Bye bye banking job for life

Many of the banking folk I meet have been with the bank as man and boy, woman and girl. It’s a job for life. Funnily enough, I’ve never known one of those jobs. I guess it’s because I work in tech, and many of the tech firms I’ve worked for have gone bankrupt. Tech firms are continually having to innovate to keep up. They also have to predict future market needs and requirements. Think about it. If Facebook hadn’t committed fundamentally to mobile, they wouldn’t be here today (and they almost weren’t); IBM misjudged the move away from mainframes and posted American’s biggest losses ever recorded in the 1990s; and there are many fallen giants from Wang to Digital to Compaq to MySpace to AOL and on and on and on.

How come banks don’t see collapses like these? Well, it’s because banks are large, stable, regulated and rarely see massive market shake-ups unless there’s a crisis. Sure, we’ve seen thousands of job losses since 2008, but it’s just because of the billions lost in the GFC (Global Financial Crisis). Or is it?

I’ve already blogged a few times about bankers losing jobs as tech takes over, but many of us may not realise the net impact Fintech is having, or going to have, on bank jobs across the board.

“We need to take cost out of the middle and back office of doing simple repetitive rules transactions and move those people into other roles.” Greg Baxter, Citibank's global head of digital strategy

Earlier this year, Citibank produced a report about Digital Disruption: How FinTech is Forcing Banking to a Tipping Point. In that report, they predict that although only about 1% of North American consumer banking revenue has so far migrated to new digital business models, that number will rise to about 10% by 2020 and 17% by 2023 as consumer behaviour continues to shift toward digital ways to save, spend and move money.

- Since 2010, more than $50 billion has been invested globally in almost 2,500 fintech companies.

- In the United States alone, fintech investing increased from $1.8 billion in 2010 to $19 billion in 2015.

- In China, fintech companies such as Alipay and Tencent already claim to have more clients than the country's top banks.

- As many as half of the retail bank branches in the United States may disappear by 2025, along with a 30% reduction in bank employees.

- 67% of the 85 million millennials coming of age use mobile banking apps.

In fact, I heard a figure the other day which, if true, is quite stunning.

Fintech firms now represent 30% of the total market capitalisation value of all financial firms.

I haven’t been able to substantiate that figure, but it sounds about right as we seen megabanks like Deutsche losing its lustre whilst upstarts like Stripe and TransferWise gain huge unicorn valuations. It’s all based upon this pivotal moment of the switch from physical financial services to digital.

McKinsey pretty much nail it, with this chart that shows 30 areas where Fintech is impacting banking business.

This means that banks are becoming like technology firms, and technology firms regularly fail. Some get resurrected, like Apple, but there are so many big names of the past that have gone by the bye, that the list would be too long to reproduce here.

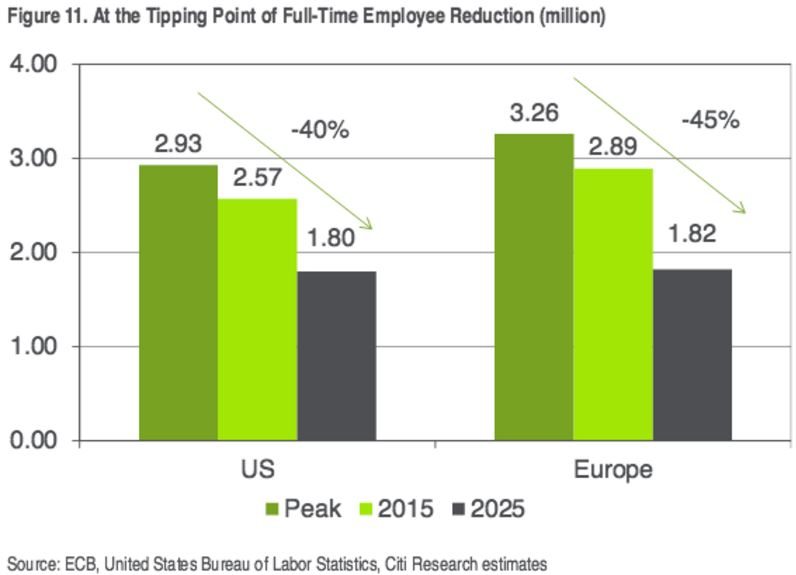

As a result, Citibank predict that European and US banks will cut 1.7 million jobs in the next decade, as financial technology companies stalk profitable growth areas. That’s the equivalent of 30% of the staff banks currently employ, on top of the 730,000 jobs that US and European banks have already shed from their peak staffing levels in 2008. The number of employees at American banks would drop to 1.8 million people in the year 2025, down from 2.6 million last year and 2.9 million before the financial crisis. An even sharper 37% drop is predicted for European banks.

The net:net of these changes is that the big banks are rapidly shifting to pivot from physical to digital. The big banks we can name, but are they doing it fast enough and with enough commitment, is my question. I regularly come back to Leadership and regularly point back to that report about banks having a C-suite full of bankers, and zero technology leadership.

If a bank is serious about changing from physical to digital, they must reboot their boardroom. After all, making those tough decisions to close trading floors, lay off tellers, close branches and get rid of all the colleagues they worked with or hired, is hard.

UBS Wall Street Trading Room, 2008

UBS Wall Street Trading Room, 2016

In fact, I’d be as bold as to say that big banks need to bring in new, external leaders who have the skills and background to understand the Fintech bank, but not necessarily having any knowledge of banking. Just a thought.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...