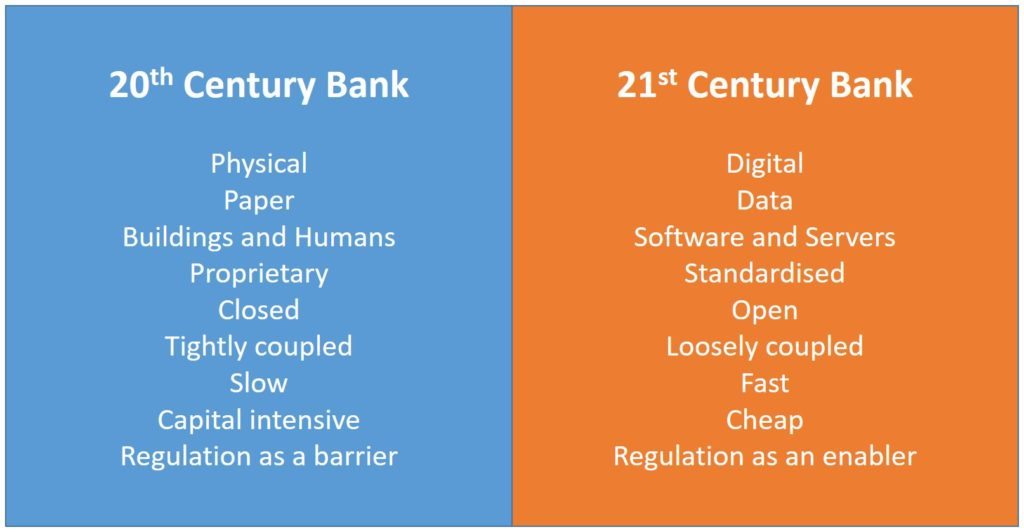

I realised the other day that I didn’t have a good slide comparing the old bank world with the new. I often refer to it with the line that banks were built in the last century for the physical distribution of money as paper in branches with buildings and humans; now they have to be rebuilt for the digital distribution of money as data in the network with software and servers. It’s a good line, but only touches on the surface of things, so I put this slide together to elaborate a little more:

Today the network is open to all and, thanks to open sourcing, is fast and cheap to develop. It’s agile and adaptable, collaborative and easy. Nothing like the old world of proprietary structures that are closed and require heavy lifting to operate. This is why old world firms have 100s of thousands of people to complete the task, because it’s all non-standard and internalised. Today’s digital firms have 1/100th of the numbers of staff, because they provide platforms for all to access and use. I blogged about that recently, and shared these charts comparing old world (industrial revolution) firms with new world (digital revolution) firms:

Similarly, I compared old world banks and new world banks:

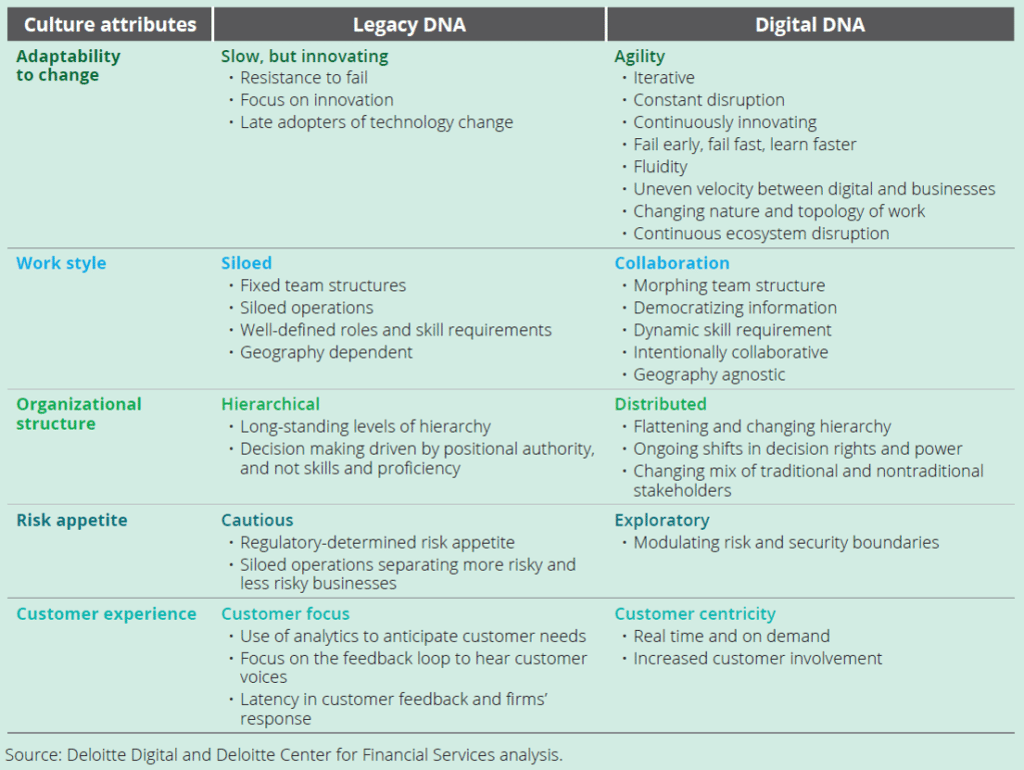

Now, I haven’t seen many other reports with this content but was impressed by one just released by Deloitte summarising the fifth annual study conducted by MIT Sloan Management Review and Deloitte Digital. In this report, they have this chart:

The Deloitte report talks about Digital DNA, and articulates the clear cultural change that must take place to get digital in your company’s DNA:

Being digital is significantly different from the traditional way of doing things in FSI firms. As our survey suggests, FSI firms’ legacy cultural attributes include a protracted response to change, siloed work style, hierarchical organizational structure, and a cautious, regulation-determined risk appetite, among other behaviors.

On the other hand, Digital DNA behaviors create the environment that enables firms to do business digitally. We have grouped Deloitte’s Digital DNA framework’s characteristics into five categories for purposes of our study: agility, collaboration, distributed organizational structure, bold risk appetite, and customer centricity.

As the chart above shows, there may be some extent of commonality between the legacy DNA and Digital DNA attributes. Customer experience is a good example, where FSI firms have been doing digital and investing in new products and capabilities. That said, many FSI firms have the scope to improve real-time collection of customer data and provide more relevant on-demand experiences.

In contrast, there are some Digital DNA attributes that are potentially in conflict with the legacy way of doing things— for example, risk appetite. Here, it’s essential to strike a balance, which could allow firms to remain cautious when engaging in high-risk activities, but lend a freer hand and become more exploratory when handling less-risky ones. Banks opening up their APIs to allow technology firms to build applications for their customers could be viewed as one such exploratory move.

These charts and discussions clearly illustrate why it is imperative to have digital leadership and reboot the bank boardroom (one of the top trends of 2017).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...