In 2009, I coined the word BaaS. No, nothing to do with sheep! Instead, BaaS stands for Banking-as-a-Service. In 2016, everyone is talking about this:

- Banking as a Platform (BaaP), The Financial Brand, March 2016

- Banking-as-a-Service: Common play of banks and fintech, FinTech Rankings, March 2016

- 'Banking as a Service' for Fintechs Seeking Scale, American Banker, March 2016

- The Platformification of Banking, The Financial Brand, July 2016

I’m not saying I was ahead of my time, but seven years is a long time in the life of a dog.

Anywho, the reason for blogging about this today is that my friends in Singapore, Vladislav Solodkiy and Igor Pesin who run the FinTech VC firm Life.SREDA, have just released a new report called … you guessed it … Bank-as-a-Service. They kindly reference where the idea came from and point to banks opportunities to grow business by releasing more of their capabilities as APIs, as software, as apps, as widgets … as anything that can plug-and-play into anything else.

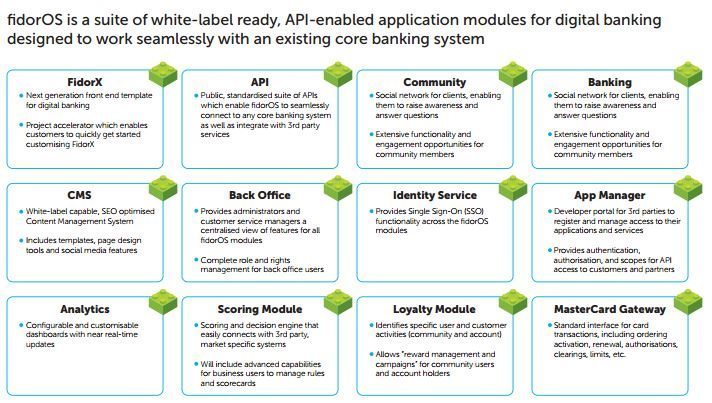

Part of this is that it’s not just banks’ products, processes and designs that should plug-and-play, but we should be able to plug-and-play any other services into the BaaS model, such as Stripe, PayPal, Fidor, Moven or any other APIs, apps and analytics we want.

The Life.SREDA report mainly focuses upon financial APIs and their usage. For example, they cite the fact that, in December 2015, LetsTalkPayments.com counted 63 insanely useful APIs from fintech-startups across 12 segments «to supercharge your product.

They also note that Gartner predicted in 2013 that, by now, 75% of the top 50 banks in the world will open their API and 25% of these banks will have their app stores for customers. They haven’t by the way, as I’d estimate it as more like 25% of the top 50 banks have opened their APIs, but what do I know?

Having said that, there are some great examples of firms that have opened themselves to the world. One of the best examples is Bancorp. Bancorp has over 75 million prepaid cards in circulation in the US and over 100 private-label non-bank partners, including Simple. This has given them a combined annual processing volume of $232 billion. As a result, the bank has grown from its “roots as a branchless commercial bank to become a true financial services leader, offering private-label banking and technology solutions to non-bank companies ranging from entrepreneurial start-ups to those on the Fortune 500.”

The Life.SREDA report also points to Fidor, who are the power behind the telco Telefonica, and their O2 banking service in Germany. A bank that pays interest in mobile data.

There’s a range of other examples from Wirecard (the bank licence behind Holvi and Loot Bank) to SolarisBank. Notably, that’s three German banks leading the market. I would also point to PayPal and PrivatBank as notable other examples.

Anyways, you can read Life.SREDA’s report at their newly launched website Bank-as-a-Service.com.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...