In a final post about African transformation through technology, I’ve covered the key themes: mobile financial inclusion, smartphone innovation through apps, digital currencies and blockchain identities. One thing missed is a mention of the Water ATM.

I hadn’t heard of automated machines for water being deployed before, although it started in India in 2013 and is now being rolled out across Africa.

According to the India government, about 150 million people in the country have no access to clean water. Water supply in rural areas is routinely contaminated with toxic bacteria and many children die every year because of toxic water. Equally, the high fluoride content in water has resulted in several cases of pains and aches in joints and ligaments.

The Asian Development Bank, in their 2013 Outlook Report, concluded that India’s water prospects are “hazardous.” Experts say that increased population of cities has resulted in increased demand for water. Government’s own data reveals that residents in 22 out of 32 major cities have to deal with daily shortages. There is fast depletion of groundwater as well. According to the World Bank, India is the largest user of ground water in the world, after China.

Water management is the need of the hour. A solution was created by Sarvajal, an Indian social enterprise, who came up with the idea of a Water ATM. It’s not actually an ATM, as it doesn’t dispense cash, but it does dispense water and hence the nickname. Here’s an illustration of how it works:

As dawn breaks, two queues start forming at the only petrol pump in Lakshmangarh, a small town in Rajasthan’s Alwar district. One, obviously, is of people waiting to get their vehicles’ fuel tanks refilled. The other is in front of a simple metal box mounted on the petrol pump’s boundary wall. People like to call it ATM machine. But instead of dispensing cash, it gives them clean drinking water.

On her turn, 26-year-old Sapna Jatav takes out a plastic card and holds it in front of a sensor of the water ATM. The sensor reads her card and shows a balance of Rs 130. Jatav places a 10-litre container below a pipe on the water ATM and presses a button. Reverse Osmosis (RO) processed water starts flowing from the pipe. Jatav releases the button when the container is full. The machine calculates the quantity of water dispensed and deducts the amount from her account. One litre costs 50 paisa.

The technological initiative, powered by solar energy, is changing the lives of many in Rajasthan, Gujarat and Madhya Pradesh. Earlier, people depended on the saline municipal water or groundwater that has high fluoride content. “Water was not fit even for cooking,” says homemaker Rekha Atolia. “Tea would get curdled. Dal would not cook if baking soda was not added to it. When relatives would come, we would buy bottled water,” she says.

You can find out more about the technology involved but the basics is that the ATMs are supplied with water from a processing plant that can clean up to 1,000 litres of water an hour. The system uses mobile communication GSM structures to monitor the ATMs, and not only alerts if a machine is malfunctioning but even the areas of the pipes that might be subject to rust or damage.

The operation of water ATMs is managed through local partners. [For example] in Lakshmangarh, petrol pump owner Abhir Modi manages the operations. So far, he has around 550 customers who either come to the ATM or get water delivered at their doorsteps. “We have only one water ATM in the village, so people who live far prefer to get it delivered at their homes,” says Modi. The charge for home delivery is 70 paisa. Modi sells around 700 litres of water every day. In summers, the requirement goes up to 1,000 litres. “It is better to drink clean water than spend money on medical treatment later,” says Atolia. Sarvajal now plans to set up one more machine in the town.

It is a profitable business for the company as well. The total cost of setting up the RO plant with the machine is around Rs 5 lakh. Franchisees pay 40 per cent of their earnings to the company. If the franchisees own the machine, they pay 20 per cent of the earnings to the company. A unit breaks even when it serves 125 families with 20 litres each daily. The company provides maintenance, advertising support and community drive.

This idea of Water ATMs is now being deployed in Kenya, with a different emphasis.

Local water vendors are not happy with fruit seller Mercy Muiruri. At the end of last year, she found a different solution to washing fruits before making them into a salad for her customers – a water ATM. “Now I know the water I use is safe and from a trusted source. Even my customers will be happy,” she says.

Muiruri has been operating food businesses in one of Kenya’s most populous slums, Mathare, for nearly two decades. Until recently, she used water from local vendors whenever she needed it.

“But I could not vouch for its safety. I, like many of my friends, never knew the source of that water. It got to us in 20-litre plastic containers and we used it,” she says.

Not just that but the water ATMs in Mathare slum have reduced weekly expenditure on water from Sh250 ($2.5) to Sh2.50 cents (25 cents).

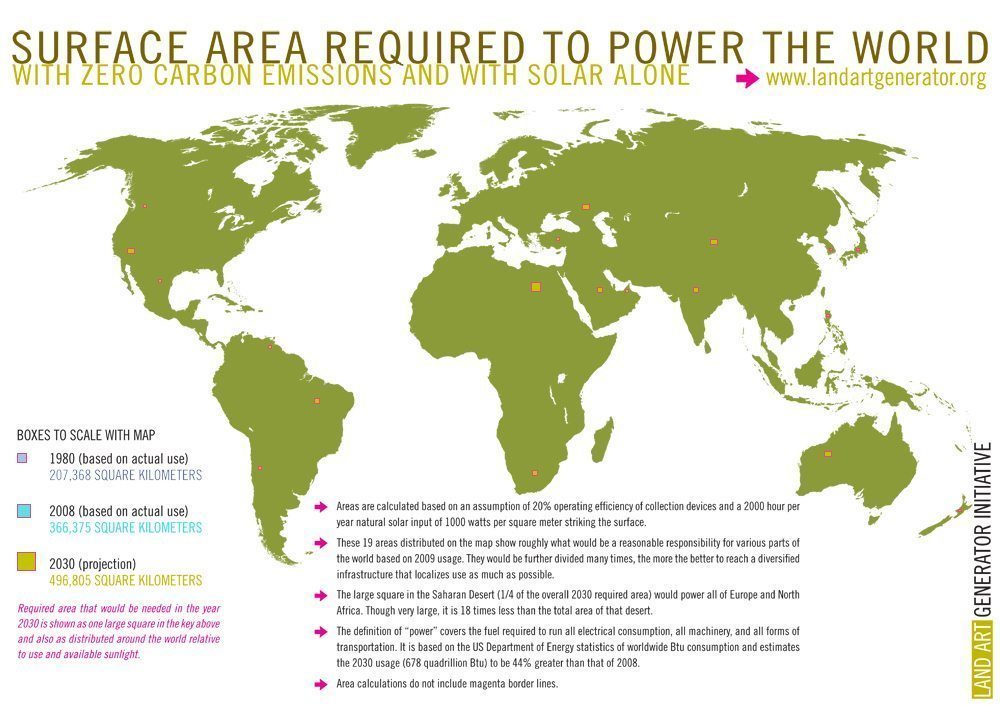

I love this idea and a key part of what this illustrates is the growing use of solar power in these markets. In fact, mobile technologies that are solar powered are another revolution in the making, and will also deliver a critical difference in future markets. The combination of cheap technologies, bright minds and new ideas are solving things we thought were insolvable. Keep on innovating.

Image from Land Art Generator

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...