I enjoyed much of the discussions at Dot Finance, especially the presentation from Kosta Peric of the Bill & Melinda Gates Foundation. Kosta’s been a good friend for some years and features as one of the case study interviews in ValueWeb. He was also responsible for getting Bill Gates to keynote at SIBOS in 2014, and much of the background to the Foundation’s work can be found in my blog about his speech.

At Dot Finance, Kosta outlined The Level One Project and other key developments, and made the case for financial inclusion as everyone benefits from an economy that includes everyone.

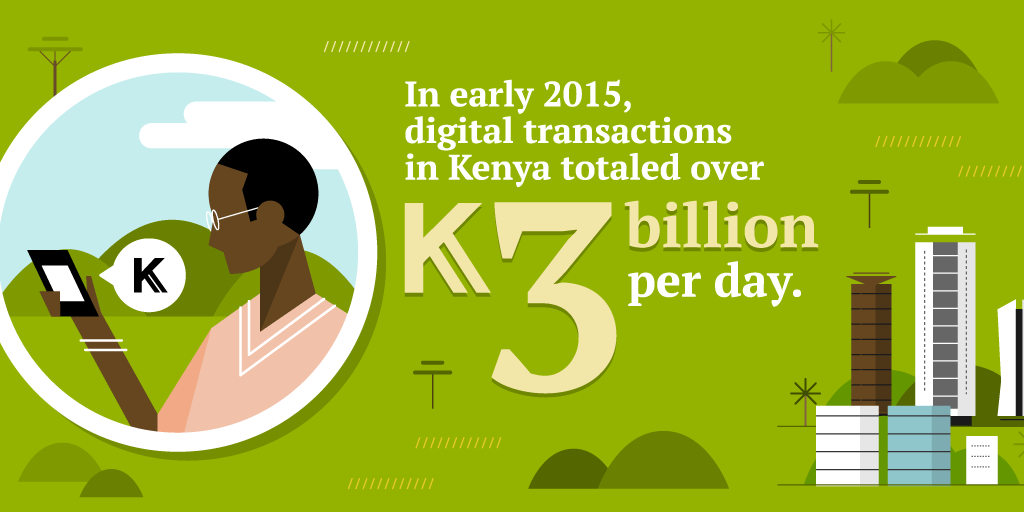

You can find out much more about this over here and, as Kosta outlined, there is money to be made from mobile financial inclusion. After all, it is expected that more than US$14 billion will be sent and received as mobile money in Africa in the year 2020, and that’s a massive market to tap into. I’ll talk more about that tomorrow and specifically what is happening with some of the banks and MNO’s in Africa tomorrow but, for now, here’s Kosta’s take on the conference last week.

A GLIMPSE OF TOMORROW’S ECONOMY: DOT FINANCE AFRICA by Kosta Peric, Deputy Director, Financial Services for the Poor, the Bill & Melinda Gates Foundation.

One thing is clear: Digital financial services (DFS) are reshaping the economies in Kenya, Uganda, Tanzania, and other African nations and setting a powerful precedent for the rest of the world.

This week, I was lucky enough to speak at the Dot Finance conference in Nairobi, an exciting gathering of top fintech and banking leaders from around the world. The enthusiasm was palpable, a testament to the incredible growth, innovation and leadership happening across the continent.

Some of my main takeaways from the conference:

The amount of brainpower focusing on financial inclusion as a key driver of FinTech is incredible. Looking at the roster of speakers and exhibitors, and the subjects covered, I felt my passion and job are at the center of this maelstrom. All of this brainpower was unleashed with an opening from Chris Skinner, providing a powerful FinTech “State of the union” overview, and a glimpse of the future with IoT and blockchain. And all of this in East Africa, clearly the cradle of innovation in financial services.

What does one make of blockchain technology? There was a lot of discussion at the conference, with the pros and cons given fairly equal attention. Blockchain definitely has security in its favor. But its tendencies toward anonymous transactions and segregation from established currencies make it somewhat dubious as a vehicle for financial inclusion.

For an unbanked person to participate fully in the formal economy—and, for that matter, society—she needs a government-recognized ID and unfettered access to the merchants and services that surround her. Basically, she needs to use the same money that everyone else uses. Any digital solution, whether it’s blockchain or a mobile wallet, needs to account for this.

In the keynote he delivered, David Brear of the Eleven FS Group made some very smart points about customers. A lack of analytics in mid-African nations, he pointed out, is keeping providers from understanding what customers want and need. With better data on the people we want to serve—including gender-segregated data, so we can identify where and why women are more excluded than men—we can design products that really make a difference in their lives.

We also discussed the young customer base now entering banking. They demand the utmost speed and convenience in all services, and only digital can deliver it. This means that digital is not just how we will bring unbanked people into the formal economy. It is how we will bring banking into the modern era.

Finally, in a session led by Neal Cross of DBS Bank, we focused on innovation. I found myself agreeing with much of what he proposed, such as bank-sponsored hackathons and an infusion of startups and fintech experiments.

I’m a firm believer in working in the sandbox—testing solutions outside of large and traditional institutions and systems. In the sandbox, you have more freedom to risk failure and explore new directions. BRAC Bank allowed bKash that kind of freedom, and it signed up 10 million customers in three years. Kenya’s M-PESA enjoyed similar freedom and has achieved even more meteoric success.

Africa is living proof that when digital innovations are allowed to bloom, and the needs and lifestyles of customers are kept at the forefront, the entire face of the economy changes. And the more the world follows Africa’s lead, the more everyone will benefit.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...