The Bright Future

The year is 2030. Europe grows from strength to strength, after the harmonisation agreements between the German Finance Minister, the European Central Bank and the European Parliament for the clearance for Quantitative Easing and bailout funds for Italy in 2018. This was a turning point in the Union as the clear support of countries in trouble – Greece, Italy, Spain and Portugal in particular – gave a signal for closer political and monetary union. The creation of a strong Europe was further enhanced when Turkey joined the Union in 2024. Some saw this as a troubling issue – the British in particular – but the creation of a Union that spanned East and West was more of a concern for Russia, where the economy had moved from weak to worse. When the Russian President Vladimir Putin – yes, he’s still there! – announced a war on Turkey after the end of the ISIS regime in Syria, the NATO agreement to protect Turkey from Russian aggression was the bridge needed to bring Turkey into the fold. Meanwhile, as the Euro has become one of the key currencies embraced by the bancor, the global internet cryptocurrency, as one of the preferred currencies of choice in their digital basket, along with the dollar and the yuan. Some wondered why the British pound and Japanese yen were not included, but hey, we all know what happened to those countries don’t we?

The Ugly Future

The year is 2030. Europe was a popular idea. It is no more. Germany’s agreement to work closely with Austria, Hungary, Poland, Slovakia and the Czech Republic as part of the deal to create the New Germanic Region (NGR) was the culmination of the discussions at the end of the European Union ideal in 2024. That fragmentation of structures was caused by the disagreement between France and Germany over the bailout of Italy in 2021. Discussions were long but actions were short, and the whole agreement of structure fell into disarray. Many blame this on the original issues in the Union created by Britain’s vote to Leave in 2016, but the British always point to the issues beginning before that as the Sovereign Debit Crisis hit in the early 2010s. That’s possible, but the Europeans have always held it against the Brits for the breakup of the Union.

The Reality

OK, just giving you two quick ideas of a European future that might or might not happen Who knows? Anything can happen in the future. As someone who tracks the future based upon the forces of change – Political, Economic, Social and Technological (PEST) being the primary ones – I know that the future is unpredictable. Anything involving politics is particular unpredictable, as we’ve seen recently in Britain and the vote to Leave. However, one thing that is predictable is the change in fortunes economically between the US and China, and Europe’s ailing economies. For example, as soon as Brexit was confirmed, our politicians have run off to Beijing and New York to drum up business. But again, who are we betting on for the economic future? America, China or India, Indonesia and Indochina or Africa and specifically Nigeria? Again, no one knows. Just a few years ago the Economist Intelligence Unit came up with a new acronym to replace the BRICs (Brazil, Russia, India and China) called the CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa). That was before the Arab Spring, the Syrian War and the rumbling of President Zuma.

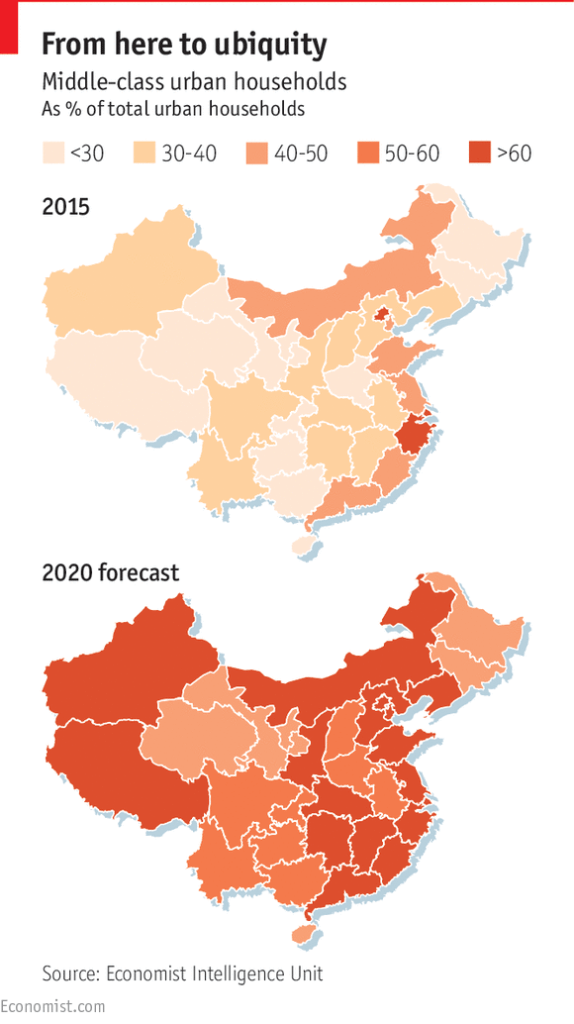

Economists don’t really know much, as much of what they do is guesswork. Informed guesswork admittedly, but it’s still guesswork. What is more enlightening is things we can see happening in societies and technologies, as these things are often more predictable. For example, this week’s Economist has a fascinating study about the new middle class in China.

Before the late 1990s China barely had a middle class. In 2000, 5 million households made between $11,500 and $43,000 a year in current dollars; today 225 million do. By 2020 the ranks of the Chinese middle class may well outnumber Europeans.

Add into this a large sprinkling of Indian middle class and the world axis is changing. According to Ernst & Young around one billion people in China could be middle class by 2030, as much as 70% of its projected population. India’s global middle class at around 50 million people, or 5% of the population, is expected to reach 200 million by 2020 and 475 million by 2030. In other words, this means that India will be adding more people than the Chinese to the global middle class worldwide after 2027.

So here’s a real and likely future scenario.

By 2030, Europe becomes a UNESCO Museum for Chinese, Indian and American tourists to visit.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...