We had a meeting of the Financial Services Club in Oslo last night, talking about the Payment Services Directive 2 (PSD2) and Open APIs (Application Program Interfaces). It was a fun meeting and covered the in’s and out’s of closed versus open APIs, the implications of allowing Trusted Third Parties (TTPs) access to the bank’s data, adapting core systems for open market access and more. One specific part of the agenda however looked at the challenge of offering an Open API. That doesn’t sound too difficult, does it, but is has huge threat and opportunity. The opportunity is obvious: by opening doors to all-comers, the bank can drive volume of transactions and become more relevant. The threat is less obvious: by opening the doors to all-comers, the bank could collapse.

The latter part was discussed in depth by Tim Richards of Consult Hyperion.

Tim likened the development to the birth and growth of the railroads. The railroads started in the 1800s following the birth of the Rocket steam engine, and was a hurly-burly wild development of big ticket investors. Like the internet boom, railway firms garnered big ticket investments because they were seen as the future of the world, and they were. However, they were also a mess. Lots of local lines emerged, covering trips of 15 minutes to 30 minutes. These lines all had different specifications and the railway carriages were disgusting by modern standards. Often there were no toilets, no refreshments and even no seats. This was fine for short journeys but, over the years, the lines started to connect. As they connected, journeys got longer and longer and customers were unhappy with their little seatless carriages, so everything started to be upgraded.

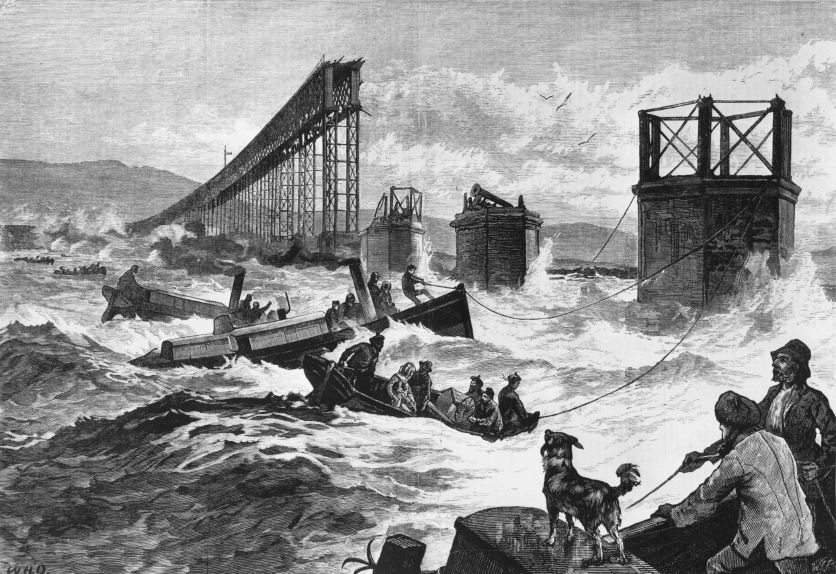

But then there was a major issue: the tracks. The tracks were all different sizes, and it cost a fortune to build trains to cover distance over tracks of different widths. This led eventually to an act of Parliament in 1846, which decreed that the width of lines would be standardised to 4 feet 8 ½ inches and effectively ended Isambard Kingdom Brunel’s broad gauge lines. Through standardisation, the train network in the UK expanded and thrived. By allowing longer journeys on standardised lines, the trains could get longer and larger and this is the key point of Tim’s discussion. The trains got bigger, but the tracks weren’t built for such large and heavy trains and so they broke down. This culminated in one of the worst disasters of the Victorian era, when the Tay Bridge collapsed in Scotland taking the train down into the sea and the loss of 75 lives.

Tim likened this to the core systems of banks with APIs. By opening banks core systems to all and sundry traffic volume may increase but, if the banks systems aren’t built for such volumes, then they will collapse. Maybe.

I certainly took as my walk away the fact that we are still in the early era of the internet of value. Some of us may believe that this technology revolution is done, but when you look at battery life of a smartphone (ed: not mentioned Samsung here, oh shoot, I just did) or the reliability of your laptop, then we still have a long way to go. Specifically, and again as Tim pointed out, we have a lot of heavy lifting on the financial lines. In the old era of transport, lots of people would unload trains and ships when they arrived at the stations, because everything being transported was non-standard. In the new era, the unloading and loading of trains and ships has been standardised thanks to the container box (read more on this in the great book the Box, which is recommended reading for everyone interested in how standards build markets).

By standardising the movement of goods into a container that had the same dimensions globally, ships could transport goods globally and be loaded and unloaded quickly and easily by automated systems. Before, humans had to do all the dockside work of loading and unloading.

Tim’s claim is that the financial network of today is like the old transport network before the standardisation of tracks and containers. There are lots of processes involved in packing messages to send overseas. There are then lots of processes involved in unpacking those messages at the other end. This is what SWIFT does, and is why KYC and AML is such an overhead. There are no standards in ensuring the people sending and receiving are verified, and so we all do the same work over and over again.

By building APIs and creating standards through shared databases (distributed ledgers), we just might find a solution to all that heavy lifting in the financial system. However, that will entail new core systems that can support the increase in transaction volumes and more.

I’ll talk about that later but it’s a valid point.

Meantime, for those train buffs out there, you can read more about the mess before standards in this update from Wikipedia, and even relive those times by watching the ITV series Jericho.

From Wikipedia:

Although the Government was in favour of the development of trunk railways to stimulate economic recovery and to facilitate the movement of troops in times of potential civil unrest, it was legally necessary that each line be authorised by a separate Act of Parliament. While there were entrepreneurs with the vision of an intercity network of lines, such as those through the East Midlands, it was much easier to find investors to back shorter stretches that were clearly defined in purpose, where rapid returns on investment could be predicted.

The boom years were 1836 and 1845–47, when Parliament authorized 8,000 miles of lines at a projected cost of £200 million, which was about the same value as the country’s annual Gross Domestic Product (GDP) at that time. A new railway needed a charter, which typically cost over £200,000 (about $1 million) to obtain from Parliament, but opposition could effectively prevent its construction. The canal companies, unable or unwilling to upgrade their facilities to compete with railways, used political power to try to stop them. The railways responded by purchasing about a fourth of the canal system, in part to get the right of way, and in part to buy off critics. Once a charter was obtained, there was little government regulation, as laissez faire and private ownership had become accepted practices. The railways largely had exclusive territory, but given the compact size of Britain, this meant that two or more competing lines could connect major cities.

George Hudson (1800–71) became the most important railway promoter of his time. Called the "railway king" of Britain, Hudson amalgamated numerous short lines and set up a "Clearing House" in 1842 which rationalized the service by providing uniform paperwork and standardized methods for transferring passengers and freight between lines, and loaning out freight cars. He could design complex company and line amalgamations and his activities helped to bring about the beginnings of a more modern railway network. In 1849 he exercised effective control over nearly 30% of the rail track then operating in Britain, most of it owned by four railway groups, the Eastern Counties Railway, the Midland, the York, Newcastle and Berwick, and the York and North Midland, before a series of scandalous revelations forced him out of office. The economic, railway, and accounting literatures have treated Hudson as an important figure in railway history, although concentrating largely on the financial reporting malpractices of the Eastern Counties Railway, while Hudson was its chairman, which were incorporated into the influential Monteagle Committee Report of 1849. He did away with accountants and manipulated funds—paying large dividends out of capital because profits were quite low, but no one knew that until his system collapsed.

All the railways were promoted by commercial interests; as those opened by the year 1836 were paying good dividends it prompted financiers to invest money in them, and by 1845 over one thousand projected schemes had been put forward. This led to a speculative frenzy, following a common pattern: as the price of railway shares increased, more and more money was poured in by speculators, until the inevitable collapse in price. It reached its zenith in 1846, when no fewer than 272 Acts of Parliament setting up new railway companies were passed. Unlike most stock market bubbles, there was a net tangible result from all the investment in the form of a vast expansion of the British railway system, though perhaps at an inflated cost. When the government stepped in and announced closure for depositing schemes, the period of "Railway Mania", as it was called, was brought to an end.

The commercial interests mentioned above were often of a local nature, and there was never a nationwide plan to develop a logical network of railways. Some railways, however, began to grow faster than others, often taking over smaller lines to expand their own. The L&MR success led to the idea of linking Liverpool to London, and from that the seeds of the London and North Western Railway (L&NWR) - an amalgamation of four hitherto separate enterprises, including the L&MR - were sown. Within 50 years the L&NWR was to become "the biggest joint stock company in the world".

The legacy of the Railway Mania can still be seen today, with duplication of some routes and cities possessing several stations on the same, or different lines - sometimes with no direct connection between them, although a significant amount of this duplication was removed by the Beeching Axe in the 1960s. The best example of this is London, which has no fewer than twelve main line terminal stations serving its dense and complex suburban network - basically the result of the many competing railway companies during the Mania that were competing to run their routes in the capital.

Government involvement

The railway directors often had important political and social connections, and used it to their company's advantage. For example, the directors of the Great Western came from elite backgrounds and typically had political influence when they joined the board. When an issue came up with the government, they knew who to see in London. Landed aristocrats Were especially welcome on the corporate boards. The aristocrats saw railway directorships as a socially acceptable form of contact with the otherwise dubious world of commerce and industry. They leveraged the business acumen and connections gained through railways to join corporate boardrooms in other industries.

While it had been necessary to obtain an Act of Parliament to build a new railway, the government initially took a laissez faire approach to their construction and operation. The Government began to take an interest in safety matters, with the 1840 "Act for Regulating Railways", which empowered the Board of Trade to appoint railway inspectors. The Railway Inspectorate was established in 1840 to enquire after the causes of accidents and recommend ways of avoiding them. The first investigation was conducted by Colonel Frederic Smith into 5 deaths caused by a large casting falling from a moving train in 1840 (Howden rail crash). He also conducted an enquiry into the derailment on the GWR when a mixed goods and passenger train derailed on Christmas Eve, 1841. The train hit a landslide at Sonning (Railway accident at Sonning Cutting), killing 9 passengers. As early as 1844 a bill had been put before Parliament suggesting the state purchase of the railways; this was not adopted. It did, however, lead to the introduction to minimum standards for the construction of third-class carriages, an issue raised by the Sonning accident, which came to be known as "Parliamentary Carriages".

"The Battle of the Gauges"

George Stephenson built the L&MR to the same gauge as the tramroads in use in the North Eastern colliery railways he had grown up working on: a rail gauge of 4 ft 8 1⁄2 in (1,435 mm), and all railways built by him and his assistants adhered to that gauge. When Bristol businessmen wished to build their railway linking their city with London, they chose Isambard Kingdom Brunel as their engineer. Brunel favoured a wider gauge of 7 ft 1⁄4 in (2,140 mm): he felt that railways would not be in contact with one another and that there was therefore no need for there to be a uniform British gauge. The Great Western Railway (GWR) (completed in 1841) was constructed to Brunel's broad gauge. However his assumption was incorrect; and when railways of a different gauge met the inconvenience caused led to the setting up of a commission to look into the matter. Their conclusion was that Stephenson's "narrow gauge" should be adopted as Britain's standard gauge. Parliament passed the 1846 Gauge of Railways Act which stipulated the standard gauge of 4 ft 8 1⁄2 in (1,435 mm).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...