I was thinking about not sharing this info but hey, as you are good enough to read my blog … here’s the bottom-line on digital disruption (ed: oh no, Chris said the D-word!).

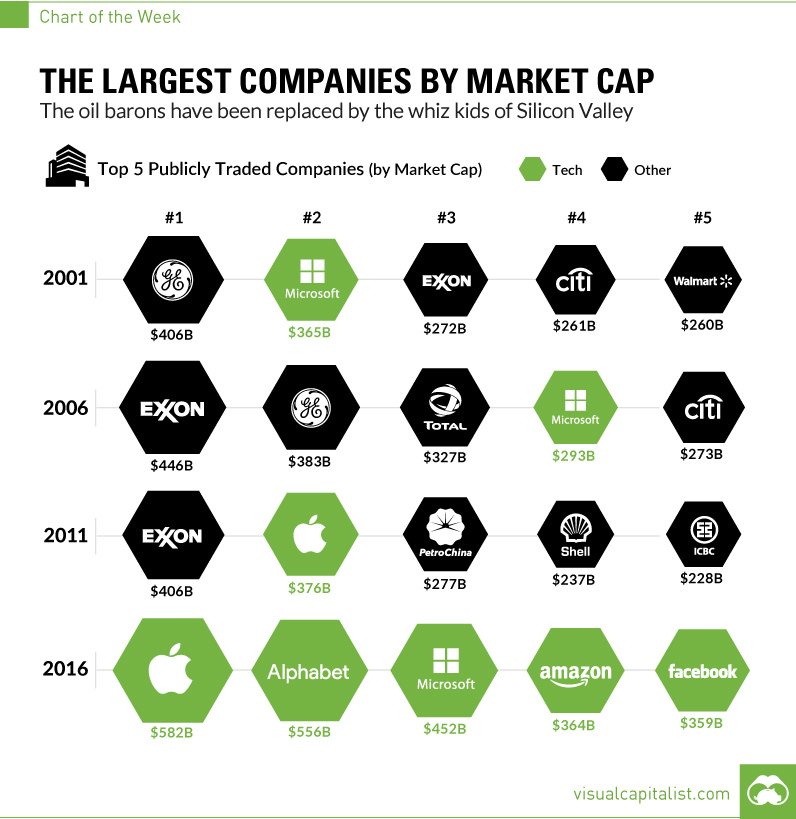

There’s a slide that’s been doing the circuit for a while. It comes from Visual Capitalist, and charts the change in the world’s largest companies over the last 15 years.

As you can see, digital platforms and providers have risen to the top of the heap. I saw this at the same time as reading Geoffrey Parker’s The Platform Revolution. I say Parker, who is one of the co-authors, as I saw him present at a conference recently where he projected this slide.

The statement is clear: monolith firms are industrial age; platform firms are digital age. It also clearly shows the difference in focus. Monolith firms are heavy lifting physical assets; platform firms are providing open markets.

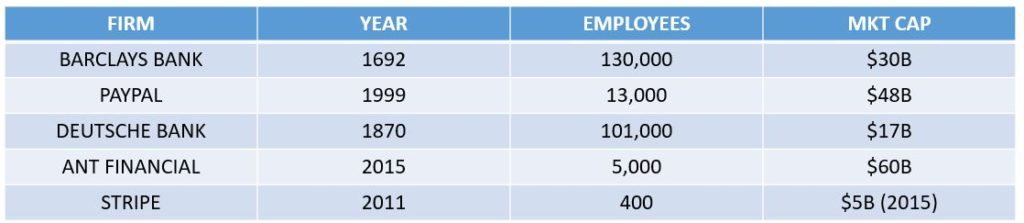

This is why the industrial age firms have 100’s of thousands of employees to generate their market capitalisation whilst platform firms have just a few thousand. After all, an open marketplace has 1000’s of other people doing the work to buy and sell on your platform; a monolith firms does it all themselves.

This is almost like an aha moment as, when I look at banks, they are monolith firms. Built for the industrial age, they like to control everything internally. They do everything themselves. Banks are A-Grade Control Freaks.

The idea of opening up to all and sundry in a marketplace is like an enema to them, but they will have to do this to survive in the digital age. I’ve blogged a lot about this lately, but it really strikes home when you think about today’s financial world.

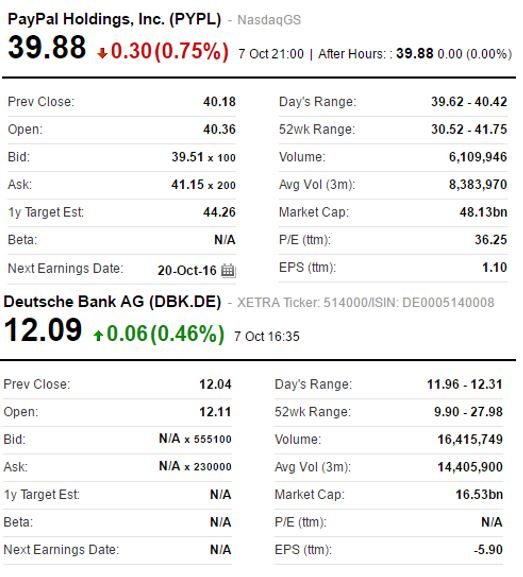

Today’s world is one where a PayPal is worth three Deutsche Banks ….

…. where Ant Financial is one of the largest financial firms in the world (valuation $60 billion) and where Stripe has risen from nowhere to be a challenger. Using Geoffrey Parker’s chart you can see the stark contrast:

The only stand-out bank is the world’s most valuable bank, JPMorgan Chase. Market Cap of $245 billion is pretty impressive. But let’s set that against Stripe, a five year old. Stripe was valued at $5 billion a year ago, but has grown up a lot more in just the last 12 months. They’ve expanded into Asia and gained investment from Sumitomo Mitsui, the largest Japanese credit card provider, as an investor. Based upon that development I’d double their valuation but, being conservative, let’s stick with last year’s figure of $5 billion.

After five years, Stripe’s 400 staffers are generating $12 million of value per employee. JPMorgan’s 217 year history (est. 1799) and 235,000 people has given them the ability, as the most valuable bank in the world, to generate just over $1 million in value per employee.

Now some of the cynics will be sitting back and saying oh yea, Chris is quoting wildly over-rated unicorn figures to make a point that banking is dead, but they’d be wrong. I’m not saying banking is dead. Just that something has changed and if banks can’t turn into open marketplaces, they will not survive. These charts make that clear and if any bank CEO is holding back, believing that the heady days of monolith structures still works, show them this blog. They don’t.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...