Not sure how many of you spotted the announcement last month that Goldman Sachs is launching a retail bank, but it’s been interesting to monitor such developments.

First there was a raft of press reviews of the announcement:

- Goldman Sachs gets into retail banking

- Goldman Sachs Enters Retail Banking Market with GS Bank

- Here's How Goldman Sachs Plans to Go After the Global Not-So-Rich

- Goldman Sachs Group Inc Plans to Tap “Mass Affluent” Segment

- Goldman Sachs launches GS Bank, an Internet bank with a $1 ...

- Online banks are booming, and Goldman Sachs has joined the party

- Goldman Sachs Group Inc Enters Retail Banking Amid Troubled ...

In case you missed the announcement, it started with the announcement in April that Goldman Sachs had completed the acquisition of GE Capital Bank:

Today, April 18, 2016, Goldman Sachs announced that Goldman Sachs Bank USA (“GS Bank”) has acquired the online deposit platform of GE Capital Bank (“GECB”), and assumed approximately $16 billion of deposits. Our new customers and those who would like to learn more about us are welcome to visit www.gsbank.com to get an in-depth look at our deposit offering.

TechCrunch probably gives the best overview of the bank launch:

Goldman Sachs has traditionally functioned like a run-of-the-mill investment bank. Minimums to open an account were in the range of $10 million, and returns were not guaranteed. While that will still remain true for the firm’s wealth management arm, Goldman is opening its doors to the masses with the launch of GS Bank, an FDIC-insured, Internet-based savings bank. And just what do we mean by the masses? Well, anyone with an Internet connection and a dollar — because that is what each account’s minimum balance will be.

GS Bank’s interest rates will be high, giving customers an annual yield of 1.05 percent. This rate trumps the average U.S. saving’s bank yield of .06 percent APY, but is relatively in line with other online rival banks like Ally, which offers 1 percent APY. Deposit yields from online banks are traditionally much higher than traditional banks, mainly because of the cost savings that come from not having to support brick-and-mortar branches.

The bank was born out of Goldman’s acquisition of GE Capital Bank, the online retail bank previously run by General Electric’s capital arm. The launch of GS Bank and acquisition of GE Capital Bank is a move by Goldman to diversify revenue streams and strengthen liquidity in a market where traditional investment banking isn’t doing as well as it has in the past. Currently, GS Bank has total deposits of around $114 billion, which pales in comparison to the total deposits of large consumer banks like Wells Fargo and Bank of America.

It's not just Goldmans opening an online retail bank either. There are lots of the media speculating about the motivation behind such a move:

- Why Goldman Sachs Is Launching an Online Bank

- Why Goldman Sachs suddenly wants to work for average people

- Why Goldman Sachs suddenly wants to serve the mass market

My favourite is from Quartz:

[Goldman Sachs] recent acquisitions include an Austin, Texas-based startup called Honest Dollar, which helps freelancers and small-business owners set up retirement accounts. Its new GS Bank, based on an online banking platform acquired last year from GE Capital, invites anyone to park their money in an FDIC-insured online savings account or certificate of deposit (CD), with no minimum balance requirement and no transaction fees. And now Goldman is building an online consumer lending business meant to compete with the likes of Lending Club and Prosper.

Goldman’s ability to dabble in businesses more typical of a corner bank branch than a Wall Street powerhouse dates back to a 2008 change in regulatory classification—one that gave the firm permission to enter the same businesses as plain-vanilla commercial banks. But this doesn’t explain why Goldman is just getting interested in the opportunity now. The reason for that is technology, which has come a long way since Goldman, along with its rival Morgan Stanley, got emergency approval eight years ago to become a bank holding company.

That change in designation put two of the last big, independent investment banks under the official purview of the Federal Reserve. The move was meant to make the firms eligible for the same backstops available to commercial banks, and to inspire confidence in a market still absorbing the initial shock of a cascading financial crisis. But it also meant that for the first time, these firms could build their own retail bank branches.

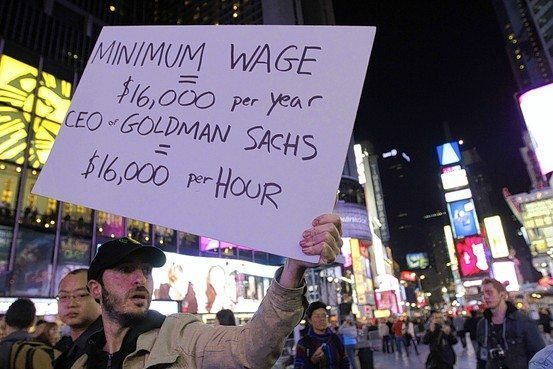

Which raises some questions, such as what does the Goldman Sachs brand mean to the average American and will they recognise that GS Bank is Goldman Sachs?

A second question is whether they will purely remain an online bank only, or will we see Main Street America with GS Bank branches spread around the USA? Certainly ING Direct did that in the USA, as did Che Banca in Italy and one Forbes commentator (Jonathan Salem Baskin sees Goldman Sachs as copying Che Banca’s story:

The precedent for Goldman Sachs’ recent move into retail banking (GS Bank) was set in 2008 by Alberto Nagel, CEO of Italy’s Mediobanca, who not only created the digital retail business model for investment banks, but did so in a far more challenging market … instead of launching the bank only online, it started with reimagining new branches as stores where bankers could educate customers on using technology, as well as interact with them more informally. It purposefully didn’t recruit bankers for its staff, but instead drew from high street retailers, and people from fashion, electronics, and other industries known for customer service … another strategy was to position those retail experiences as more advisory than transactional, to make it easier to migrate customers to its digital channels.

Will GS Bank follow the same route? I think probably, as an online only bank has a restriction in trust, and Che Banca clearly believe that their branches are there as a marketing program to exhibit their brand identity and gain increased trust. Where Che Banca has a branch, they gain over two-and-a-half times the number of assets compared to where they don’t.

In any case, the real reason Goldman Sachs is doing this is revenues. The Wall Street Journal nails it:

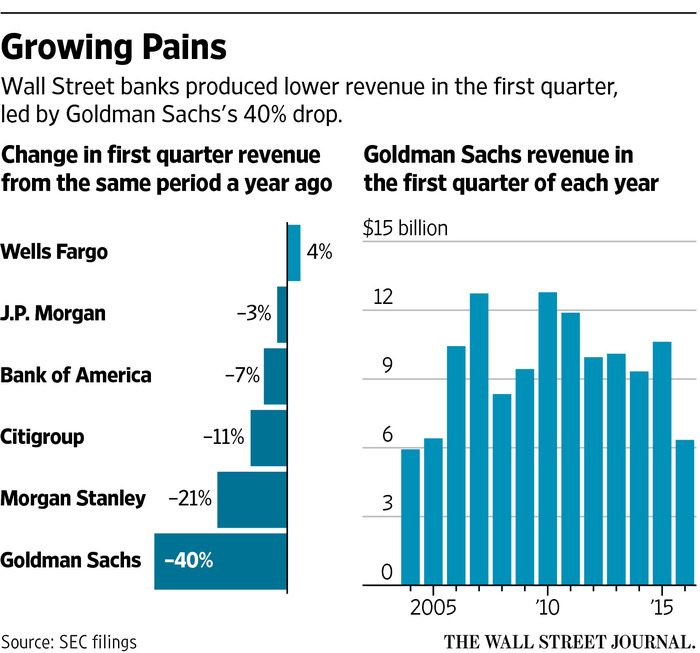

Trading in fixed-income, currencies and commodities has carried Goldman’s results many times over the past two decades. But last quarter, revenue in that business fell by nearly half, bringing overall trading revenue down 37%, the steepest drop of the five banks with large Wall Street trading desks.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...