Reflecting on the last year, it’s been crazy. I feel like I’ve spent most of the year jumping on and off airplanes. Most visited cities are London, for obvious reasons, and Singapore. I must have been there five or six times this year, and that reflects Singapore’s ambitions to be a Fintech hub. I’ve also been in Hong Kong, Bangkok, Jakarta and other cities in Asia through the year, with Asia pulling me into its arms as the new models of Fintech rise.

Then there was a trip or two to Kenya and South Africa, and many journeys around Europe from France to Turkey to Norway. The USA has figured in my travels too, with New York being the main touchpoint. It’s been a busy year.

What strikes me as I make these sojourns is how each market, each regulator and each community is different. All the cities have ambition to encourage start-ups and be a Fintech hub, but some get that more than others. Certainly, the UK and Singapore governments have been determined to push their structures to the fore, but there are nuances around this. For example, China has emerged as the dominant Fintech nation of 2016, and yet their Fintech is very different to what we see in Europe and America. That is partly down to Chinese financial markets using technology infrastructures that were implemented after the mid-1990s, and so a lot of Chinese Fintech is being created with zero legacy. That is the Chinese advantage over Europe and America, as the banks and financial markets in the West are trying to rearchitect their legacies. China, India and Africa are starting with almost a blank sheet of paper. In fact, India and Africa are creating whole new ways of thinking about money and value exchange, that has not even been considered by many. This is because these are countries where financial inclusion has become a key mantra and governments in Tanzania, Ghana and Uganda have been determined to push the mobile wallet capabilities to their citizens. Meantime, India is trying to go cashless, well before most other nations have even developed a policy for it.

This makes for exciting times in emerging, developing and growth markets, but then we come back to the dullness of Europe. European banks are struggling with a lot of old tech. They talk about Open APIs under PSD2 with hushed dread, and reference the major groups of workers digitalising the bank at a cost of billions. Really? Surely, if the bank is spending billions on tech today, it’s wasting the banks money? I don’t see start-ups that need billions to start-up. So why do European and American banks talk about megaprojects with massive legions of coders requiring months to develop their digital assets?

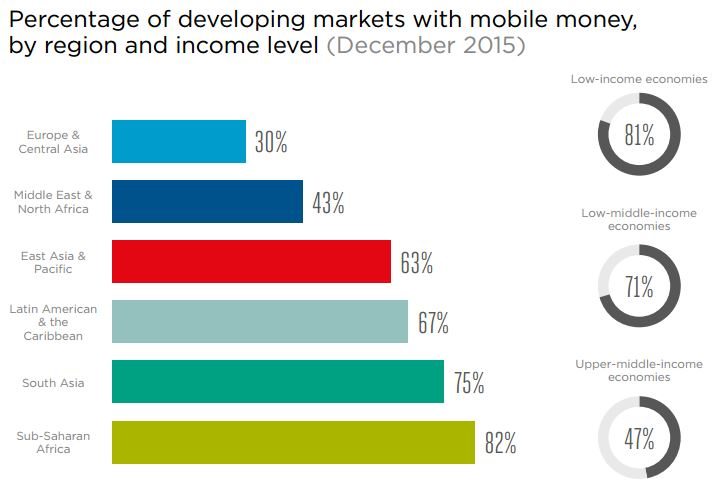

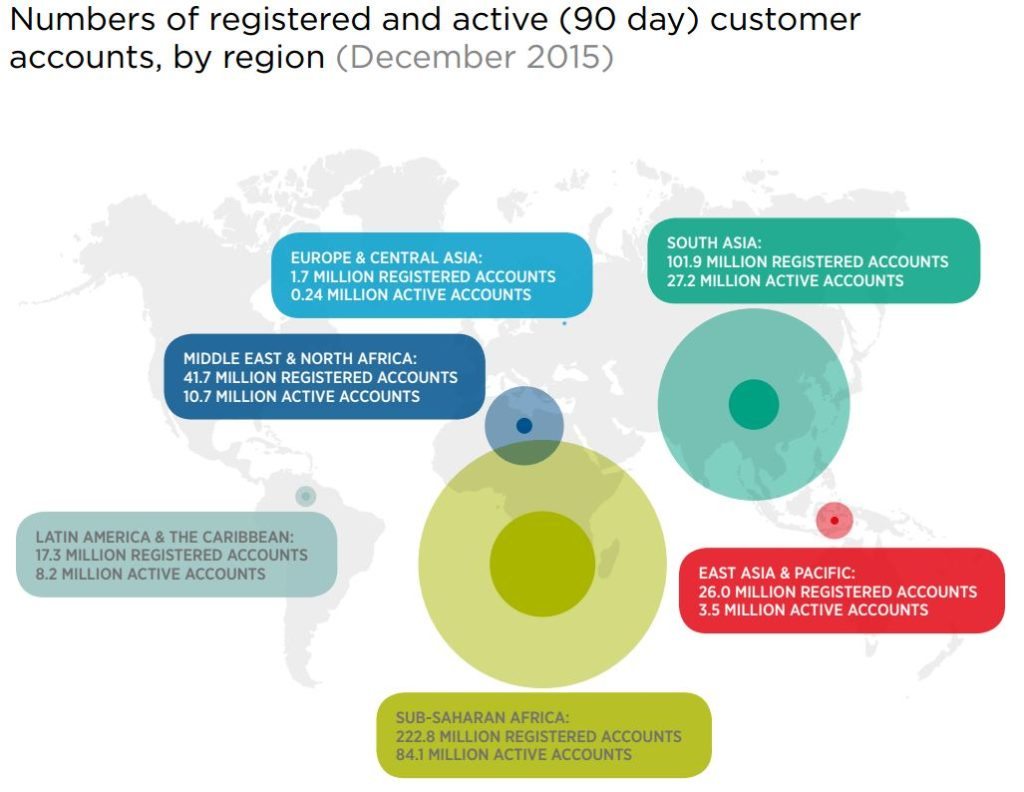

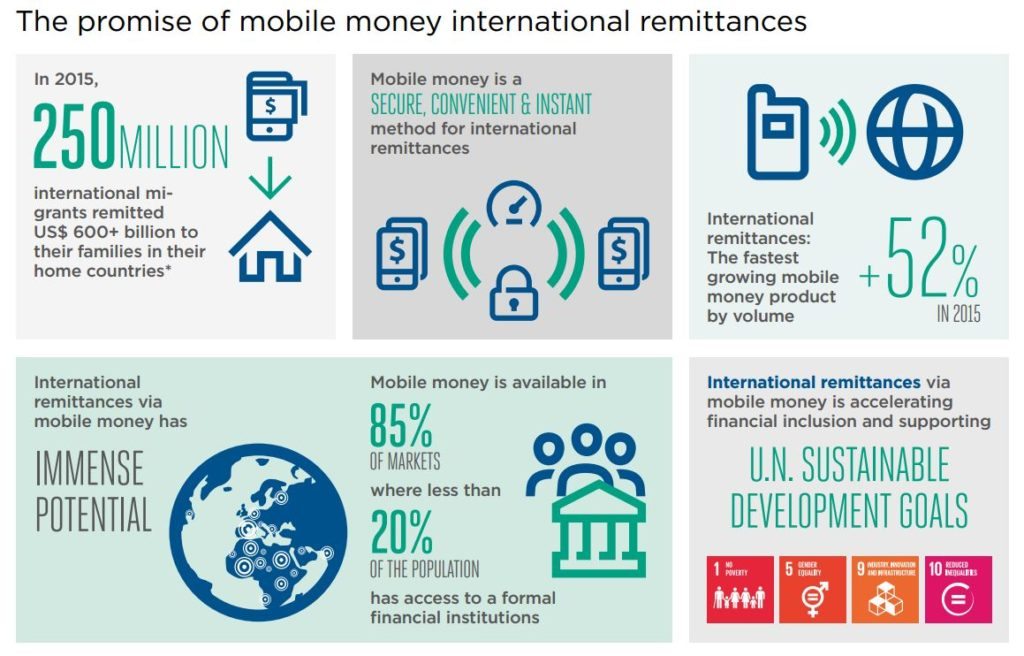

It’s because American and European banks are full of legacy. We don’t have that in the nations that are innovating. China, India, Sub-Saharan Africa, Turkey, Poland and a few other nations are leap-frogging the world with technology in finance. Take Tanzania for example. Here, people can move money between mobile wallets across all the network operators for almost no cost. In other African nations, digital identity schemes linked to mobile wallets are on the rise. This makes for an incredible combination of technologies that reinvent much of the banking system. The Sub-Saharan African nations are, for example, moving billions of dollars through the mobile network because citizens now have mobile money, and they love it.

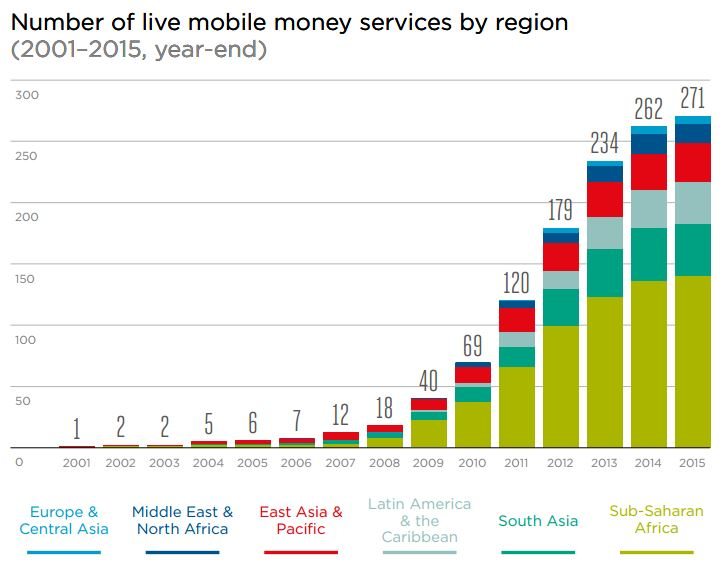

These are people who had zero access to banking, but now they can buy, sell and generate credit histories through their mobile phones. That’s why the GSMA latest publication about mobile money reports that there were 1 billion mobile money transactions in December 2015, or 33 million per day. That is more than double the amount PayPal process. There are at least 19 countries with more mobile money accounts than bank accounts, and most of them are in Sub-Saharan Africa. 1 in 3 mobile connections in Sub-Saharan Africa are linked to a mobile money account. In East Africa, that figure rises to 1 in 2.

This is why I love the world we see today – a world turned on its head - because we now have massive inspiration, innovation and invention in financial transactions coming from markets that never had access to banking before. They are making this happen because they now have access to finance through technology. It is why I’m fascinated by the developments in India, China, Indonesia, Brazil, Colombia and other markets where technology is reaching the unreachable, because they are doing things with the technology that have never been conceived of before.

Whilst we in the USA and Europe tinker with our complex spaghetti infrastructures of old, the emerging, developing and growth economies across the world are reinventing finance. It’ll be fascinating to see what they come up with.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...