a robot... pic.twitter.com/uHvutoe5wz

— Heather Stewart (@GuardianHeather) November 12, 2015

A new report by Australian Government Agency CSIRO (Commonwealth Scientific and Industrial Research Organisation) finds ten major forces changing the dynamics of work

- Education and training is becoming ever more important

- New capabilities are needed for new jobs of the future

- Digital literacy is needed alongside numeracy and literacy

- The changing importance of STEM (whilst participation rates are in decline)

- Aptitudes and mindsets to handle a dynamic labour market

- Challenging perceptions and norms about job types

- Improving workforce participation in vulnerable demographics

- Towards tapered retirement models

- New models to forecast job transition requirements

- Improved understanding of the peer-to-peer (and freelancer) economy

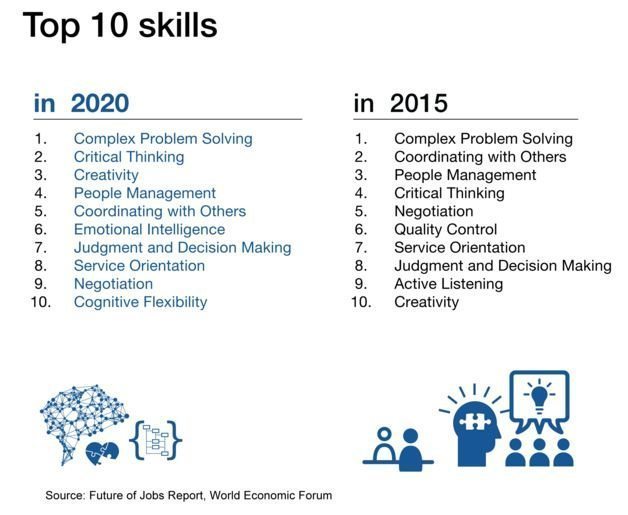

Whilst the World Economic Forum’s Future of Jobs report finds enormous change predicted in the skill sets needed to thrive in the new landscape.

In banking, we are already seeing major changes, with traders almost irrelevant in investment banking these days. The days of multimillion dollar bonuses may be over, when a machine can invest better than a human. According to Daniel Nadler, CEO of Kensho, a financial analytics tool, a third to a half of the current employees in finance will lose their jobs to automation software within the next decade.

Whatever happens, it is clear that jobs are changing thanks to automation, but they always have. There will always be jobs, just different jobs and new jobs. The result is that you will have two types of people: those who own the robots and those who work for them (courtesy Marc Andreessen).

By the way, did someone just eat my cheese?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...