I’ve had a few meetings with folks at the White House over the past eighteen months, which has been an honour and not something I felt I should blog about. The National Economic Council woke up to the FinTech world early last year and have been consulting with many in the FinTech ecosystem. The latest meeting was a FinTech Summit for a select few at the White House last Friday. I was lucky enough to be one of the select few and thought I’d blog about the four key panel discussions that took place this week.

Jeff Zients, Assistant to the President for Economic Policy and Director of the National Economic Council for the White House makes the opening remarks

The first focused upon the changing landscape of Financial Services, and the role of government in FinTech.

Marla Blow, Founder and CEO of FS Card Inc, and Partner with Fenway Summer LLC set the scene. She cited the fact that many FinTech start-ups were trying to create companies that worked around existing financial regulations, in order to ensure they didn’t have to face the capital requirements and onerous administration that goes with being a fully fledged financial institution. I loved the fact that she stated that:

“Regulatory arbitrage is not a good business model”

It’s not because if you’re doing something that is finance with technology, you will get regulated … eventually. It was also interesting to hear that the US regulatory structure is more Napoleonic than Anglo-Saxon.

“We don't want principles based regulation. We want safe harbours and rules, which means regulation takes a long time to develop and always lags the markets.”

It sure does. When Dodd-Frank first appeared in July 2010, it was already 850 pages. Three years later, this had ballooned into 13,789 pages and more than 15 million words.

A good illustration of this is the Volcker Rule. Paul Volcker originally wrote it down in a three-page letter to the president. When Dodd-Frank went to Congress, the Volcker Rule took up 10 pages. When the proposed regulations for the Volcker Rule finally emerged, the text had increased to 298 pages, and was accompanied by more than 1,300 questions about 400 topics.

Even more fundamentally, just as banks have tried to get to grips with the radical restructuring of Dodd-Frank, the rules are still being written. A year ago, 40% of Dodd-Frank’s 400 tules had yet to be written and implemented and, just as all this goes on, everyone realises that hey, it’s not that important anyway.

"For most of the short life of Dodd-Frank, there has been an aggressive campaign to repeal it," Treasury Secretary Jack Lew said at a Brookings Institution appearance earlier this month. "We're seeing proposed changes that are in the name of simplifying it that would actually go at the heart of some of the protections that we've put in place."

Wow! Maybe a good thing as just last week, House Financial Services Committee Chairman Jeb Hensarling announced the plan to replace Dodd-Frank with the Financial CHOICE Act. Nothing like rules-based regulation is there?

This was echoed by Bruce Wallace, Chief Digital Officer at Silicon Valley Bank, who made it clear that the decentralised and fragmented structure of US regulation was inhibiting innovation. Bruce was asked by the panel chair (Secretary Penny Pritzker, US Department of Commerce) how government policy could be improved in order to promote FinTech?

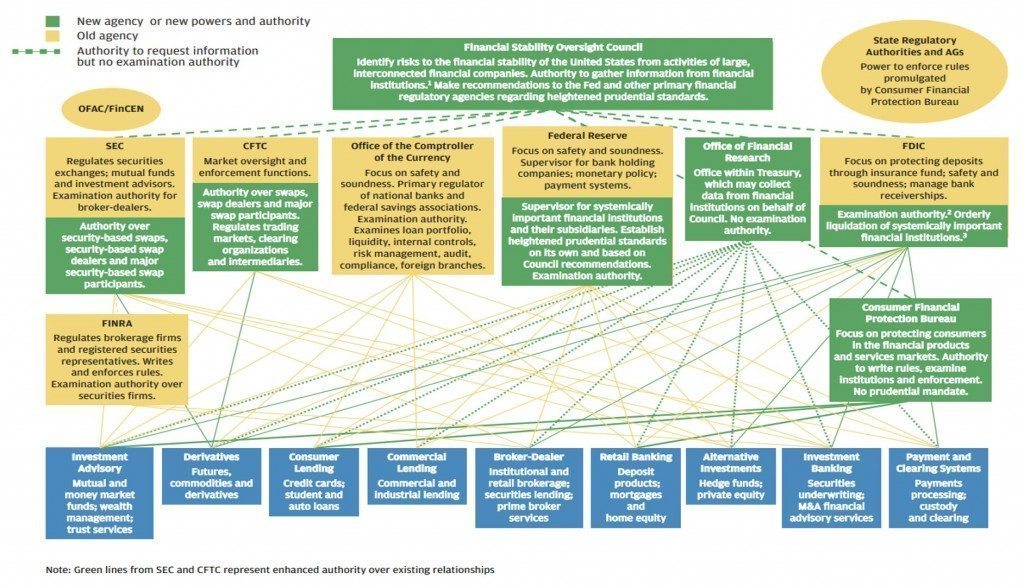

Bruce replied that the rules need to be simplified. There are 400 agencies, sub-agencies and government departments that most startups have to deal with. That is a problem for companies that are worrying more about how to get their next round of funding, how to find customers and how to build their management team. The last thing they want to have to do is work out how to find the regulator they have to deal with. In fact, for a start-up, engaging with government is hard. How could this be improved? You need to change government from seeking out startups to startups seeking out you. It needs to be clear what government can do for them, and where to go as the touch point that will help them move forward. You need a simplified structure that provides a single place to go to and one that can shield start-ups from the sausage making regulatory structure. Just make it a simplified engagement model with one website and one agency, rather than hundreds of agencies and 1000’s of websites, requiring millions in legal fees.

Penny Pritzker then made it clear that all Americans should have access to the digital economy and, in her view, the Government’s role is to promote and support the innovations in that economy. Adam Carson, Managing Partner for Global Technology Strategy & Partnerships at JPMorgan Chase, felt that this goal could best be achieved by copying the UK regulatory sandbox approach in some form (early dialogue with the FCA is already in play). He added that the issue is that there are too many regulations and regulators involved with the banks today, and that their policies are inconsistent and too fragmented. I guess you can see that in the 2011 annual report shareholder update from Jamie Dimon (page 19).

Adam asked the question that everyone at conferences asks: where is the Uber of FinTech? The answer is there isn’t one because there are many regulations they have to comply with. A specific constraint is that the start-up would have to be able to scale massively with bulletproof security. That's why you don't see many start-ups breaking through these barriers and, more often than not, they want to partner with the banks to make this work. Equally, the banks want to partner with the start-ups to improve the user experience. This is because the bank has to keep up with the best benchmark digital players: Google, Amazon and Facebook. When your user is going from Google to Amazon to Facebook to JPM, the experience has to be as good. This is why Adam has 300 people is Silicon Valley working to do this and those people are from those firms.

Equally, many FinTech firms are collaborating with the banks and the main thing the start-ups want from banks is customers. The result should be that consumers are better served and is the economy improved as a result. That's a win/win for everybody. This is why we’re seeing so much partnering and acquiring and discussion:

- North West Mutual acquired Learnvest;

- BlackRock acquired FutureAdvisor;

- UBS invested in SigFig;

- Ondeck, SoFi, Prosper and LendingClub: all have bank partner models;

- Stripe, Square, Braintree, PayPal and Venmo all sit on bank structures;

- Simple and Moven sit on bank licenses;

... the list goes on and it illustrates well that there's a lot of collaboration and partnering in the USA that is just not visible … until you look under the hood.

Ali Rosenthal, VP of Strategic Partnerships at Wealthfront, agreed. “We all want to partner with firms that are regulated and trusted”, she said, but added that what FinTech is doing is “reducing costs significantly whilst increasing distribution to all”. This is a key aspect of what is happening in the world. Technology is reducing barriers and giving access to everyone at low cost. That is the beauty of the new FinTech model on top of those old banking structures and licences.

Finally Tim Estes, Founder and CEO of Digital Reasoning, hit the key point where the government could focus. The government needs to identify where it needs tight regulations – vis-à-vis the rules based regulation a la Dodd-Frank – and where it can apply loose regulations – vis-à-vis tree principles-based regulation of the FCA.

“If it's a Wild West on the left and a Regulatory Boa Constrictor on the right, we need to work out when and where we need to be in the scale of this with security of data. Who's data is it and who is liable for it?”

Panel #1 from left to right: Penny Pritzker, Adam Carson, Tim Estes, Ali Rosenthal and Bruce Wallace

All in all, it was obvious that the regulatory burden and overhead is too great, too decentralised, too inconsistent and too fragmented in the USA. There are too many bodies doing too many things and no single sign-on to the regulatory structure. As a result, the start-ups innovate around the regulations whilst leaving the incumbents to deal with the overhead.

However, as mentioned at the start, regulatory arbitrage is not a great business model so the FinTech dreamers better make assure they’ve ticked those regulatory boxes through collaboration and partnership, or be prepared to face the regulatory meltdown.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...