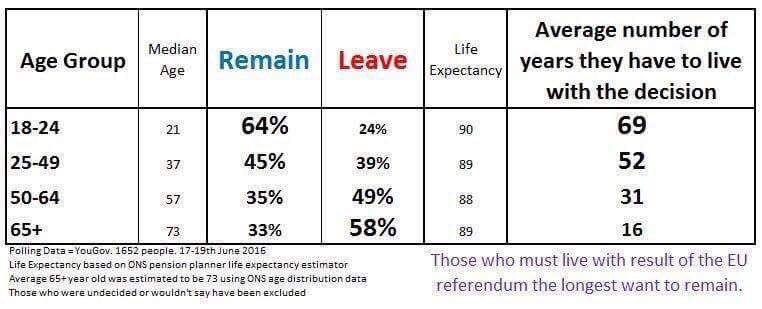

Well, like all of you, I wake up this morning to find that the UK has decided to tell Europe to fork off. You probably think I’m going to blog about what it all means and the implications for financial markets (I did that the other day and back in February). Apparently the vote is the fault of the Northerners and Welsh, which was called out to me by a City colleague over a month ago. His view was that the London market people may all listen to the economic pundits and forecasters, but the average chap on the Clapham Omnibus reads The Sun and Rupert Murdoch ran a very effective campaign to Leave. Thanks Rupert. A special thanks for giving the youth of Britain a legacy they do not want.

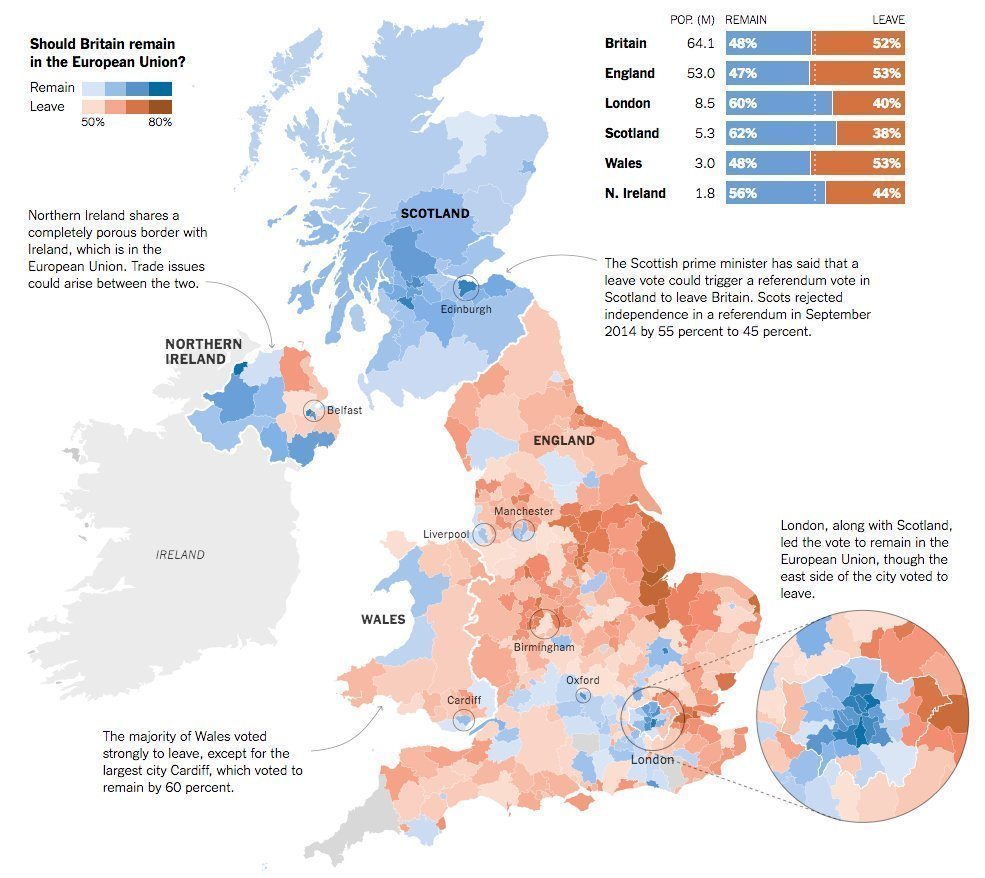

Following this vote, no one knows what will happen next (although the BBC have a go, as you'll see below). For example, it’s interesting to see that England and Wales voted Leave, whilst Scotland and Northern Ireland voted Remain. Is this the start of devolution of the United Kingdom?

How Britain Voted from the New York Times

No wonder David Cameron, our Prime Minister, is exiting following the Brexiting as his position is no longer tenable. Unfortunately, it means we will have never-ending coverage from the BBC, who will no doubt talk about this for months to come. Mind you, if you want to know what it all means, the BBC has a great analysis and summarise the exit process as follows.

What happens next?

Mr Cameron said in the event of a leave vote, he would activate Article 50 of the 2009 Lisbon Treaty without undue delay - setting in motion the process of withdrawing from the European Union. George Osborne has suggested this could happen within two weeks of a leave vote.

Once Article 50 is triggered, there is no way back into the EU unless by unanimous consent from all other member states.

But quitting the EU is not an automatic process - it has to be negotiated with the remaining members. These negotiations are meant to be completed within two years but the European Parliament has a veto over any new agreement formalising the relationship between the UK and the EU.

The idea would be to allow other EU leaders the time to realise they need a "friendly" trade deal with the UK to continue exporting their consumer goods into the British market without tariffs.

Also Britain could, technically, ignore all of this, the Vote Leave campaign says, and simply write the EU out of its laws, although that wouldn't make future negotiations any easier.

As only one part of one country has ever left the European Community - Greenland more than 30 years ago (read Carolyn Quinn's feature on how they left) - we will be in uncharted territory here.

So, depending on when the prime minister triggers Article 50, perhaps at some time in late summer, or early autumn 2016, negotiations will begin in Brussels on the terms of its exit and the nature of the UK's subsequent relationship with the EU.

This would involve not only rescinding the European Communities Act, which gives primacy to EU law in the UK, but also sifting through an estimated 80,000 pages of EU agreements, which have been enacted over the past five decades, to decide which will be repealed, amended or retained - a process which Parliament will want to oversee.

After two years, the UK would no longer be bound by existing EU Treaties unless both it and the other 27 states agree unanimously to extend the process of negotiations.

As the Article 50 two-year deadline approaches after the vote to leave, the prime minister of the day will be under pressure to sort out the terms of Britain's exit and a new trade deal with the EU before the country ceases to be a member.

It is possible, say Remain campaigners, that Britain's membership could cease and the UK revert to trading with the EU under World Trade Organization rules, which would involve exporters being hit by import taxes, or tariffs.

The deal would have to be agreed by a qualified majority on the council of ministers and be ratified by the member states. It would also have to be agreed by the European Parliament and MPs at Westminster.

Under this scenario British ministers would return to Brussels, at some point, to negotiate a more favourable trade deal, which Remain campaigners have warned could take years, maybe even decades, to fully complete.

The Leave campaign insists that a favourable trade deal could be done fairly rapidly because it would not be in the interests of France and Germany to lose access to the British market for its consumer goods.

They also reject the two-year timetable for exit, saying the government should aim to complete negotiations on a new EU-UK trade deal by 2020.

Bankers reactions

There’s a range of reactions so far that have hit the headlines including Lloyd Blankfein, Chairman and CEO of Goldman Sachs, who has stated that “we respect the decision of the British electorate and have been focused on planning for either referendum outcome for many months. Goldman Sachs has a long history of adapting to change, and we will work with relevant authorities as the terms of the exit become clear. Our primary focus, as always, remains serving our clients’ needs.”

Reuters reports that Barclays CEO Jes Staley said the outcome of the vote would not affect the bank's new strategy of being a 'transatlantic' bank anchored in the UK and US. “The strategy we announced on 1 March, 2016 was not conditional on the UK remaining in the EU”.

Douglas Flint, Chairman of HSBC said Friday marked “a new era for Britain and British business … the work to establish fresh terms of trade with our European and global partners will be complex and time consuming. We will be working tirelessly in the coming weeks and months to help our customers adjust to and prepare for the new environment.”

Meanwhile Mark Carney has reassured the markets by saying:

“There will be no initial change in the way our people can travel, in the way our goods can move or the way our services can be sold. And it will take some time for the United Kingdom to establish new relationships with Europe and the rest of the world. Some market and economic volatility can be expected as this process unfolds. But we are well prepared for this. The Treasury and the Bank of England have engaged in extensive contingency planning and the Chancellor and I have been in close contact, including through the night and this morning. The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward.”

What does it mean for London as a Fintech Hub (according to IB Times)?

Consensus among the technology community is that Brexit will topple London from its position as the most favoured fintech hub on the planet; the view of many startups and venture capitalists.

There are three main reasons for this - firms rely on rolling out products across Europe, many technology companies rely on developers from all over the EU, and the concomitant fear and uncertainly which will curb investment pouring into the capital’s tech scene.

We are dealing in unknowns right now, but certain legal and regulatory strictures could be mentioned, such as EU laws around data protection which firms were formerly bound by, or the European Commission’s attempt to establish a “Digital Single Market”. Adjustments to the regimes around doing business are expected to take a couple of years to iron out and the words “keep calm and carry on” now seem to be the order of the day.

There are around 500 fintech companies in the UK, averaging £25m revenue and a profit of £5m; paying 20% tax this equates to about £5bn over the next ten years. Players in the fintech arena predict the most likely winners would be cities like Amsterdam and Dublin which already boast a progressive regulatory environment, tax advantages and growing technology clusters.

Simon Black, CEO, of digital payment platform PPRO Group, said: “Dublin would probably benefit most within Europe: It has a big tech scene, taxes are particularly low with a 12% corporate rate and major FinTech companies such as MasterCard, Apple, PayPal and First Data already have significant operations there providing critical mass.

Black said in an emailed statement that fintech firms “will see their status as financial institutions recognised across the EU and EEA under threat, all of these businesses will not wait for trade deals to be resolved. They will immediately begin forming plans to relocate at least some of their operations, and the majority of new jobs will be outside of the UK”.

Ah well, there you have it. The British have given up their membership of the European Club.

#Brexit pic.twitter.com/S8xSP1JeMB

— Bored Elon Musk (@BoredElonMusk) June 24, 2016

Finally, in a NSFW moment, here is the Brexit song:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...