According to latest stats, China’s FinTech markets are booming in 2016. Over $10 billion went into FinTech firms in China in the first half of 2016, although half of that was Ant Financial followed closely by Lu and JD Finance.

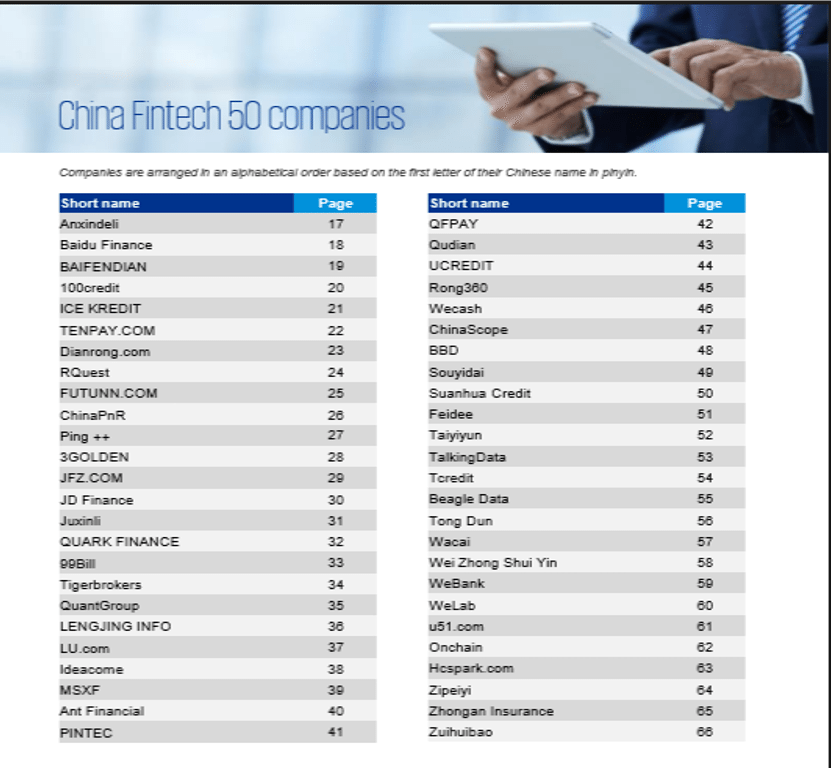

China’s Fintech 50 by KPMG (download the full report here)

What intrigues is that this is a market that is newborn. Unlike the USA and much of Europe, China’s explosion of riches over the past three decades stems back to open trade agreements and radical restructuring of State-Owned Enterprises (SOEs) into private company operations. Some fear this has led to bad practices, as it is only twenty years since the Asian Financial Crisis, caused by poor risk management and bad loans.

My first visit to China was just after that crisis, and the talk was all about how to convert the banking system into something customer-focused as, until then, it was just an administration service for the People’s Government of China. That has changed, and the change has been fast (something I wrote about ten years ago and again last year.

Now the issue is starting to hit hard, as China’s shadow banking system has been a major concern for a while now. Shadow banking provides financing and leveraged debt outside the regulated banking markets, and has been growing for a while now as China’s growth slows.

According to Bloomberg, China’s shadow lending has evolved to dodge a regulatory clampdown by using brokers and funds to take on the role previously played by more heavily regulated trusts in expanding informal financing.

On top of this, banks are increasingly turning to these so-called directional asset-management plans issued by brokerages and the subsidiaries of mutual-fund providers to channel lending. The amount of money placed in such products jumped 70% last year to 18.8 trillion yuan ($2.9 trillion), outpacing the 17% growth for trust assets ... Commerzbank AG estimates shadow bank financing, hidden from view on balance sheets, may cause banks losses of as much as 1 trillion yuan ($155 billion) over five years. Shadow lending assets swelled to 45 trillion yuan ($6.9 trillion) as of June 30, equal to about two-thirds of the economy, from 19.2 trillion yuan ($2.95 trillion) in 2011, Moody’s Investors Service estimates.

Yep, it’s an issue.

And whilst we have seen reliable peer-to-peer lending emerging in the UK under the careful diligence of firms like Zopa and Ratesetter, China has seen a Wild West – or is that Erratic East? – of lending start-ups. According to the Cambridge Centre for Alternative Finance, online lending in China registered peer-to-peer consumer lending at $52.44 billion during 2015; whilst peer to business lending reached $39.63 billion. These incredible numbers are indicative of the shortfall of traditional banking firms’ ability to provide access to credit to both consumers and small business. But it’s also now a big issue, as China’s economy has been slowing down and growth has been propped up through debt, which is thought to be worth 225% of GDP according to, amongst others, the International Monetary Fund.

The South China Post reported over the weekend that over one-third of the country’s peer-to-peer lenders were problematic. By the end of 2015, nearly 2,600 P2P platforms were operating on the mainland – an increase of 65 per cent compared with 2014 – and yet the annual review of these services (the Blue Book of Internet Finance) found that 1,263 of the P2P platforms were problematic, which included cases of fraud or firms going out of business. Many of these P2P platforms are involved in fraudulent tricks that took advantage of loopholes in regulations. For example, one typical case of fraud is where a P2P platform, in this case Rong Zuan Dai, went online in November 2015 and published 37 financing projects that promised high interest rates to hundreds of investors. Two weeks later, the website suddenly closed.

The highest-profile case so far involves the P2P platform Ezubao, which was allegedly running a Ponzi scheme and faked 95% of its online loans. The scheme split long-term financing schemes into several short-term projects, and used the lending from new investors to pay back original lenders. The whole thing collapsed earlier this year, but not without impact. Up to December 2015, Ezubao had collected more than 74 billion yuan ($11 billion) from more than 900,000 lenders across the country.

Another big failure is Jinxing Investments whose owners, the Shanghai Uprosper Asset Management Co, disappeared with assets worth over 400 million yuan ($62 million) uncashable. This resulted in the Shanghai office of auditing firm Ernst & Young being surrounded by 100s of angry investors last Thursday, as the peer-to-peer company had claimed that the risk management of their investment products were run by Ernst & Young. They weren’t.

Other cases of fraud saw company bosses launching P2P platforms to fund their own businesses because they found it was quicker and saved on costs. In one example, in January 2015, Gao Qin, founder of a real estate company in Jinan, was investigated over claims she illegally attracted public investment totaling more than 1 billion yuan ($155 million) through two P2P platforms she had set up to fund her real estate business.

In August this year, China’s banking regulator introduced rules that imposed a cap on P2P loans, under which an individual can borrow only up to 200,000 yuan ($30,000) from any one P2P platform, with total loans limited to 1 million yuan ($155,000). More background if needed:

P2P maintains its appeal as China redraws financial system

China’s HK$59 billion online Ponzi scheme: who started it, how did it happen and now what?

Nationwide crackdown takes its toll on China’s P2P and internet finance industry

China imposes cap on peer-to-peer loans to rein in runaway ‘shadow banking’ scams

All this is taking place whist the poster child of Chinese lending, Lufax, prepares its IPO. At its last fund raising round in January, the firm was valued at $18 billion and Thomson Reuters are estimating the firm will raise around $5 billion from the IPO. Now ok, Lufax is different to the examples above as it is backed by a reputable insurance group Ping An, China’s second largest insurance firm, who are trying to distance itself from the market as a whole. The president of Ping An Insurance, China’s second-largest insurer, told the Financial Times that most P2P lenders were “fakes” and that the vast majority of China’s P2P lenders would not be able to continue their business in the future. The president of Ant Financial Services has also tried to distance the company from China’s broader P2P lending market. China’s self-styled “Warren Buffett” and billionaire businessman Guo Guangchang called the country’s Rmb440bn ($65.9bn) peer-to-peer lending market “basically a scam”.

Hmmmm … not the best way to create a trusted system.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...