As mentioned I’ve just attended #Money2020Europe where 4,000 folks gathered to listen to great speakers like me. Unfortunately, I didn’t get long to stay at the show for various reasons, but did pick up a magazine about Copenhagen as a FinTech hub. Everywhere wants to be a FinTech hub, now that the scene is so active and key. Not everywhere will be a hub, as only so many places can offer the right capabilities. For example, it was interesting talking with Jon Weiner the co-founder of Money2020, who lives in Lisbon and was telling me about their leading tech capabilities. Do they have a FinTech centre in Lisbon? I asked, as I’d never heard of one. No, Jon said. Unsurprising as Lisbon isn’t really a Global Financial Centre.

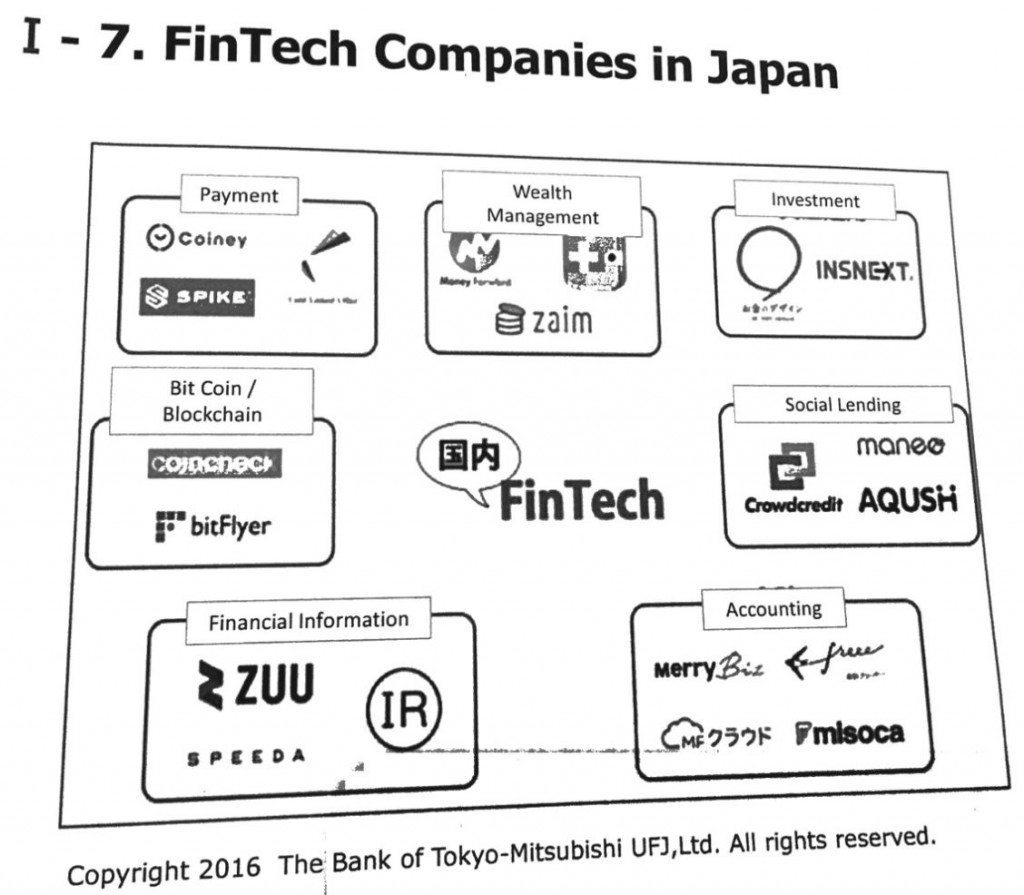

So you would expect the world’s global financial centres to encourage and nurture FinTech. In the latest Z/Yen Global Financial Centres Index (issue #19, March 2016), London, New York, Singapore, Hong Kong and Tokyo comprise the top 5. Intriguingly, the first three are very actively building their FinTech capabilities but, having been in Hong Kong and Tokyo recently, I know they are more challenged. For example, a colleague at Bank of Tokyo-Mitsubishi presented this slide in the FinTech forum I attended there:

This is Japan’s FinTech scene and it’s tiny, compared with London and New York.

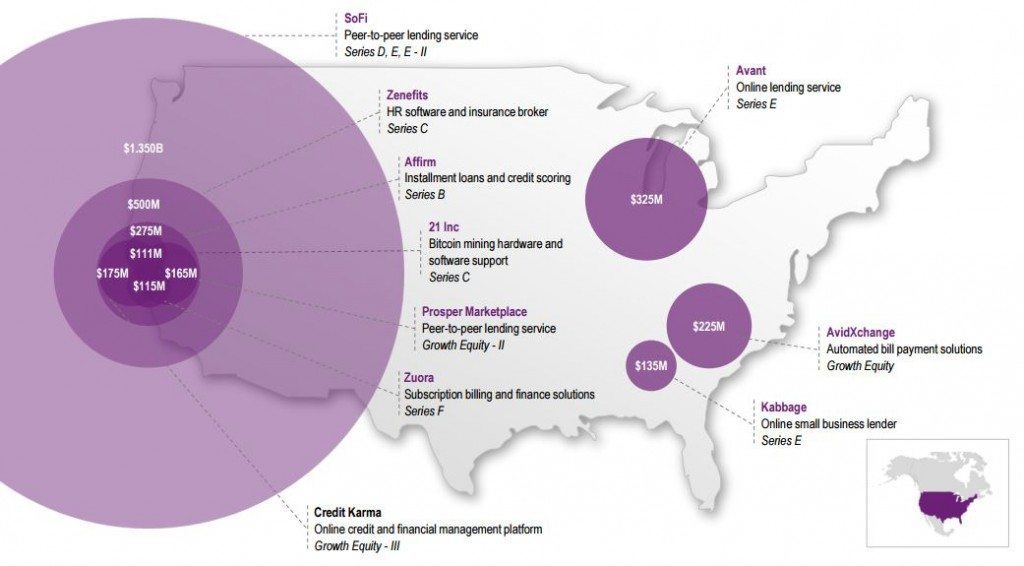

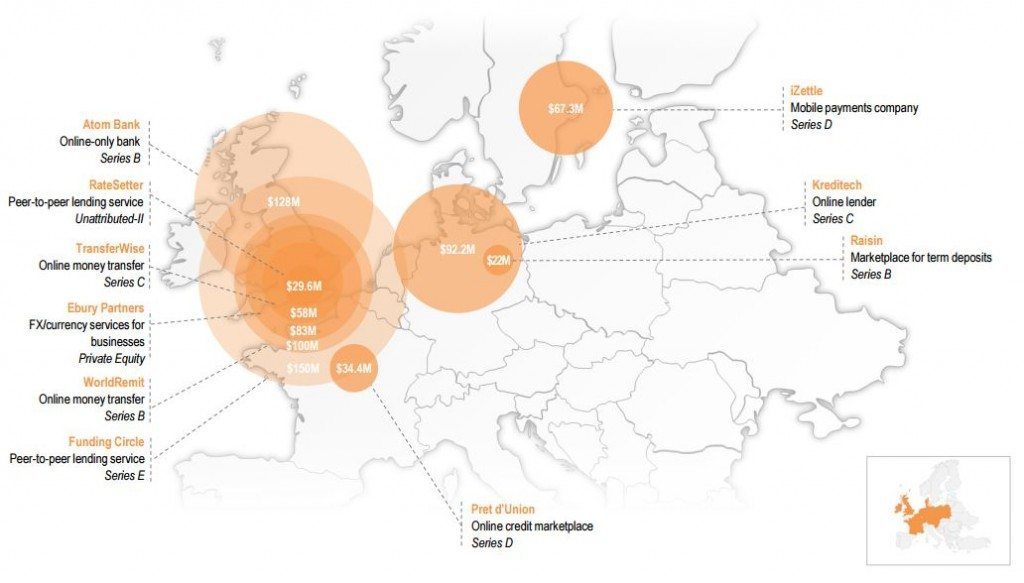

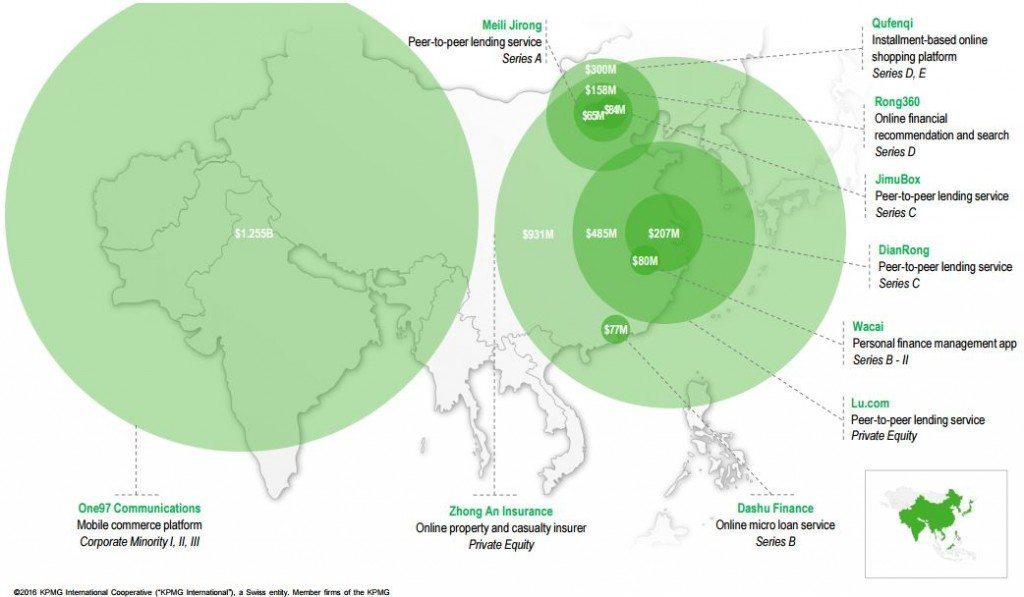

KPMG’s Pulse of FinTech 2015 report illustrates the challenge further, showing that US FinTech leads the world. Of the $13.8 billion invested by Venture Capital firms in FinTech in 2015, $7.39 billion went into US start-ups, compared with $4.5 billion into Asian firms and just $1.5 billion in European organisations.

The 10 largest FinTech funding rounds in America, 2015

The 10 largest FinTech funding rounds in Europe, 2015

The 10 largest FinTech funding rounds in Asia, 2015

So what does it take to truly become a FinTech hub?

Well, going back to Copenhagen, my friends at CFIR commissioned Oxford Research and Rainmaking Innovation to find out the answer. The resulting research report concludes that there are six key factors for becoming a FinTech hub:

1. A vibrant FinTech startup community:

At the grass root level, there needs to be a lot of events and activities going on, which can help the establishment and growth of start-ups.

2. Active established players:

It is crucial that large established FinTech players invest in innovation and in leveraging the FinTech potential - start-ups cannot build a world class FinTech hub alone.

3. Access to risk capital:

The access to risk capital is critical to fund the establishment and growth of innovative companies.

4. Political support and ‘friendly’ regulator:

Central public bodies need to support the FinTech sector and announce their support publicly, and regulators need to change from a reactive to a more proactive and collaborative mindset.

5. Access to talent:

FinTech is a knowledge intensive sector highly dependent on access to high skilled specialised labour.

6. Brand as a FinTech hub:

To attract international talent, investors, businesses, etc. One needs to build a brand as an important FinTech hub.

So there you go. If you want to be a FinTech hub, you need finance, government, regulators and technologists to work side-by-side to make it happen, which is why I keep saying that London has the upper hand, because we are side-by-side.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...