Talking with the leader of a large bank the other day proved illuminating. He said to me that he could see the digital revolution happening, and wants to embrace it. All well and good. He continued then to say something that I hear quite often: “but what do we do about the people”.

Just as robots will displace human traders, so will digital replace branch staff. Most banks are rationalising their branch networks and making closures in developed markets (it’s different in countries where regulations stop closures or where development of the banking system is younger and needs more branches for accessibility). Half of all U.S. bank branches could disappear in the next ten years, according to Keefe, Bruyette & Woods, a financial services research firm. That would be stark, as data from the Federal Deposit Insurance Corporation (FDIC) shows the total US branch-count only falling slightly in the last few years from a peak of 99,550 in 2009 to 94,725 as of June 2014.

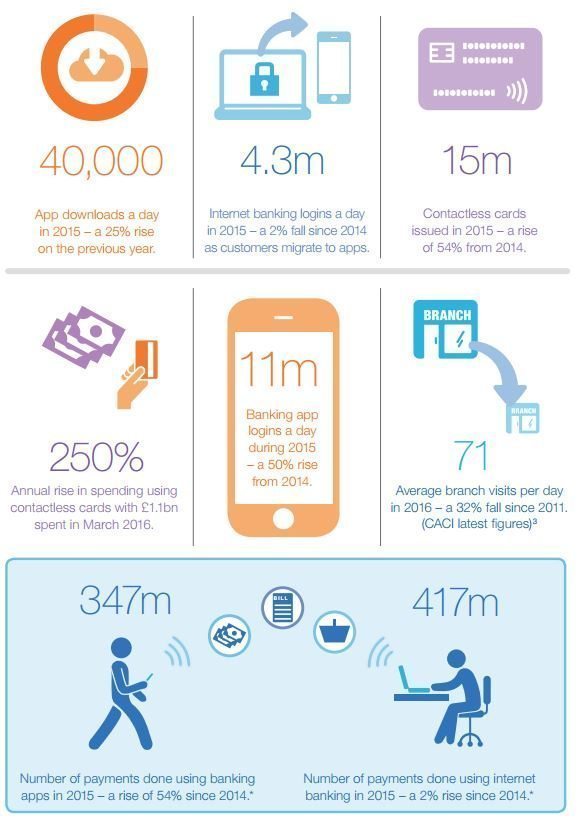

However, as customers move to mobile and remote access, this will fall. The British Bankers’ Association (BBA) released their annual The Way We Bank Now report last week, and this shows that smartphone-addicted Britons are making payments via mobile apps increasing by 54% in 2015, checking their finances on their phone more than once a day and the average branch dealing with just 71 customers a day, a 32% decline since 2011.

This is why UK banks have closed 600 branches in the last year - around 7.5 percent of the total network – and many in the poorest areas. Recent research found more than 90 percent of the branch closures were in areas where incomes are below average. In fact, around a third of the UK branch network has been shut down in the last ten years and this has led to a starvation of investment in small businesses. Campaign group Move Your Money estimated lending to small local businesses was down 63 percent in towns and villages that had lost a bank branch.

Obviously, there are some new trends – such as the growth of Funding Circle and launch of new banks like Shawbrook, Aldermore, Atom and more – but these do not counter the overall move towards slimmer, lower cost remote banking via digital platforms replacing human ones.

So, going back to the displacement of people by digital platforms, what do we do about that?

Many of these people are transaction administrators, who are no longer required. However, some of them are good with customers and people who are good with customers can be good with customers either physically and/or digitally. So some banks will follow the example of mBank in Poland and move staff from branch to Skype servicing. Others might follow the example of ICICI Bank in India, who moved staff from branch to Facebook servicing.

Generally, I think the trend will be that whatever the number of branches were in a developed economy in 2005 will be reduced by anything between 50 and 80 percent by 2025, dependent upon the economy and its outlook towards employment. For example, in Denmark and Iceland the numbers are already nearing the high end of these percentages, because people get a soft landing when they exit a firm. In Germany, France and Spain, those percentages are far less.

However, the view of my bank head friend is that his bank must look after those people who are asked to leave. That is the only way he could see the bank gaining their support for a digital program. If people were forced to leave the bank with no support, he believed they would block the digital program and make it fail. After all, you are getting the turkeys to vote for Christmas.

It was an interesting conversation and I know that most American banks will just shut branches and let the staff leave with a fortnight’s notice and little to live on. That’s the way US firms generally work. UK banks might shut branches and give staff a few months’ pay dependent upon length of service. That’s the way UK and European law works. My bank head friend wants to shut branches and offer staff who have been with the bank for over ten years, and are aged over 45, to be given a pension for life. That’s the way humane (and rich) banks work. Oh, and the bank just happens to be Asian.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...