I’ve spent decades preaching transformation and the easiest way to shut me up is ask: Where’s the business case? This is the question normally asked by the mealy-mouthed cynical financial controlling banker in the audience …

They want the spreadsheet showing the cost-benefit analysis and return on investment figures. The problem is that, as anyone dealing with innovation will tell you, there isn’t one. Uber, now valued at $70 billion, would have started out saying they were going to get some of the multibillion dollar personal transportation market. The cynical banker would say: how much? Show me the analysis? Where are the stats? Can you guarantee them?

Of course you can’t!!!! That’s why most innovation comes from Venture Capital and Private Equity funds. Venture Capital is exactly that: investing in adventures. An adventure is unknown. It’s a little like going back to great explorers like Captain Cook, Daniel Boone or Edmund Hillary. They would all enter the halls of money (or Royalty in the case of James Cook) and say they were going on a great adventure. They don’t know where they’re going, for how long or how far away, but they know they will come back having conquered the unconquerable, discovered the undiscovered and made a mark in history.

In some ways that’s what the transformation opportunity is all about: an adventure into the unknown. The thing is, what banker in their sane mind would take an adventure into the unknown. Bankers like to deal with known knowns and avoid known unknowns. In fact, they like to avoid anything unknown.

Q: What’s the likely impact on our customers if we transform to digital?

A: They’ll like it.

Q: That’s not good enough. How many will like it?

A: Lots of them.

Q: But exactly how many?

A: More than those who leave us if we don’t do this.

Q: How many will leave us?

A: Loads.

Q: Give me a number.

A: Well, I can’t today but it’s obvious that they’ll leave us because the competition is going digital.

Q: Which competition?

A: That new start-up Astro Bank.

Q: Astro what?

A: Astro Bank.

Q: Who are they?

A: A new digital start-up that is targeting to steal all of our customers.

Q: Have they actually stolen any?

A: Not yet ...

Q: Ah, go away.

A: … but they will.

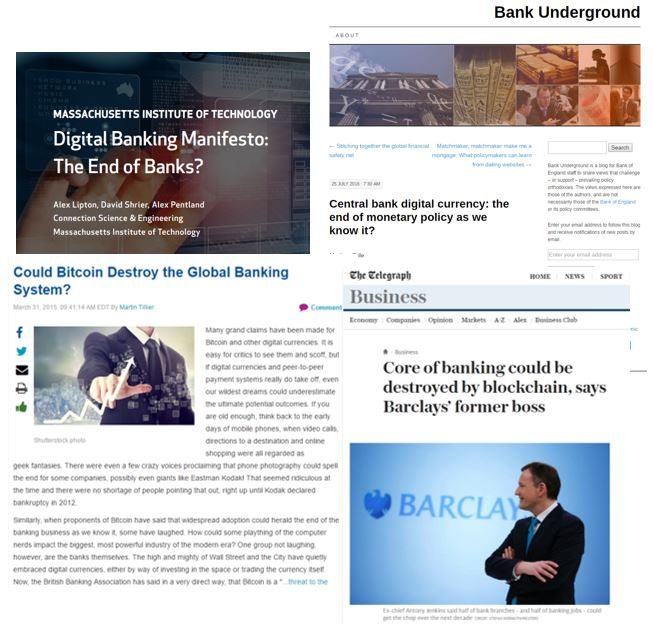

You see the issue. We have those convinced that things will change and transform, and those who don’t believe it. In fact, without a business case, there’s only one other way in which a bank executive who is cynical would work on transforming the bank, and that’s a burning platform.

A burning platform is one that shows the bank will implode and die if they don’t change. There’s certainly enough people claiming this could happen, but is anyone in the C-suite getting that message … yes, some do.

(still doesn't mean that they know what to do about it)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...