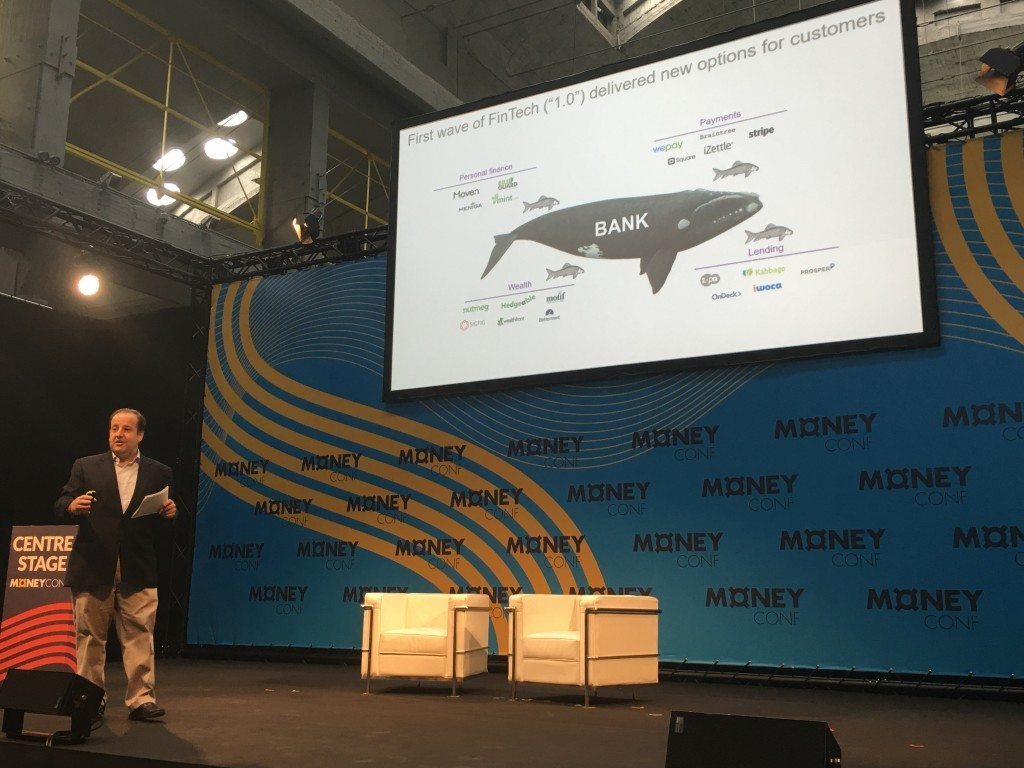

I was piqued by Victor Matarranz’s [SEVP Head of Group Strategy and Chairman's Office, Banco Santander] presentation at MoneyConf last week, mainly because he began by talking about Fintech 1.0 versus Fintech 2.0.

Fintech 1.0 he defined as the emergence of peer-to-peer lenders and new payments companies between 2010 and 2014. During this time everyone was talking about disruptive change and unbundling the bank but, as Matarranz put it, it was actually a lot of small fish swimming around the large bank whales.

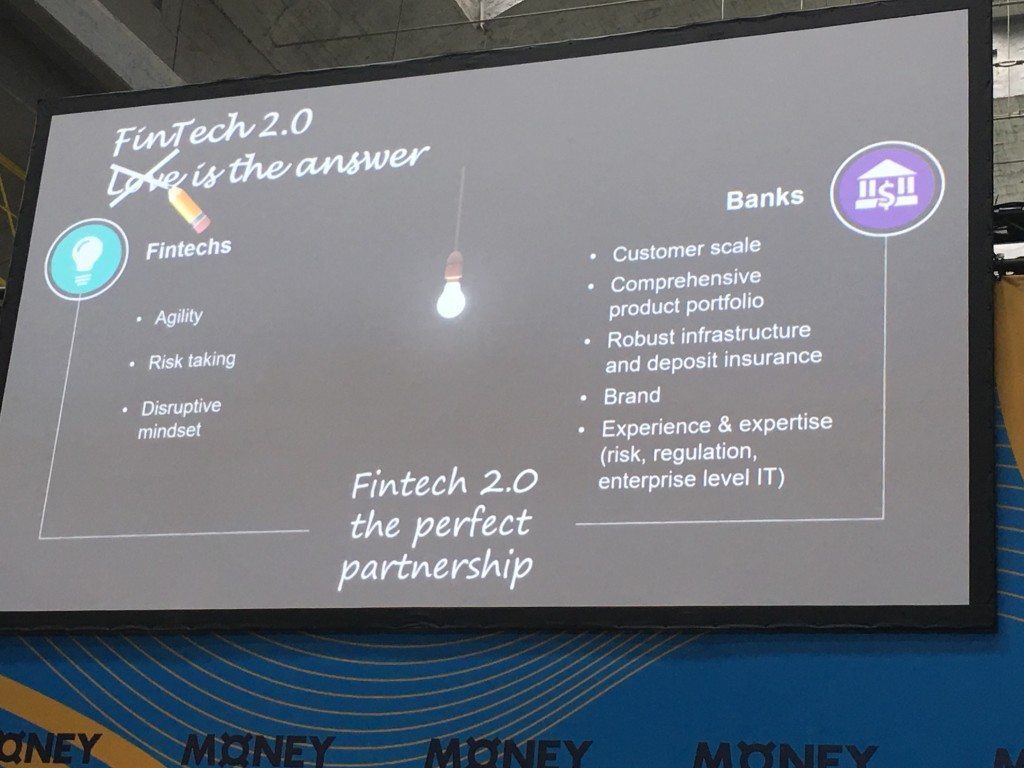

Fintech 2.0 has pushed this further in that, as the Fintech emerging players emerged, the banks began to work with them. During the 2014 period onwards, we saw Innovation Labs, Accelerators, Hackathons and more being run by many of the more dynamic banks – DBS, Barclays, BBVA, Citi spring to mind as the early leader here, but now most banks have something going on.

In this era, it’s all about collaboration and cooperation.

I agree to an extent, but feel there is a more fundamental underlying trend. That trend is the open sourcing of financial structures.

Historically, banks have been control freaks. They have developed everything internally, and have little trust of external firms, unless it’s for tertiary activities. Core systems are carefully maintained and controlled, and that control freak supervision of the core has been a traditional strength of the bank. Now it is the fundamental weakness. Banks have spent years building upon their core, which they control and trust because they built it.

However, as we entered the second decade of the 21st century, more and more technologies were attacking this core, proprietary structure. It is the open sourcing of that structure that has become the transitional new world and, by its nature, is creating the major weakness in the old structure.

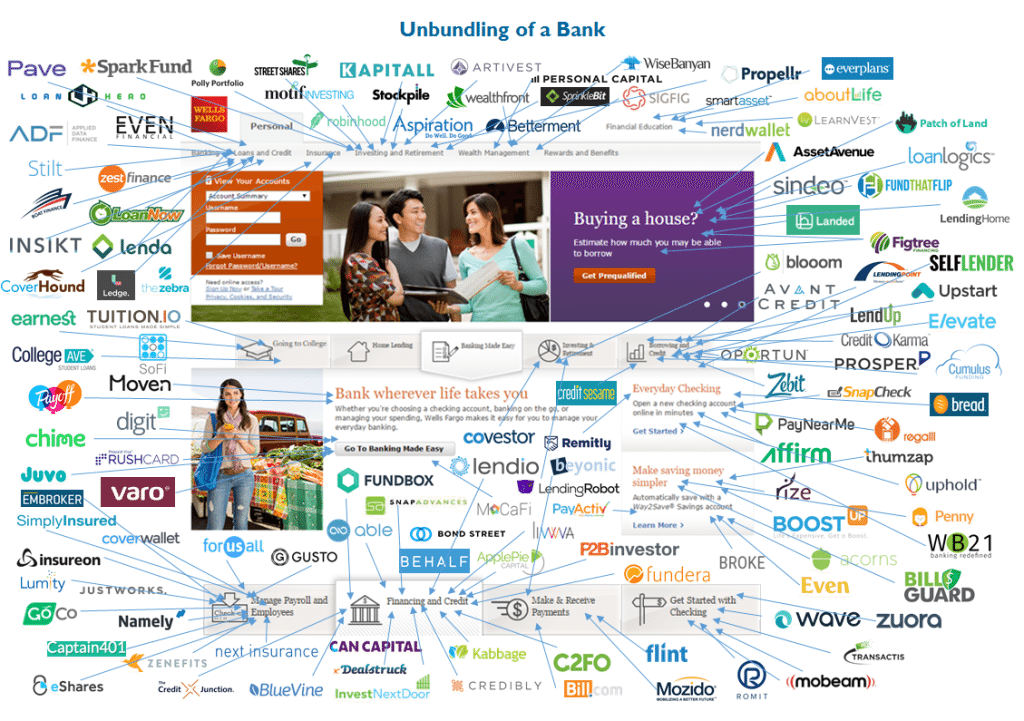

Apps, APIs, analytics, AI, machine learning, cloud, mobile, blockchain and more are all driving financial services to be plug-and-play as-a-service. We can see this when we look at the vast array of new players, with some already substantial players …

Image from CBInsights

In fact, what I’ve seen happening is the first wave of Fintech attacking areas that banks under-served or over-looked. SME funding, student finance, frictionless mobile payments and checkout. In the first wave, we talked about Fintech start-ups in three categories:

- Those who focused upon payment processing

- Those who were generating new lending models using peer-to-peer structures

- Those who were helping banks through PFM (Personal Financial Management) and Risk Modelling tools

In the last two years, this has shifted. The areas above are still in play, but we now have the rise of the robo-advisors, new forms of trading and investing, the rethinking of infrastructures through blockchain protocol, the acceptance of bitcoin as something more interesting than a rogue currency and more.

In the Fintech 2.0 wave, I believe we have moved from a few buzzing insects stinging the backside of the banks to a veritable storm of locusts attacking the underbelly of the banking beast.

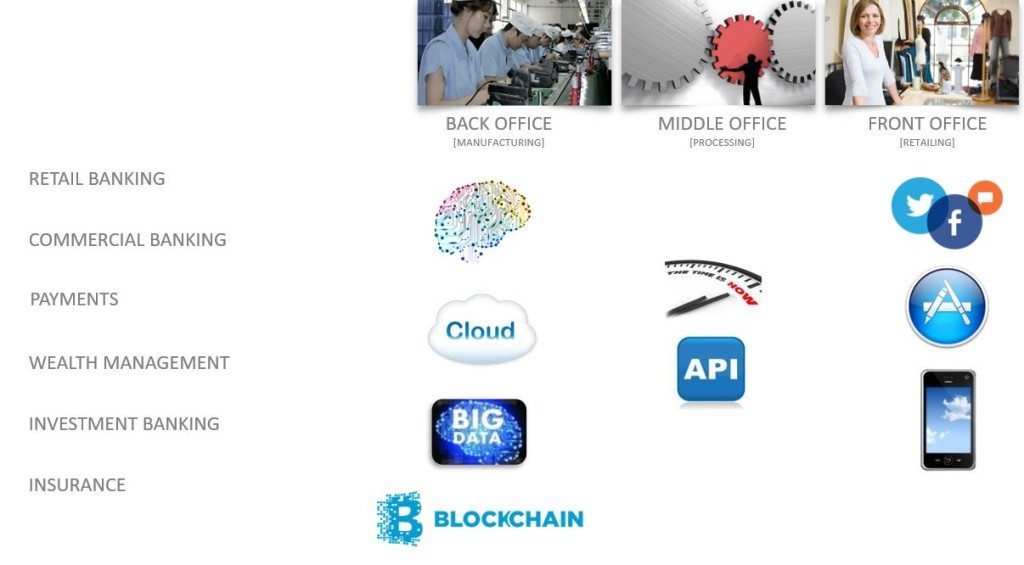

This is because Fintech 2.0 is actually deconstructing financial pieces into their base elements. Some are back office, some middle office, some front office, and each area is ripe for the plucking thanks to the technologies of today. Smart things with intelligence inside integrated via apps make the front office customer experience exceptional; API plug-and-play interfaces in the middle office make the connection between front and back office simple and real-time; and machine learning, artificial intelligence, deep data analytics, cloud structures alongside blockchain shared ledgers are reconstructing back office services.

This is the core fundamental shift in the Fintech world of 2016. It will continue to shift and change for the next decade, and a bank that is not at the centre of this storm, open sourcing their core services, will be wrecked.

The thing is that in this process, the bank has to have leadership who understand this structural shift from vertically integrated proprietary structures to open sourced collaborative structures. Do banks have that understanding? Clearly not when only 3% of the world’s largest banks are run by technologists whilst 77% have only one or no (43% of banks) technology experts in their leadership teams.

Meanwhile, when we get to Fintech 3.0, the bank that survive this change will look far more like collaborative financial integrators of the value chain with their proprietary core structures in ruins. The banks that don’t survive will be the ones that hang on for dear life trying to keep those structures in play long past their sell-by dates.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...