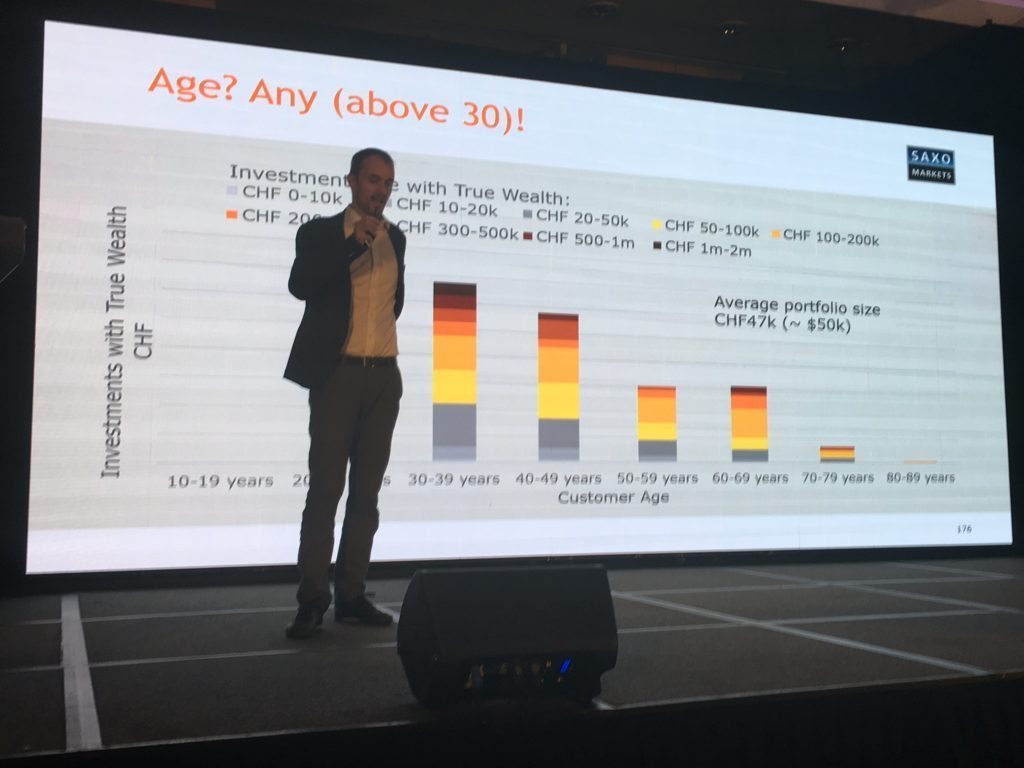

I got into a conference this week (for a change) where the presenter of a roboadvising wealth manager got into a bit of a Q&A scuffle with an audience member. Felix Niederer, founder and CEO of Zurich-based start-up True Wealth showed the stats for their customers.

Most of them are over 30, and the real $’s are in the over 40’s age bracket. Felix said this is because wealth is something you accumulate over time. You don’t tend to be that wealthy when you’re 18-35 years of age, as you have other priorities.

The audience member said that maybe it was that their site was designed to attract older clients, and if they designed it differently they would get younger ones. Felix countered that the average age of a customer of a Swiss private bank is sixty-seven.

Whoa.

I often hark back to conversations I’ve had with folks like Mark Mullen (CEO and founder of Atom Bank) and Matthias Kroener (CEO and founder of Fidor Bank), who both assert that their customers are not millennials, but Gen X and above. This is because these demographics are not only comfortable with money – they’ve had a salary, bank account and mortgage for some time in most cases; but they also have money – they’re no longer yearning, but earning.

This is a critical point that I think is forgotten by many folks who believe face-to-face interaction, advice in branch and an ability to talk about money is unimportant. It’s just all done in an app, they say. I agree it’s all done in an app for those who have experience of money but, for those just embarking on that journey who have no idea what a loan even looks like, it’s a totally different story.

I’m reminded of this when I received and email yesterday of light-hearted research here in the UK by the Nationwide Building Society. The research was conducted in August 2016, and involved interviews of 500 undergraduates and 614 parents of children who are about to go, currently at or recently graduated from university. Almost seven in ten (69%) said they were taught insufficiently about finance and were ill prepared for student life, with nearly a third (30%) saying they taught themselves everything they know about how to manage money. Students polled also admitted that the lack of knowledge around budgeting didn’t stop them being frivolous with their student loan. 29 per cent said that they spend it all within a few months of receiving it, and just over one in ten (11%) confessed to spending it in the first month.

The student loan that is meant to be for rent, food, study and fees, instead is spent on:

- Nights out (67%)

- Nice clothes (66%)

- Holidays (30%)

- A car (8%)

This doesn’t surprise me – I was a student once – but I remember that my trust was in mum and dad to be the lender of last resort if I got into trouble. According to Legal & General, the Bank of Mum & Dad lends £5 billion a year in the UK alone and if the Bank of Mum & Dad runs dry, then maybe it's time to ask someone else's mum and dad to help you out.

So when I hear all these pontificators saying that kids and folks in their 20s don’t need advice, support or education with money – which is what banks should give (if they were ethical) – then I think this video from the Nationwide study puts it all in context (do watch this, it's very funny):

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...