I caught sight of a report by Deloitte over the weekend that says the marketplace lenders like Zopa and Lending Club are no serious threat to banks. This follows the report by Goldman Sachs a year ago, that said 20% of bank lending will move to these platforms over the next decade. Who’s right and who’s wrong? That remains to be seen, but here’s a few highlights from the Deloitte report:

Marketplace lenders (MPLs) have recently gained prominence following rapid growth in markets like the UK, the US and China. This growth, along with an apparent investor appetite to provide them with equity funding and use them to channel funds directly into consumer and SME lending, has led some to predict profound disruption of the traditional banking model.

Unlike banks, which take in deposits and lend to consumers and businesses, MPLs do not take deposits or lend themselves. They take no risk onto their own balance sheets, and they receive no interest income directly from borrowers. Rather, they generate income from fees and commissions generated by matching borrowers with lenders.

This paper looks at the potential for MPLs to take material share from banks’ core lending and deposit-taking businesses. It tests the hypothesis that, to be truly disruptive, MPLs would need to possess competitive advantages that create real customer value for both borrowers and lenders that incumbent banks cannot counter. As part of this research, Deloitte commissioned YouGov to conduct consumer and small-business research, and also spoke to several UK marketplace lenders, banks and investment managers. Deloitte also developed a UK ‘MPL opportunity-assessment model’, comparing the lending costs of banks and MPLs, and forecasting the future size of the MPL market.

Based on this research, Deloitte draws the conclusion that MPLs do not have a sufficiently material source of competitive advantage to threaten banks’ mainstream retail and commercial lending and deposit-gathering businesses. Critically, banks should be able to deploy a structural cost of funds advantage to sustainably under-price MPLs if it becomes clear that the threat of lost volumes makes this the value maximising strategy. Three key observations underpin this conclusion:

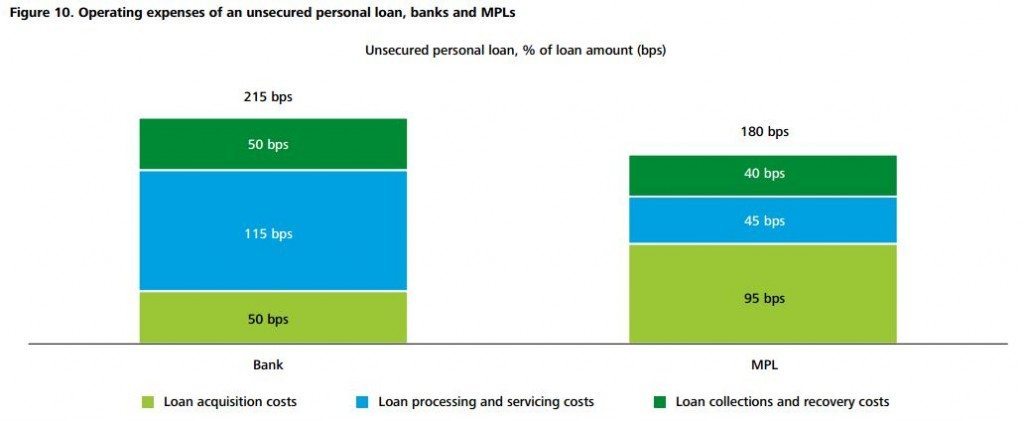

- any operating cost advantage that MPLs may have is insufficient to offset the banking model’s material costof-funds advantage. It is our view that in today’s credit environment, the cost profiles of banks and MPLs are roughly equal, meaning neither has a material pricing advantage. However, Deloitte also believes that banks will have a structural cost advantage over MPLs if and when the credit environment normalises

- although borrowers currently value the benefits of speed and convenience offered by MPLs, these are likely to prove temporary as banks replicate successful innovation in this area. In addition, Deloitte believes that borrowers who are willing to pay a material premium to access loans quickly are in the minority

- our research suggests that most people understand that lending money via an MPL is not comparable to depositing money with a bank. This is largely due to the fact that MPL investments are not covered by the government’s Financial Services Compensation Scheme (FSCS) which protects the first £75,000 of deposits. There may be times in the cycle where supply constraints in the banking sector make certain areas of marketplace lending a more attractive asset class. This is unlikely to be an enduring advantage, however, and the capital provided here is more likely to be deflected from fixed-income or equity investments rather than from bank deposits.

We do not believe that the banking model will be fully disrupted by MPLs. Based on our market sizing analysis, MPLs will not be significant players in terms of overall volume or market share. However, we also do not believe that MPLs are a temporary phenomenon. They seem likely to become a permanent part of the landscape by performing at least two valuable functions:

they may provide supply into areas of the lending market where banks do not have the risk appetite to participate, such as high-risk retail borrowers

while the likelihood of a significant outflow of deposits from the banking system does not seem strong, MPLs may offer a low-cost option for certain investors to gain direct exposure to new asset classes. We do not believe that the banking model will be fully disrupted by MPLs. However, we also do not believe that MPLs are a temporary phenomenon. So what, if anything, should banks do? Our fundamental view is that MPLs do not present an existential threat to banks and, therefore, that banks should view MPLs as complementary to the core banking model, not as mainstream competitors. We therefore believe that banks can, and should, evaluate a wide range of options for enhancing their overall customer proposition by partnering with MPLs. Options might include:

- providing easy access to such platforms for borrowing that is outside a bank’s risk appetite

- keeping an eye on evolving credit models

- leveraging MPL technology to enhance the customer experience

- utilising elements of the MPL model to expand geographically without bearing the distribution and regulatory costs of the traditional bank model.

The report is packed with charts and graphs, but these three stood out for me.

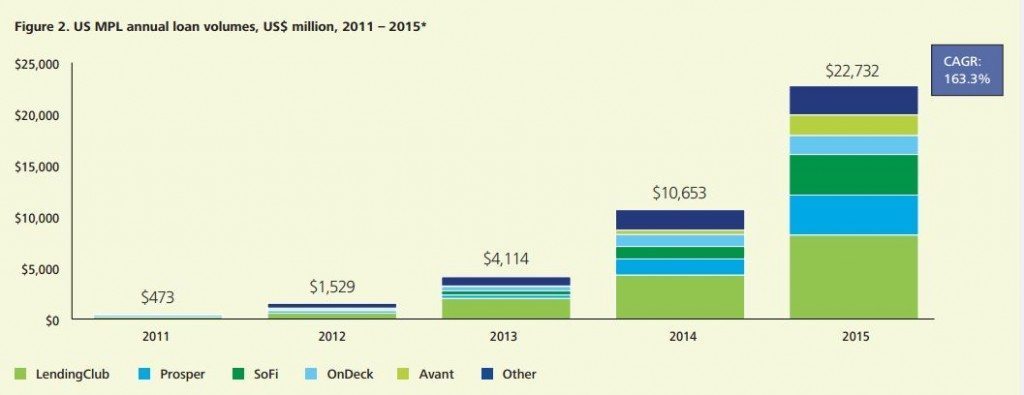

First, an illustration of the rapid rise of marketplace lending in the USA:

Second, the proof that marketplace lenders operate at razor-thin margins compared to incumbents (most of marketplace lenders costs are in customer acquisition):

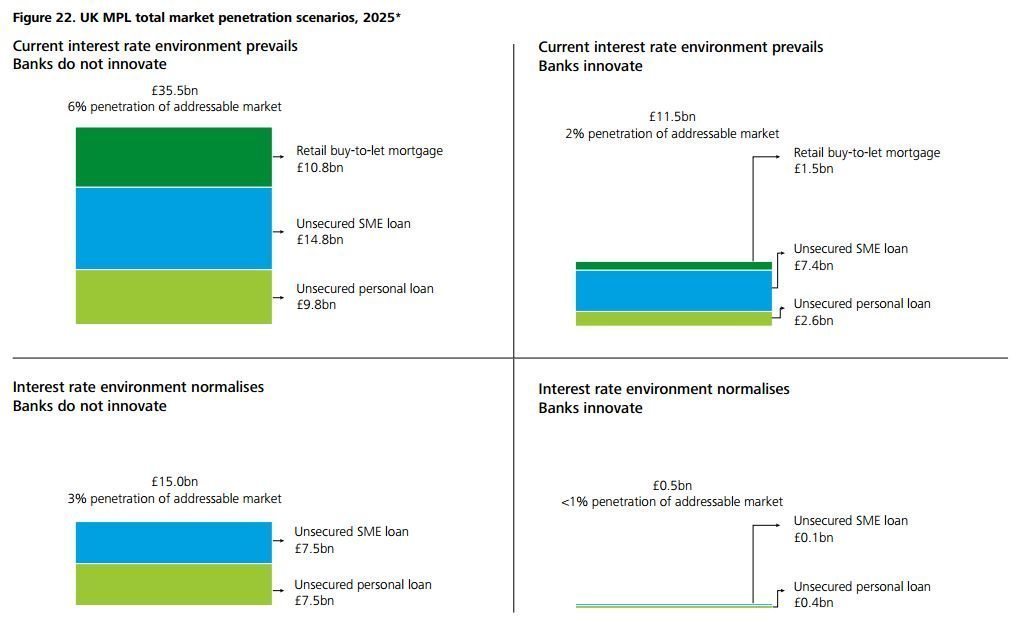

Finally, some scenarios for the future which show that if interest rates rise and banks innovate, then the marketplace lenders opportunity is pretty much obliterated:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...