When I was growing up, America was the superpower that we followed and Russia was in a Cold War. Today, there are two superpowers – America and China – and Russia is still in a bit of a Cold War that might be thawed by Donald Trump.

So when it comes to Fintech, there’s two major countries to watch – America and China – but China does it all rather different, because they can.

So, here’s a few highlights about Fintech China of late.

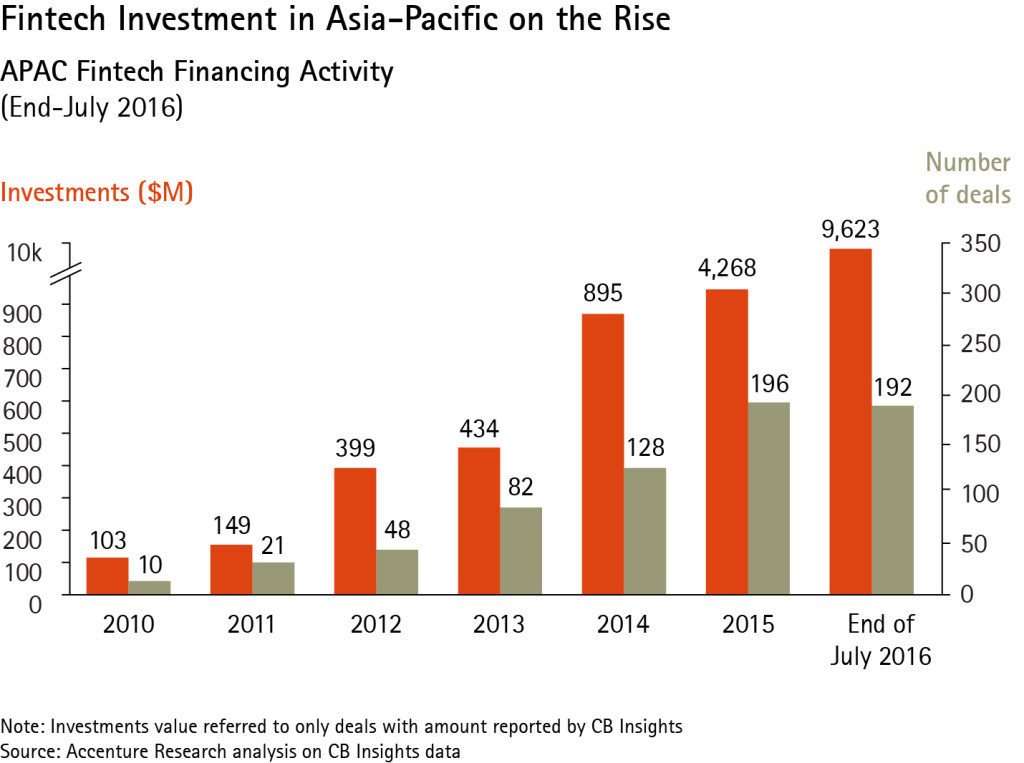

First, China’s Fintech prowess is rising fast. Investors in FinTech in Asia pumped $9.62 billion into these new ventures between January 1 and July 31 2016, more than twice the $4.26 billion invested in the region in all of 2015 according to Accenture's analysis of CB Insights data.

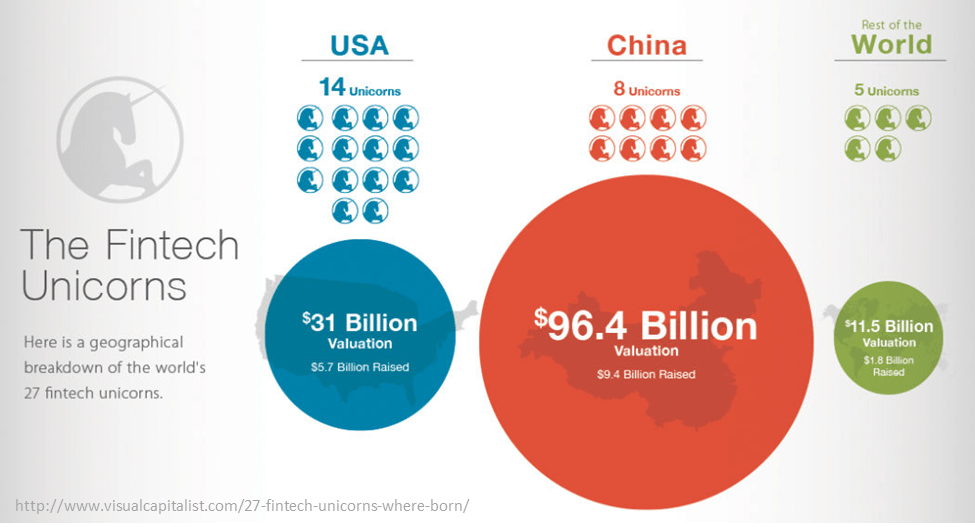

Not only is it the region with the biggest investment in Fintech this year, but also one where their eight Unicorns are worth almost $100 billion.

Second, the largest of those Unicorns is Ant Financial, who are valued at $60 billion. Not bad for a Fintech startup, but that is because they get tech and offer a marketplace of bank services from apps to APIs to analytics.

Third, Ant Financial thinks global and is moving Alipay into the hands of Chinese consumers across the world and, soon, all consumers. Here’s a good overview of Alipay:

... and note, it’s not a payment app or a mobile wallet, it’s a mobile world of everything from travel to investments to socialising to shopping. That’s why, according to a statistic Alipay used in a recent presentation, they are now paying for more transactions than cash in China.

Source: The Financial Times

Fourth, there’s a very different mentality in China, such as the peer-to-peer lending platform that demands young, female borrowers send them naked selfies for account opening. Why? Because if you default on your loan, the naked selfies of you will be released online.

If you find that crazy, then read more at Life.SREDA's blog.

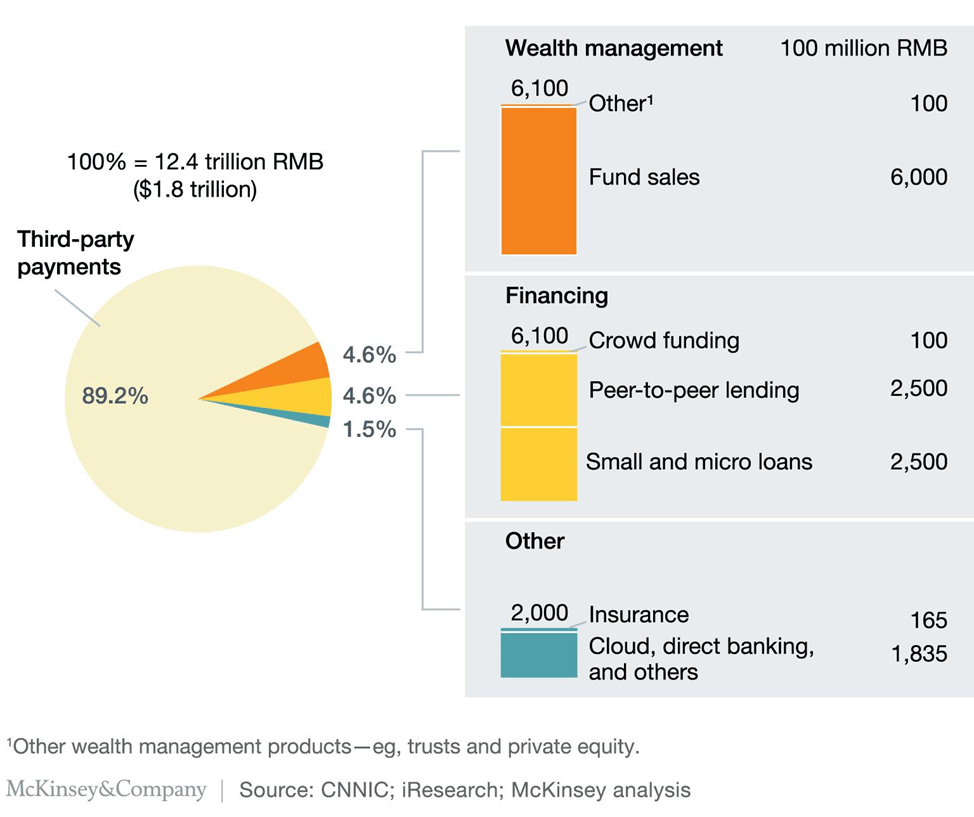

Finally, because China had no financial infrastructure in place twenty years ago, much of what is there today has come from nowhere. It has all been implemented just in the last twenty years. That is possibly why the country has the largest Fintech numbers of anywhere in the world. In 2015, internet finance in China was worth more than $1.8 trillion.

You can read more unique insights about Chinese Fintech numbers over at LetsTalkPayments.com

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...